Goldman Sach has warned of the possibility of Bitcoin (BTC) falling as low as $12,000. Experts from the firm say that there are a number of macro indicators that could trigger the fall of BTC. Economists working with Goldman Sachs, led by Jan Hatzius, say the alarming move by the Fed Funds Rate will likely trigger the decline.

Effect of Fed Funds Rate on BTC price

As you follow on Kriptokoin.com, according to experts, the Fed will increase interest rates by 0.75% this month. However, another 0.5% increase will follow by November. In addition, these figures were above the previous 0.5% and 0.25% estimates of economists.

In particular, the Fed rate hike has a strong impact on predicting Bitcoin price action in 2022. When there is a rise in the Fed rate, investors often shift to less risky investments. Therefore, the interest rate hike forces them to withdraw funds from their BTC holdings to other “safe assets”. Investors withdrew substantial funds from their BTC holdings as the Fed rate rose from nearly zero to about 2.25%-2.5%.

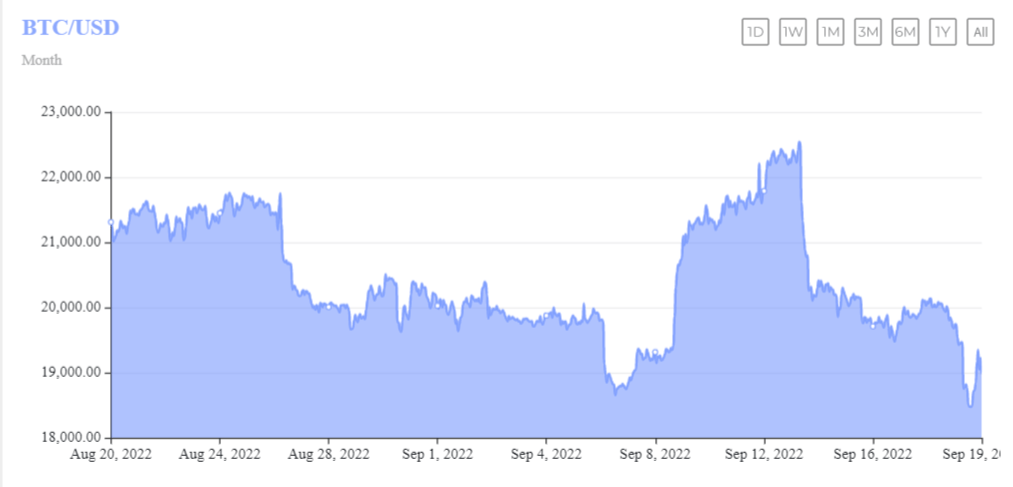

In the meantime, it should be noted that BTC had a severe period in 2022. During the year, BTC witnessed a drop of nearly 60% since year-to-date. Now, it is trading around $20,000. The drop in Bitcoin price also triggered unrest in the entire cryptocurrency space.

This unrest has put companies in the cryptocurrency space into a difficult period. During this period, some projects collapsed. Some leading companies cut their spending by laying off some of their staff. The stormy days seem to be over. However, it is possible that the emerging symptoms trigger another unrest.

Warnings about Bitcoin investment

Because of the emerging signs, analysts are warning investors to be wary of the rising Fed Funds Rate. An analyst nicknamed Doctor Profit says that the BTC price is currently in a low stage. The analyst warns that if the Fed raises interest rates by 1% instead of 0.75%, there may be a drop in BTC price. Doctor Profit urges investors to be careful about the increase and to consider the subsequent decisions of the Fed.

https://twitter.com/DrProfitCrypto/status/1571452624892993538

Meanwhile, there is another indicator for BTC that points to a potential price drop. Obviously, BTC has a positive correlation with the US stock market. Now there appears to be a sign that there is a potential risk in this respect.

In this context, Goldman Sachs strategist Sharon Bell has been warning investors to be cautious lately. In this context, Bell says the recent activity in the stock market could be a bull trap. The strategist cites Goldman Sachs’ warnings that stocks could drop 26%. According to Goldman Sachs, the decline will begin if the Fed intensifies its efforts to fight inflation.