CoinGecko’s “Cryptocurrency Industry Report” for the first quarter of 2023 has been published. The crypto market has emerged from year-end hibernation, according to the report. Also, decentralized finance (DeFi) and non-fungible token (NFT) spaces have boomed. Here are the details…

Cryptocurrencies, NFT and DeFi: What happened in Q1?

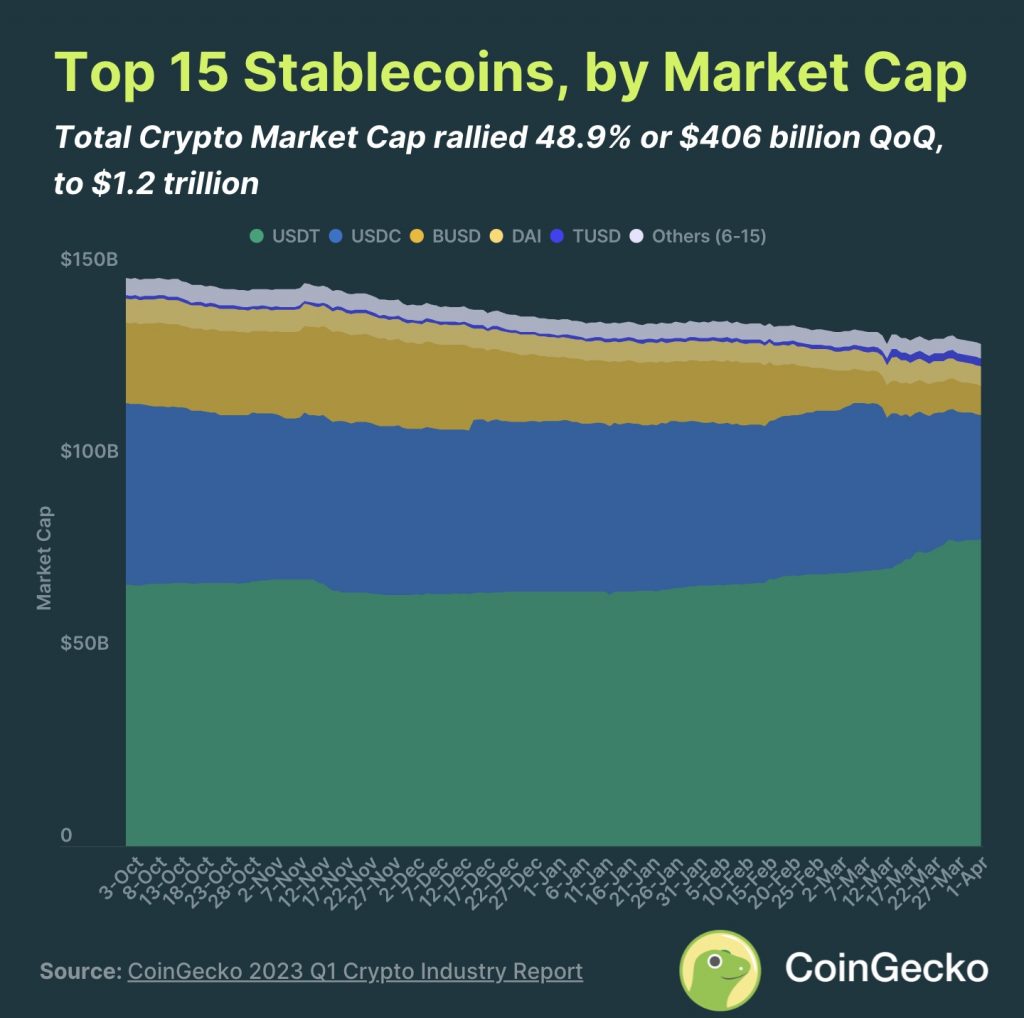

According to the report, the total market capitalization, which was $831.8 billion on January 1, 2023, increased to $1.238 billion on March 31, 2023. Thus, it experienced an increase of 48.9 percent. Bitcoin and Ethereum are currently hovering around $28,000 and $1,800 respectively. BTC is performing extremely well this quarter, gaining close to 72 percent. The report looks at the state of the crypto market from decentralized finance (DeFi) and non-fungible token (NFT) ecosystems. It also covers everything from analyzing Bitcoin and Ethereum to how centralized exchanges (CEX) and decentralized exchanges (DEX) perform.

The crypto market had a strong start to the year, with a total market cap of $1.2 trillion, bringing in $406 billion in absolute terms. Transaction volume also increased by 30 percent compared to the previous quarter. In other words, it increased from 33 percent in the 4th quarter of 2022 to 77 billion dollars in the 1st quarter of 2023. Trading volume spiked in January 2023, when the market was on the upswing. However, it was hit by the banking crisis before waning towards the end of the quarter. It rose momentarily at the beginning of March due to the increased volatility along with this crisis.

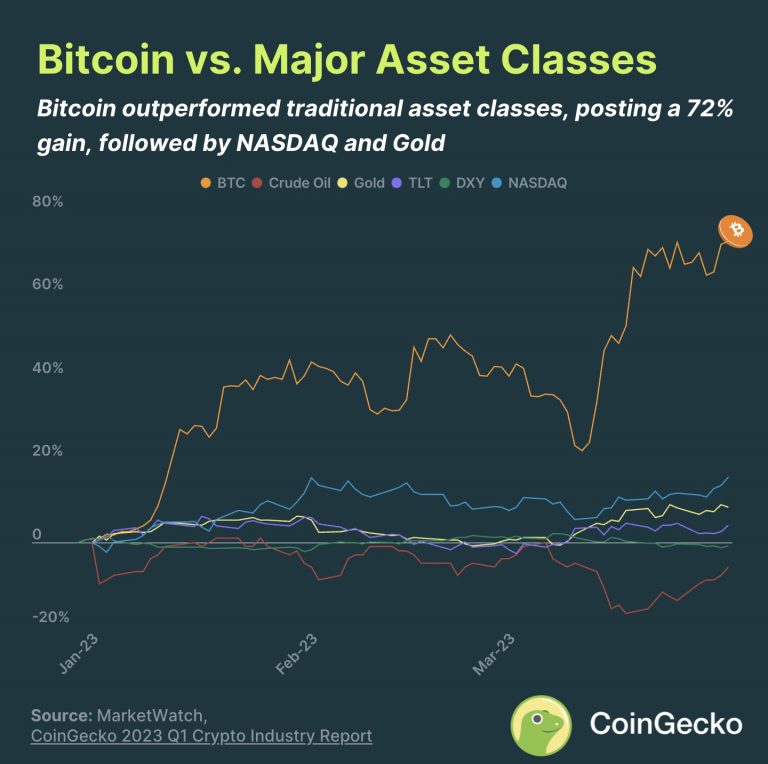

Bitcoin has moved better than traditional assets

Bitcoin has outperformed traditional asset classes. It earned 72.4 percent on an annual basis. Next, BTC was followed by the NASDAQ index (15.7 percent) and gold (8.4 percent). All major asset classes excluding crude oil finished the quarter in green. The US Dollar Index (DXY), along with other fiat currencies, was relatively flat during the quarter.

On the other hand, the market cap of stablecoins fell 4.5 percent ($6.2 billion), while USDC and BUSD were the biggest losers. Tether (USDT) added 20.5 percent ($13.6 billion) to its market cap, further cementing its position as the largest stablecoin. True USD (TUSD) has surpassed FRAX to become one of the top 5 stablecoins.

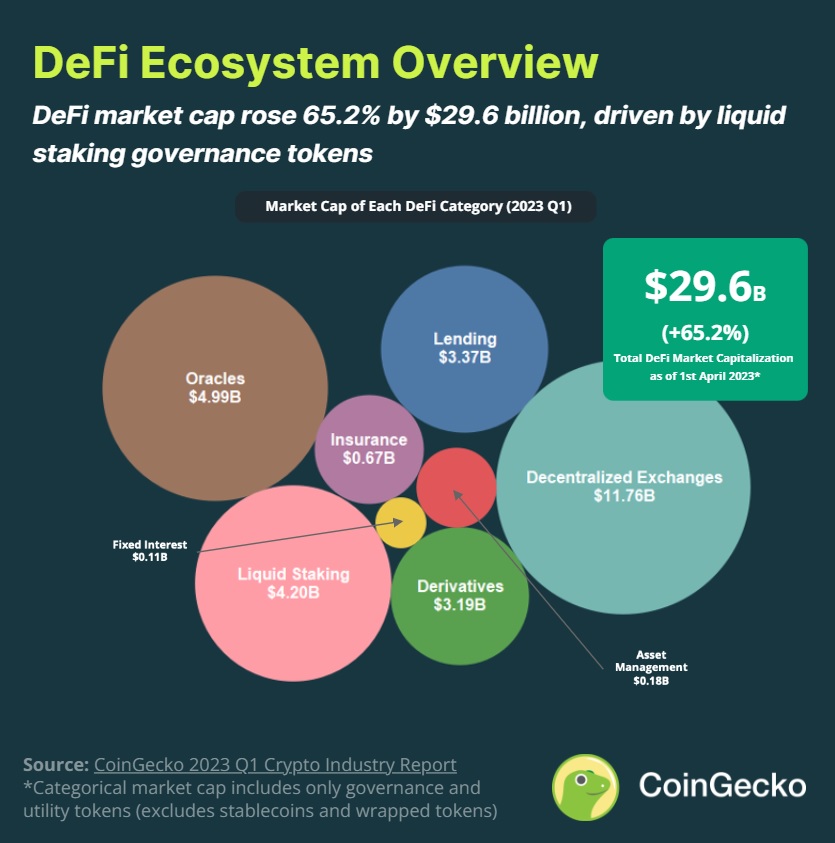

DeFi industry rose 65%

DeFi industry market capitalization increased 65.2 percent in Q1 to $29.6 billion in revenue. According to the report, especially the liquid staking governance token performance had a great impact on this increase. As we reported on cryptokoin.com, with the approval of Ethereum’s Shapella upgrade, liquid stake management tokens recorded a 210.9 percent increase in market capitalization in the first quarter. It has now surpassed lending protocols to become the 3rd largest category in DeFi.

Despite increasing 44.3 percent in market capitalization in the first quarter of 2023, decentralized exchange (DEX) governance tokens continued to lose market share. It’s down 5 percent since January.

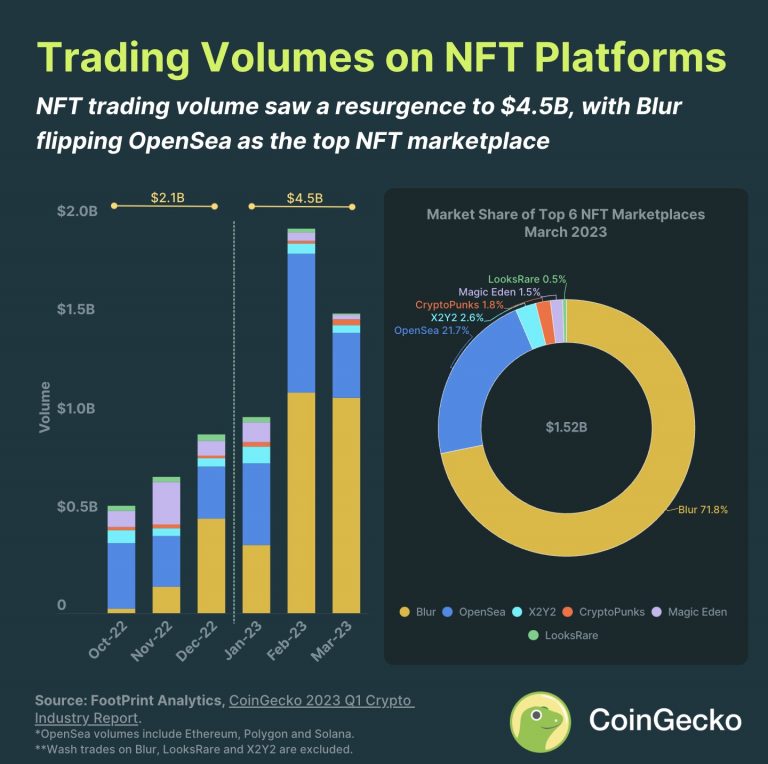

Blur outperforms OpenSea on NFTs

NFT transaction volume also started to rise again, rising from 2.1 billion dollars in the 4th quarter of 2022 to 4.5 billion dollars in the 1st quarter of 2023 with an increase of 68 percent. The majority of NFT trading volume came from Blur, a new NFT platform launched in October 2022. Within six months, he dethroned former market leader OpenSea, increasing its market share from 52.8 percent in December 2022 to 71.8 percent in March 2023. It currently dominates the top 6 NFT markets. Meanwhile, OpenSea’s market share fell from 29.3 percent to 21.7 percent in the same period.

Most networks saw an increase in transaction volume in the first quarter, while Solana’s ecosystem weakened. The largest marketplace in Solana, Magic Eden’s trading volume decreased 67.9 percent from $73.9 million in December 2022 to $23.6 million in March 2023. Famous collections y00ts and DeGods also migrated to other chains, dealing another blow to Solana. You can access the report of CoinGecko.