In 2022, the entire cryptocurrency market lost nearly $1.4 trillion in value as the industry’s liquidity problems, high-profile bankruptcies, and these culminated in the collapse of FTX. Investors expect 2023 to be a cautious year ahead of a potential bull run that could begin in 2024. Let’s take a look at how 9 analysts are plotting an estimated course for Bitcoin this year.

“A new Bitcoin bull run in 2023 is unlikely”

After a turbulent 2022, crypto investors are trying to figure out when the next Bitcoin bull run might be. Last week, Switzerland’s St. Speaking at a crypto conference in the city of Moritz, experts predicted that Bitcoin will trade within a narrow range, be sensitive to macroeconomic developments such as interest rate hikes, and remain volatile. Therefore, a new bull run in 2023 is unlikely. But experts are optimistically looking into next year and beyond…

Although Bitcoin caught a small increase at the beginning of the year in line with risky assets like stocks, experts say it is unlikely that Bitcoin will retest just below the ATH level of $ 69,000, but it may have bottomed out. “I think there’s a little more downside, but I don’t think it will be too much,” venture capitalist and crypto veteran Bill Tai told CNBC last week.

The expert added that “Bitcoin is likely to bottom out here,” adding that it could drop as low as $12,000 before rising again.

Meltem Demirors predicts that Bitcoin will be traded in the range of $ 15,000-30,000 in 2023

CoinShares chief strategy officer Meltem Demirors says Bitcoin will likely trade between $15,000 and $20,000 on the lower end and $25,000 to $30,000 on the upper end. He notes that most of the “forced sells” that occurred as a result of market crashes in 2022 are now over, but not much new money has come to Bitcoin.

“I don’t think there are many forced sales left, that’s an optimistic approach,” Demirors told CNBC on Friday. But still, I think the positive side is pretty limited because we don’t see a lot of new entries coming in.”

Meltem Demirors, CSO of CoinShares, predicts Bitcoin will trade in the $15,000-$30,000 range in 2023 pic.twitter.com/9kcX9sQVbO

— CNBC International (@CNBCi) January 13, 2023

Other experts think that a change in the macro situation, such as interest rate hikes, could help Bitcoin. Demirors says the following on this subject:

There may be catalysts that we are not aware of, again the macro situation and the political environment are quite uncertain, inflation continues to be quite hot, I think this is something new. We haven’t seen this in 30, 40 years. Well, who knows when people are trying to make allocations that crypto will fit into this portfolio as we head into the new year?

Timing of the next predicted Bitcoin bull run

Halving cycles have always been associated with Bitcoin’s bull runs. Halving usually precedes a bull run and the next will happen in 2024. On this, Anthony Scaramucci, founder of SkyBridge Capital, described 2023 as the “recovery year” for Bitcoin and predicted that it could trade between $50,000 and $100,000 in two to three years:

You take risks, but you also believe in Bitcoin. So if we get the adoption right, which I believe I will, it could easily be a fifty to a hundred thousand dollar asset in the next two to three years.

.@Scaramucci sees #bitcoin at $50,000 to $100,000 in 2-3 years as market hopes for bull run https://t.co/1SV9Rqvq7G #BTC $BTC #cryptocurrency #crypto #investors

— DeSota Wilson (@desota) January 15, 2023

Meanwhile, Bill Tai, one of the above analysts, who was expecting a bottom at $12,000 in Bitcoin, said that the start of a bull run will be “probably in a year” and the subsequent effects of the FTX crash could continue to be felt for another six to nine months.

Jean-Baptiste Graftieaux, global CEO of cryptocurrency exchange Bitstamp, says the next bull run could come in the next two years, citing the growing interest from institutional investors. However, Demirörs warns that the events in 2022 have “caused tremendous damage to the industry and the crypto market” and thinks that “it will take some time for this trust to be restored.” Different technical analysts drew attention to the indicators that support this view.

Benjamin Cowen’s Bitcoin and altcoin prediction

From a different perspective, popular crypto analyst Benjamin Cowen says that Bitcoin is still the top game for crypto market participants despite a week in which altcoins saw their prices rise. Cowen believes that the Bitcoin Dominance index (BTC.D) will rise no matter which direction BTC goes, so even if their prices rise, altcoins are risky.

The BTC.D chart tracks how much of the total crypto market capitalization belongs to Bitcoin. A rising BTC Dominance indicates that Bitcoin is rising faster than other cryptos, or altcoins are losing value as the leading crypto rises. In a bearish scenario, a rising BTC.D indicates altcoins are falling faster than Bitcoin. BTC.D is currently at the top of recent weeks.

Cowen says that aside from BTC’s rising dominance level, Bitcoin is a better game for investors as it will attract less regulators attention. However, he states that altcoins could start developing in early 2024 or later this year:

Bitcoin will not have the kind of regulatory scrutiny that the altcoin market has, and I think 2023 will likely be a tough year for altcoins in the context of these regulations. As we get to 2024, and maybe even late 2023, I’ll take off my maxi hat and probably go back to the altcoin market.

Bitcoin whales contribute to over $20,000 rally

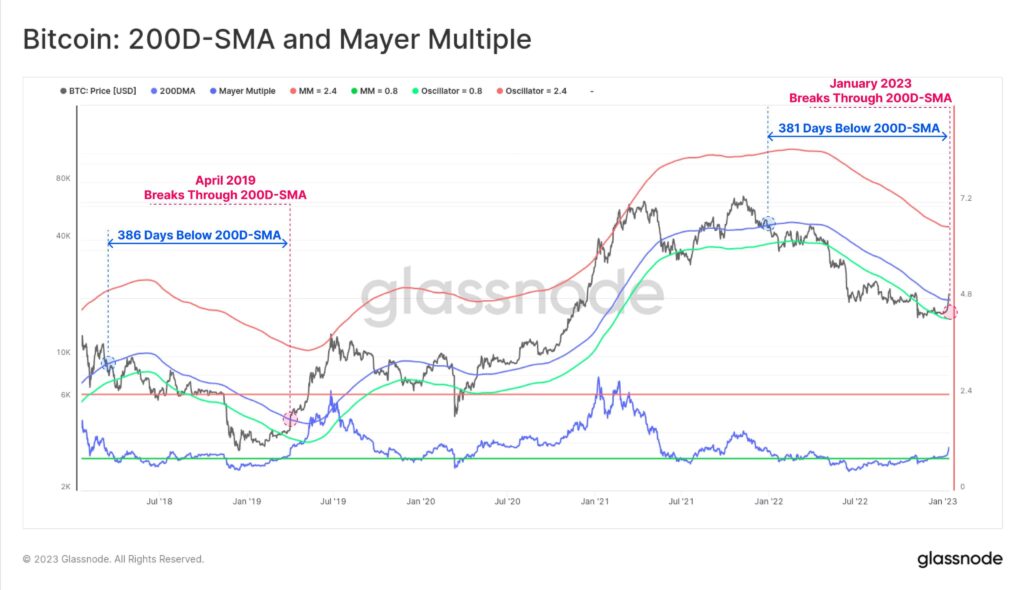

In on-chain analysis, Bitcoin showed a very strong level of consistency with its previous cycles. In the 2018-19 bear market, BTC price traded below the 200 DMA for 386 days. Now, BTC price broke above the 200DMA after trading below it for 381 days.

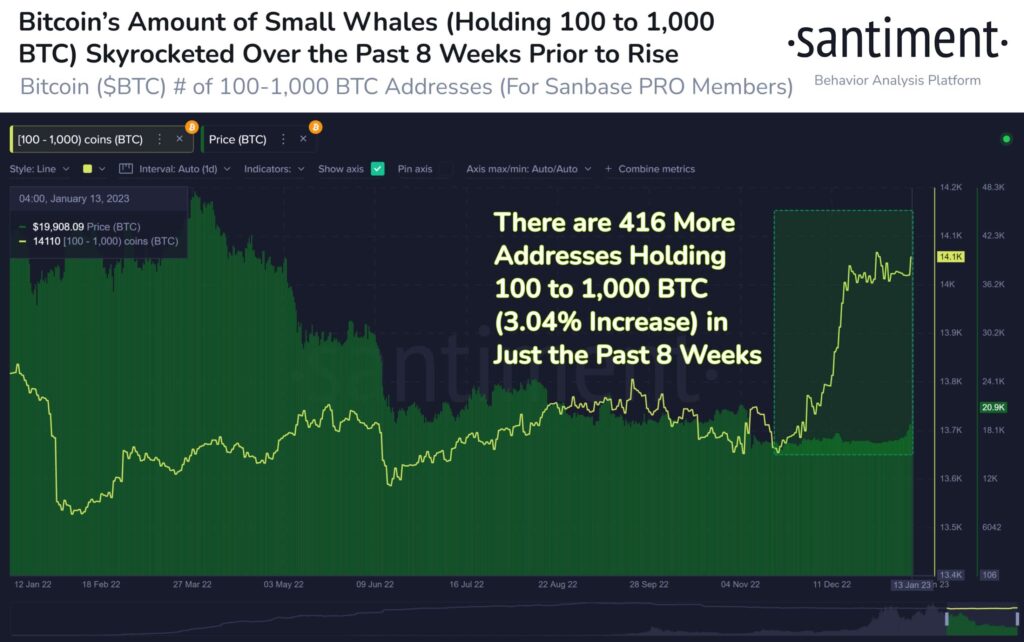

So far this year in 2023, BTC has seen strong 12-day price increases. However, this increase has occurred with the accumulation of small whale addresses in the last eight weeks. On-chain data provider Santiment reported:

Among many of the metrics that heralded this 2023 boom were the rapidly increasing amount of addresses holding $100 to $1,000 BTC. Price spikes usually happen across the market when whales accumulate Bitcoin. The largest crypto was +26% in two weeks.

Paypal CEO says it will predictably be the only Blockchain for Bitcoin

Around the time of the recent BTC rally powered by whale purchases, David Marcus, former CEO of Paypal, claimed that Bitcoin is the only Blockchain that is not under the influence of any particular person or company compared to other so-called decentralized assets.

Marcus added that the financial world has not yet fully internalized the ultimate value of Bitcoin’s decentralized nature. But some crypto enthusiasts do not share Marcus’s opinion. Mark Ghuneim argued that large stakeholder concentrations allow certain individuals, companies or organizations to influence the Bitcoin network.

#Bitcoin is the only blockchain/asset that’s not controlled or influenced by any specific person, company, or group. We haven’t fully internalized the terminal value of that yet. It’s one of a kind and can’t be replicated.

— David Marcus (@davidmarcus) January 14, 2023

David Marcus stated in a tweet earlier this month that most people focus solely on its price whenever they talk about Bitcoin, rather than the technology underlying Bitcoin. He made a New Year’s resolution to debunk the narrative. In particular, he said:

When most people talk or think about Bitcoin, it’s all about the asset and its price. My hope (and goal) for this year is to start shifting the narrative to its core technology and what it can do. There are so many opportunities ahead of you!

Bitcoin raised an estimated $70 billion this week

To wrap up the week, the leading crypto has managed to break a few key resistances hard in the new year for a strong 2023. Along this line, Bitcoin witnessed the inflow of over $73 billion in seven days under constant buying pressure. When released on January 15, BTC was controlling a market cap of $399.1 billion, representing an increase of about 22% from $326.1 billion recorded on January 8.

CPI data triggers Bitcoin capital flow

Bitcoin’s sustained capital inflows underscore the rise in the crypto market following the US’s latest consumer price index (CPI) for December, which reached 6.5% year-on-year. The reporting was interpreted as a sign that the Federal Reserve had won the battle to slow inflation. This factor refers to the possibility that risky assets such as Bitcoin will not face the further effects of a strict monetary tightening pressure. As Kriptokoin.com, we have included the statements of Fed Chairman Jerome Powell at his headquarters in Stockholm in this article.

Finally, closely followed Twitter analyst Michaël van de Poppe pointed out that Bitcoin is still facing major events that are likely to affect the current rally. In a YouTube video released Jan. 13, he said investors should be mindful of data that impacts overall economic health, such as retail sales.

He also warned that despite slowing inflation data, the Fed could still raise rates if overall economic health is low, a factor that could affect purchasing power. BTC is currently spending time in the $21,000 region, which indicates that the power is in the hands of the bulls. It gained more than 20% in value compared to last week.