Bears have dominated the cryptocurrency market since the last months of last year. During the process, most altcoins have melted more than 80% from their peak prices. However, a handful of projects have managed to post big gains in the past seven days. Thus, they look ready to see a bullish move forward. Here’s a look at three such altcoins from CNBC’s list and what made them stand out above the rest of the market…

Top 3 altcoins to watch out for in October 2022

Elrond (EGLD)

Elrond is a Blockchain platform for distributed applications and enterprise use cases. It stands out as a highly scalable, fast and secure platform. Thanks to Secure Proof of Stake (SPoS), Elrond aims to reach 15,000 transactions per second (TPS) capacity in the future.

The price of Elrond’s native cryptocurrency, EGLD, has increased by about 22.5% over the past ten days. It jumped from $45.43 to $55.65 on September 28. One reason for the spike is Elrond’s new mainnet upgrade. After Ethereum and Cardano, Elrond’s update has also been on the cards for a while. The update news started to support the price of ELGD towards the end of September. But the real rally began after Beniamin Mincu, founder and CEO of Elrond, announced the success of the new mainnet upgrade in a tweet on Oct.

Experts predict that ELGD can recover another 20% if it breaks the $54.5 barrier. This estimate means $60 soon for EGLD, which is currently trading at $55.24.

Polygon (MATIC)

MATIC is another altcoin that went green last week and shows promise for future gains. Polygon is a tier two or side chain scaling solution. It provides a framework for new and existing Ethereum-based Blockchain projects without scalability issues.

MATIC rose more than 8 percent last week. It went from $0.7754 on Oct. 1 to $0.8179 at the time of writing. According to an article published by Bankless, Polygon investors can earn more. MATIC has formed a falling wedge and an inverted head and shoulders pattern, both of which are bullish indicators. This puts MATIC in an upside break position with key resistance at $1.20.

Another factor pointing to a bullish trend around Polygon is the number of unique addresses. According to a Santiment report, MATIC was one of the top cryptocurrencies with increasing unique network addresses. According to the report, carbon neutral Blockchain ranked fifth behind Bitcoin, Ethereum, Litecoin, and Tether in terms of new daily unique interactive network addresses.

Uniswap (UNI)

Uniswap is by far the world’s leading decentralized exchange. It currently has an average daily trading volume of over $1 billion, with an average of $200 million, with its closest competitor, PancakeSwap. It also owns 64 percent of all DEX volumes, according to DeFi Llama.

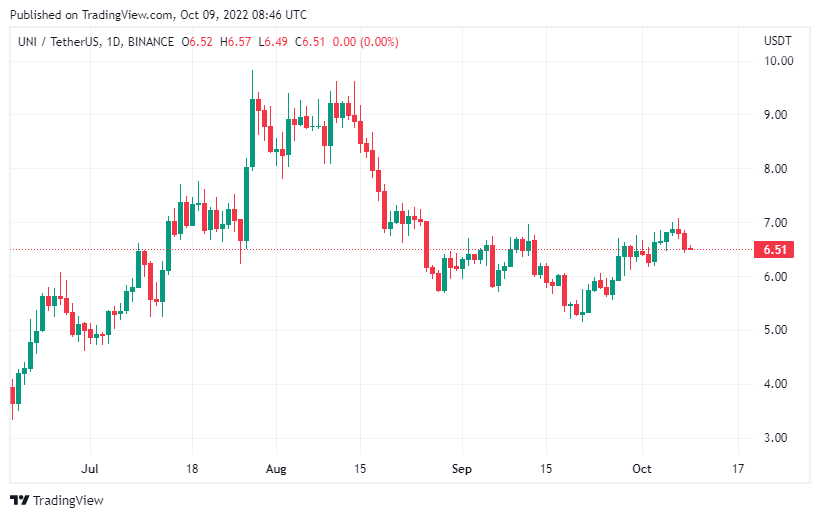

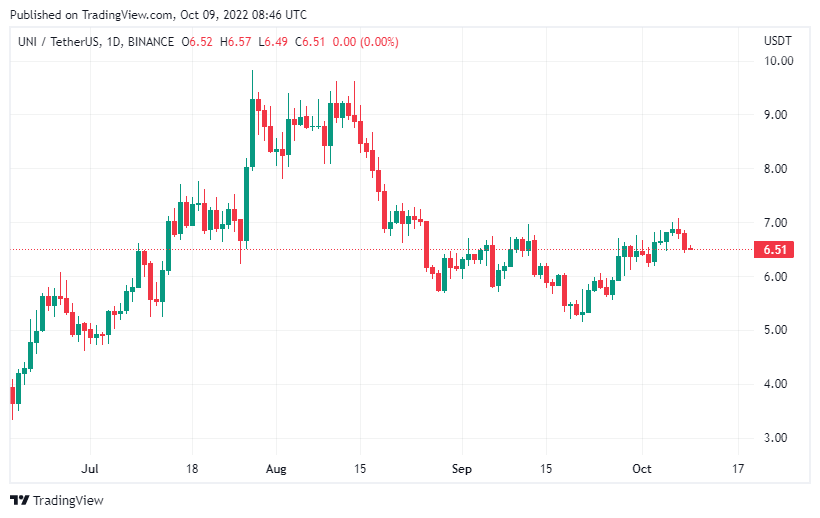

The price of the platform’s native token UNI has also increased by about 9% over the past week. UNI is currently trading in the region of $6.54, from $6.29 on October 1. This is because Uniswap Labs, the parent company of Uniswap, is preparing $200 million in new funding, according to multiple reports.

Two key investors tied to the funding round are Polychain Capital and a Singapore-based sovereign wealth fund. If the funding round passes, it will set Uniswap on track to become the next crypto unicorn. This will help Uniswap improve its product offerings and strengthen its position as the largest decentralized exchange (DEX) in the world. These are all good indicators of further price increases.