The Coinbase survey revealed where institutional investors expect crypto prices to be in a year. Macro Guru Raoul Pal says crypto markets are still fundamentally bullish despite peak negative sentiment.

General sentiment towards digital assets increased

Crypto exchange giant Coinbase has released the results of a new survey it commissioned to find out what blue-chip investors think about the future of the crypto industry. The 2022 Institutional Investor Digital Assets Overview Survey polled 140 US-based institutional investors with a combined $2.6 trillion in assets under their management about their outlook for the digital asset market.

The results show that nearly three-quarters of respondents still think crypto assets are here to stay in the middle of the last bear market. This shows that cryptocurrencies are now strongly accepted as an asset class. Coinbase makes the following statement:

Overall sentiment towards digital assets remained positive, with 72% supporting the view that digital assets are here to stay. This opinion is 86% among those currently investing in crypto. It also stands at 64% among those who plan to invest.

How do investors view cryptocurrency prices?

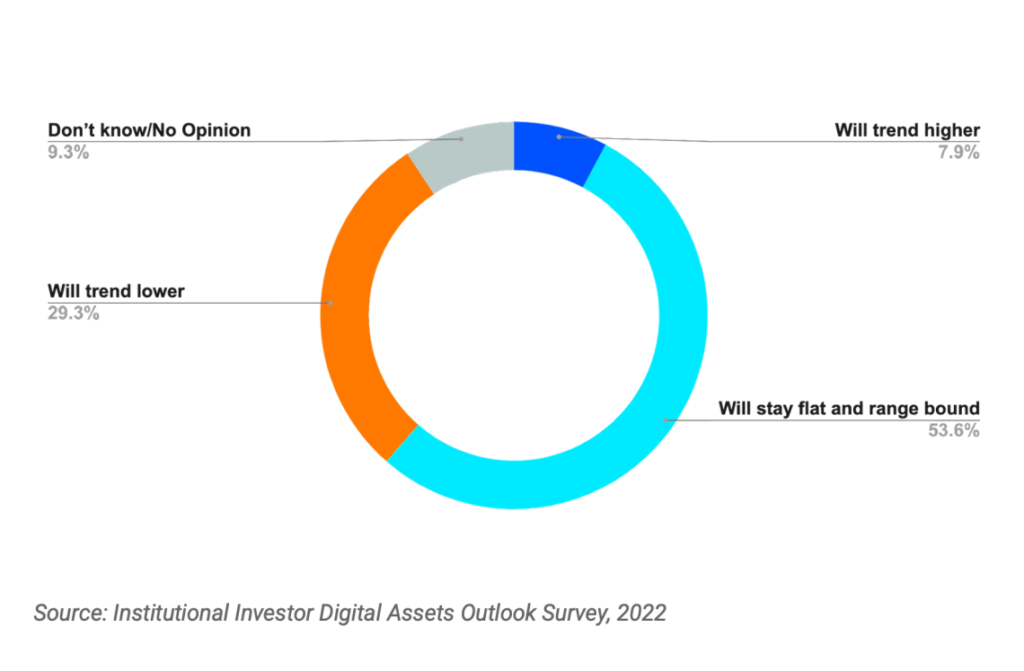

Long-term sentiment is positive. However, the results also show that turmoil in the industry has dampened investors’ optimism that digital assets will yield high returns in the coming months. More than half of those surveyed do not expect cryptocurrencies to see any significant price action in the next 12 months. Also, more than a quarter think digital assets will see more losses. Coinbase makes the following assessment:

The crypto winter dampened short-term expectations for a price increase. When asked about their outlook on prices, 54% of investors predicted that crypto prices will be range dependent. 29% of investors expect it to trend lower in the next 12 months.

Source: Coinbase

Source: CoinbaseStill, most respondents think cryptocurrencies will eventually recover, according to the survey. Coinbase makes the following statement:

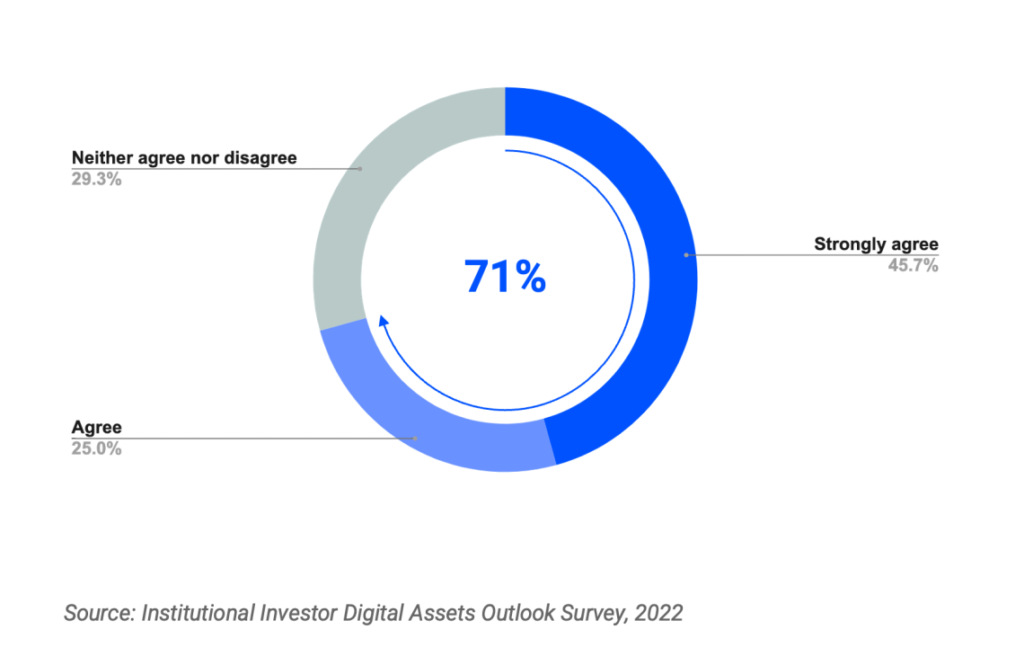

The long-term price outlook remains positive, with 71% of investors saying they expect digital asset valuations to increase over the long term.

Source: Coinbase

Source: Coinbase“Cryptocurrency has been shaken, but its fundamentals remain strong”

As you follow on Kriptokoin.com, negative emotions in the crypto industry are at an all-time high. Despite this, Macro expert and former Goldman Sachs executive Raoul Pal says its fundamentals remain strong. Pal notes that investor negativity is higher than he’s ever seen, including during the Great Recession and Dot.com bubble burst periods. In this context, the macro guru makes the following statement:

What we got is utter madness. Because there was an earthquake and everyone is hypersensitive. In my career, I have never seen such emotion in both crypto and the stock market. Twitter is so bad. I put up a relatively bullish chart to say that the NASDAQ may have priced in a major recession, only marginally higher. I must have gotten 100 anger comments. How dare I suggest that? There is anger, resentment, fear on a scale that was not present in 2008, not in 2001.

“The reason for the rise: Institutional adoption is increasing”

However, Pal points out that big tech is increasingly intertwined with the crypto industry. Thus, he says, the cryptocurrency space is on the rise as institutional investor adoption rises. Based on this, he comments:

Has anything changed in the cryptocurrency market? You are welcome? Is technology used? Has Solana agreed to use Blockchain Meta for NFTs? Yes. Does Google work with Solana? Yes. DeFi failed? No. Does the DeFi system idea work? Yes. Are cryptocurrencies exchanged in a value system on the internet? Yes. Is the number of people increasing in this ecosystem? Not so much as it stabilizes. But if you look at the past cycle, ie from the peak in 2017 to the decline in 2019, we lost about 80% of the active wallet addresses. Looking at it now, we lost about 30% as adoption continues to increase.

“Investors need to take a long-term view”

Raoul Pal says investors should take a long-term approach to investing in crypto, buy during panic dips, and hold onto their holdings to see future gains. He explains his views on this matter as follows:

So this is really a psychological game. And it’s a long-term game. We don’t interfere because we can make money in a year or two. We say, listen, the bet here is that if you wait and add to the bottom of the panic cycle and you just keep waiting and not using leverage and being sensible about what you’re doing, you’ll make it.