The leading cryptocurrency Bitcoin (BTC) rose above 41 thousand dollars after 592 days.

The bull fest has begun in the cryptocurrency market. The leading cryptocurrency BTC managed to attract attention by exceeding 40 thousand dollars the other day. On the first day of the week, BTC price broke a new record by exceeding 41 thousand dollars. BTC rose above 41 thousand dollars for the first time since April 21, 2022.

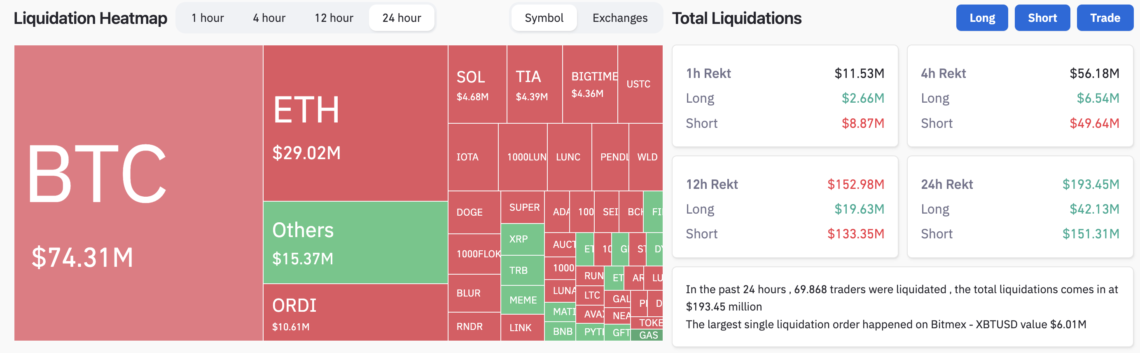

BTC’s rise comes in light of Bitcoin spot ETFs and expectations that the Fed will cut interest rates. BTC’s rise has not yet been fully accompanied by the altcoin market (except for diverging cryptocurrencies). Additionally, short (downward) transactions worth $154 million were liquidated in the last 24 hours.

Bitcoin (BTC) is ringing the bull bells fiercely

Bitcoin (BTC) started ringing the bull bells after a long wait. BTC price rose above $41,000 for the first time after April 21, 2022.

The reasons behind the rise of BTC were the economic moves of the USA and Bitcoin spot ETFs. The global market started to talk that the Fed will start reducing interest rates. The USA, which has now ended the tightening, can open the doors of money inflow to risky assets such as the crypto market. On the other hand, Bitcoin spot ETFs are expected to be approved in January. All these processes started to make us think that corporates would easily turn to BTC. Therefore, BTC caused the bulls to be hungry.

BTC rose above 41 thousand dollars in the morning and managed to maintain permanence in this region. The fact that BTC first broke the resistance of $ 40 thousand and then rose above $ 41 thousand affected the traders who opened short (bearish) transactions. According to Coinglass data, $196 million was liquidated from the crypto market in the last 24 hours. Short transactions constituted $154 million of these liquidations.

Additionally, the number of traders liquidated was 69,911. The largest liquidation from a single transaction took place on the Bitmex exchange. A trader on this exchange was liquidated for $6.01 million in XBTUSD parity.