Bitcoin (BTC) attracts ‘mega whales’ as BTC price forms new support at $16.8k. As the century-old Bitcoin trading range continues, a new 100-week ‘checkpoint’ appears below $17,000. One analyst, on the other hand, is seeing signs that Bitcoin is currently in an accumulation phase.

Bitcoin checkpoint established below $17,000?

As you follow on Kriptokoin.com, Bitcoin’s lack of volatility has led analysts to debate when a breakout might occur and in which direction it might go. But so far, the trading range, which has narrowed since the FTX crash in November, is under control. Now, on-chain analysis hints that contrary to some beliefs, BTC may not fall any further in the current phase of the bear market.

Trend Rider is looking at the one-week chart to mark $16,800 as the current 100-week checkpoint (PoC), the price level that generated the highest volume in a given period. The longer the duration and the higher the volume, the stronger the conceptual PoC support or resistance level. In his accompanying comments, ‘New Bottom shaping’ states:

About $6.8k is the new 100-Week POC for Bitcoin. In simple terms, this is the level at which the most volume has been traded in the last 100 weeks. This creates a potential bottom formation.

BTC caption chart / Source: Trend Rider/ Twitter

BTC caption chart / Source: Trend Rider/ TwitterIf that’s the case, Bitcoin could avoid the worst doomsday predictions of recent months, including a bottom to $10,000 and even lower. Longer-term PoCs include $9,200 at 200 weeks and $3,700 at 300 weeks, which are near the March 2020 Covid-19 intermarket crash lows.

Whale activity several inches higher

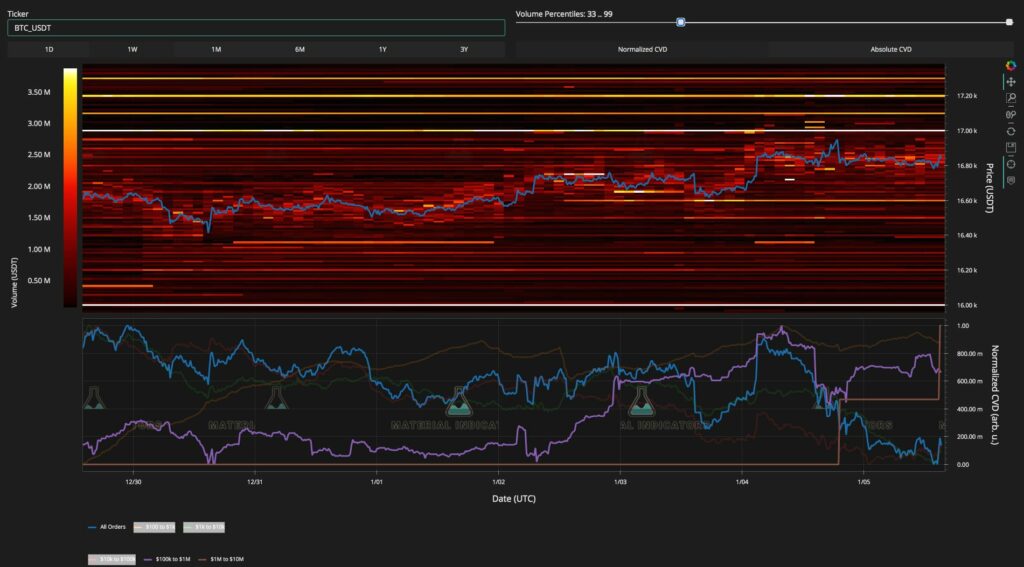

On exchanges, Bitcoin’s trade corridor was also absolutely stagnant during the day. According to monitoring resource Material Indicators, the strongest nearby support and resistance levels are $16,000 and $17,000, respectively. A chart of the Binance order book also shows the growing interest in the largest group of Bitcoin whales between the two price points. “Brown Mega Whales seem to like this range for Bitcoin,” comments Material Indicators.

BTC order book data (Binance) / Source: Material Indicators / Twitter

BTC order book data (Binance) / Source: Material Indicators / Twitter“The opportunity to accumulate Bitcoin (BTC) is about to end!”

Popular crypto analyst Jason Pizzino is seeing signs that Bitcoin (BTC) is currently in an accumulation phase. Pizzino says that based on the market cap-to-value (MVRV) ratio, Bitcoin may only have a few months left in the last-stage bear accumulation zone. In this context, the analyst makes the following statement:

We may have only five months left for Bitcoin to stay below this (MVRV accumulation) zone, which has called for pretty good buying opportunities in the past, before the market starts accumulating at higher prices, as it did in 2015 and again in 2019. Move on to the bull markets of 2020 and then to the next.

MVRV values below 1 indicate significant market capitulation and continued accumulation. Bitcoin’s MVRV rate is currently below 0.85. The analyst has the following to say on whether Bitcoin will drop below the 2022 low of around $15,600:

It can be easy for many investors to fall behind. Because they expect lower prices. But a lot of data shows that if we haven’t reached exactly this price floor in Bitcoin, we are probably somewhere around it.

“If resistance is strong at this level, we will slide to these bottoms”

According to Pizzino, if the resistance at $18,500 is strong, it is possible for Bitcoin to bottom between $13,000 and $14,000. Accordingly, the analyst makes the following assessment:

We want to see if Bitcoin will test these top prices. It will reach $18,500 first, which will be an important level. I think if we break that, we’ll probably hit a higher low in March-April. But if we don’t, if we don’t get past that $18,500, then we’re probably going to go some kind of lower. How low? This nobody can predict. However, if we use some probabilities and look at the chart, the history, then it is possible to say that it would be somewhere around $13,000 to $14,000 that has sustained the market in the past.