A deep-pocketed crypto whale succumbed to his stubbornness and closed its one-year position with a loss of $7 million today. The long-term investor has been betting on a single altcoin since the last months of 2021.

Stubborn cryptocurrency investment loses millions

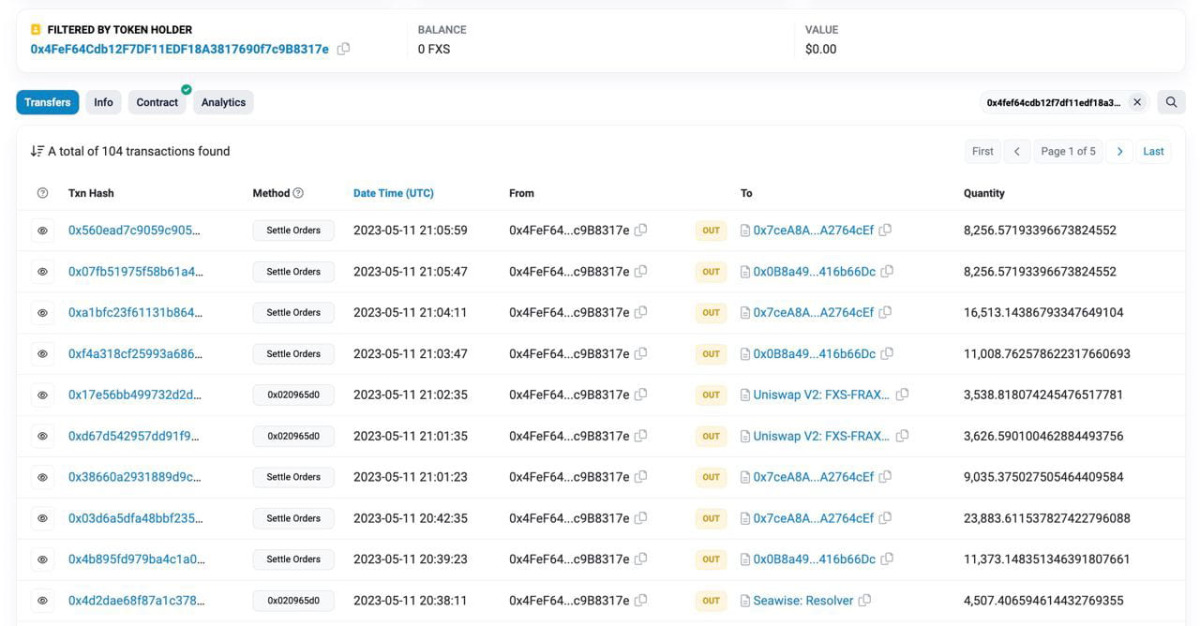

A whale that has held its Frax Share (FXS) position since the last months of 2021 admitted losses of up to $7 million on May 12, according to a report by Twitter’s @CryptoPatel. Whale has exchanged 398.7k FXS for only 2,431 million USDC in the last 2 days.

Bought every time the price rose or peaked throughout 2022

As the chart below shows, the altcoin whale continued to buy every time the FXS price fell throughout 2022. The FXS price has fallen several times well below the whale’s average purchase price. However, there was a chance to cut its losses when the price recovered somewhat in April 2022. But the whale chose to stake and add liquidity in anticipation of an even higher price.

In the end, it succumbed to the FXS price’s depreciation that had been going on since April 2022. Whale sold off all of the FXS it bought in the first months of 2022. The investment of nearly one year ended with a loss of up to 7 million dollars.

What is Frax Share (FXS)?

Frax Share is part of Frax, a decentralized stablecoin. It is also a cryptocurrency with a fixed value against the dollar. This altcoin uses a number of mechanisms for price stability. Frax Share is Frax’s management token. It controls the operation of these mechanisms, which are used to stabilize the price of Frax.

Frax Share is an Ethereum token with ERC-20 standards. This token plays an important role in Frax’s governance process. Frax Share holders can vote to make changes to the Frax protocol.

Frax Share faces a flexible supply according to market conditions. FXS supply is automatically adjusted according to the balance of supply and demand. This is important so that Frax can maintain price stability, even though the market value of FXS is not fixed.

Frax Share is gaining more and more acceptance in the DeFi world. Especially, it has an important place in its ecosystem. Frax Share is listed and used on various platforms such as DeFi protocols and decentralized exchanges. Crypto investors are showing interest due to FXS’s potential increase in value and Frax’s growing ecosystem.

How about the FXS price?

FXS price is currently trading at 85% discount from ATH at $42.67, the last last buy zone of the above whale. As we quoted as Kriptokoin.com, it was recently delisted from Binance’s Innovation Category.