Today, the maturity of over $ 3 billion of Bitcoin and Ethereum options are full. The maturity of these options will potentially lead to fluctuation in the crypto money market.

The maturity of Bitcoin and Ethereum options are full!

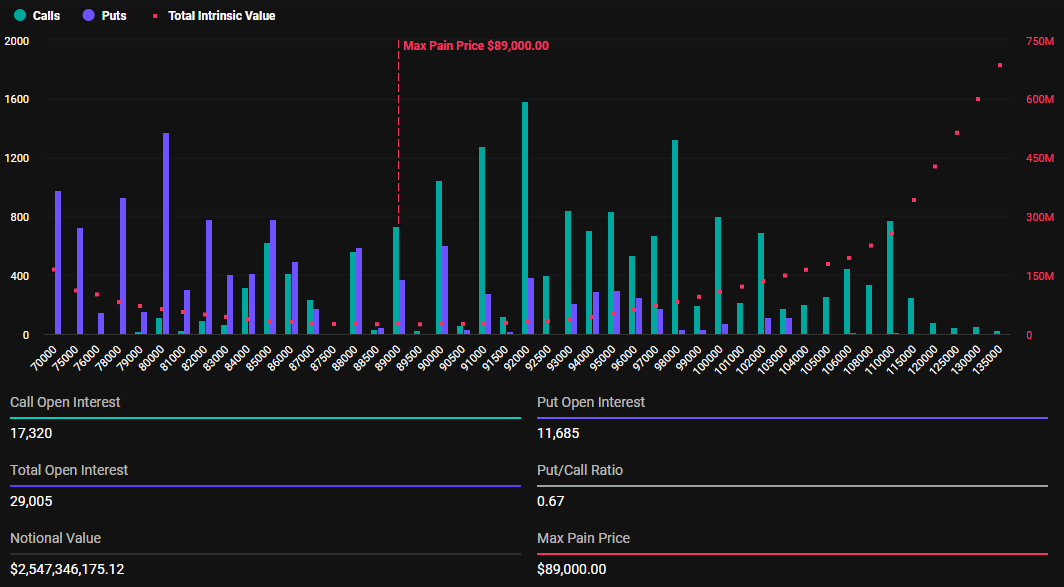

As you followed from Kriptokoin.com, sales started in the market after Donald Trump signed the Bitcoin reserve order. In addition, the 29.005 Bitcoin contract, which is a nominal value of $ 2.54 billion on March 7, will expire today. According to Deribit data, Bitcoin’s Put/Call ratio is 0.67. The maximum pain point is $ 89,000. This level refers to the price that the asset will experience financial losses to the highest number of owners.

Bitcoin options at the end of the maturity. Source: Deribit

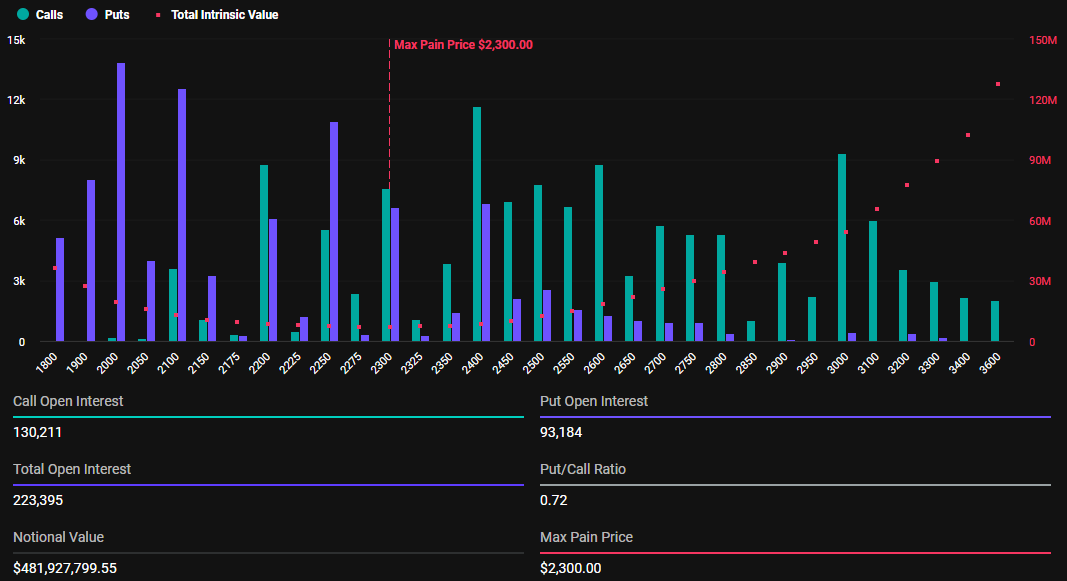

Bitcoin options at the end of the maturity. Source: DeribitIn addition, 223,395 contract with a nominal value of Ethereum $ 481.9 million will end. The maximum pain point for these contracts is $ 2,300, and the put/call ratio is 0.72.

Ethereum options that have survived. Source: Deribit

Ethereum options that have survived. Source: DeribitDoes the leader play danger bells for crypto money?

The maximum bitter point in the crypto currency option market represents the most financial disturbance price level to option holders. At the same time, Put/Call ratios, which are below 1 for both Bitcoin and Ethereum, show that purchase options (CALL) are more common than sales options (PUT).

Crypto Money Option Trade Tool Greex.Live talks about the general decline sensitivity in which trader expresses disappointments in the face of excessive volatility and wavy price movements. Bitcoin’s sharp -day fluctuations, such as the latest $ 6,000 -dollar movements, led to the conditions that the traders define as “deception in both directions”. According to analysts in Greex.live, this makes it difficult to determine a clear tendency. In this context, analysts make the following statement:

Most trades follow the 87,000-89,000 range as key resistance and have been recorded as 82,000 last bottom, but there is a significant dispute as to whether there is a sustainable bottom.

![]()

Crypto currency traders are waiting for more clear signals!

In addition, since the traders sometimes prefer to protecting down despite the upward movements, significant sales distortion reflects wider pessimism. Analysts also observe that traders adjust their strategies in the middle of high volatility. In this direction, Grreex.live, “Many trades in this environment as a preferred strategy in the range of 89,000-90,000 Call sells Call and a trader purchased at lower levels of Calls -260%reports that they are reported to be,” he adds.

The belief that the market is currently at a liquidity -oriented stage has caused focus on rapid inputs and exits. This prudent level is caused by the fact that long -term positions remain vulnerable to sudden fluctuations. External macro factors such as changing trade policies and tariff announcements increase uncertainty. As a result, many trades prefer to stay on the edge and are waiting for more clear signals before taking new positions.