Bitcoin has risen for the sixth consecutive day in the longest winning streak since March 29, when it rose eight days in a row. However, it saw a hard sell today as the US CPI came in above expectations. Financial markets expert Pinchas Cohen explains why Bitcoin will continue to drop.

“I don’t agree with traders who say bitcoin will bounce”

Crypto trader Capo Of Crypto tweeted last week. In his post, there was a pattern of buying interest that ripped supply pockets as the BTC price plummeted. Capo predicted that once this asset stops accumulating, the coin will bounce and will definitely rise by 19%. Also, Nik Bhatia, author of Layered Money, and Bitcoin Layer analyst Joe Consorti argue that “vigilant supply peaks are springboards for upward price action.”

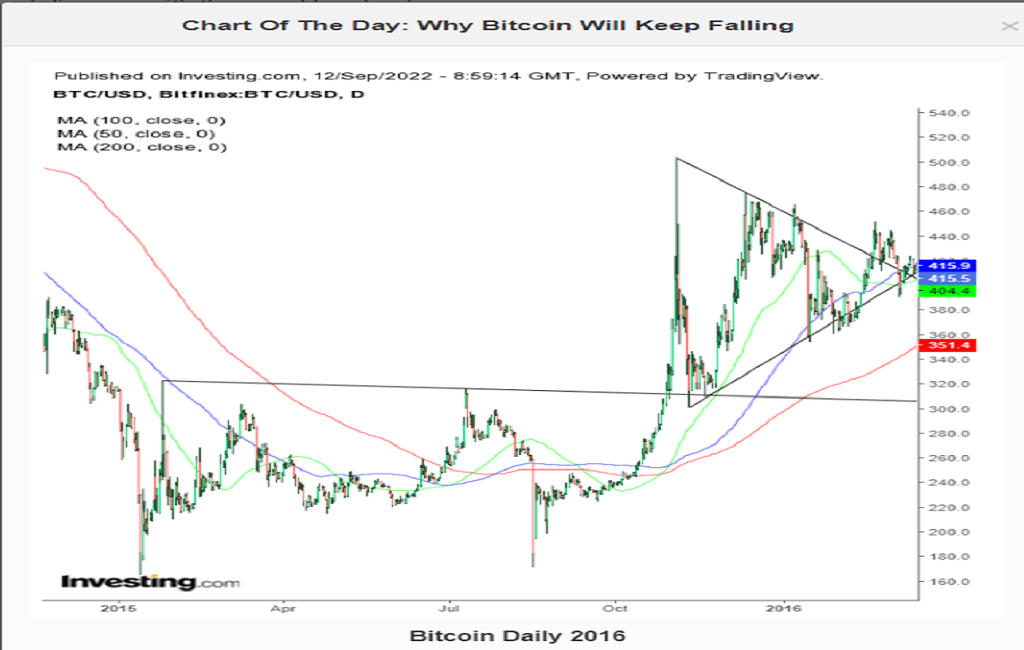

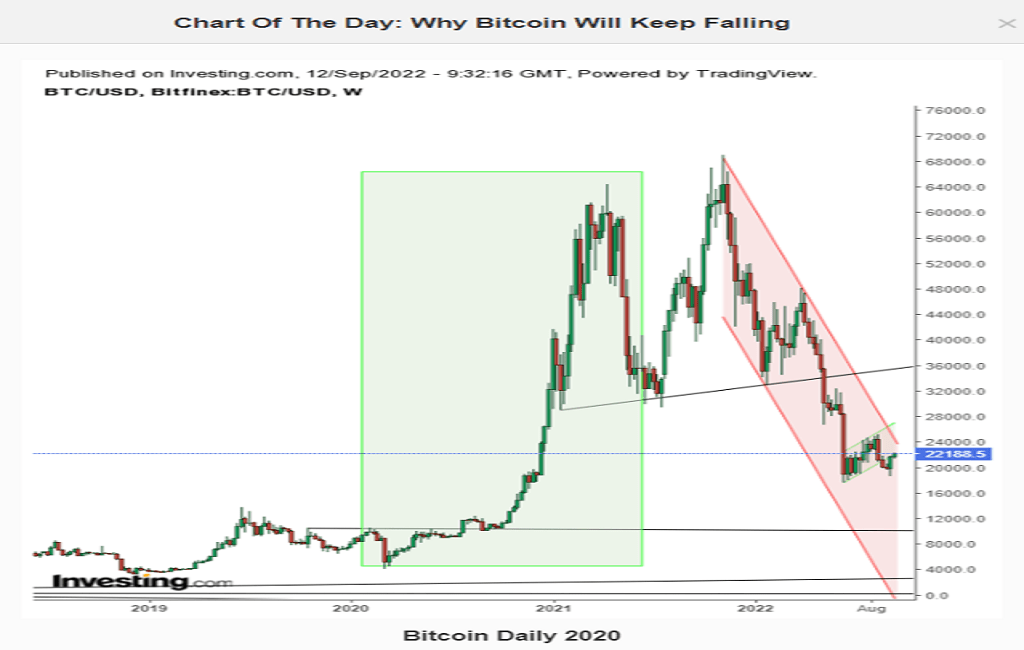

This is an argument favored by crypto traders that sleep in Bitcoin price equals a bottom. They give examples of 2016 and 2020, when Bitcoin was quiet and then the price exploded. I disagree with them and here is why:

The bottom of Bitcoin in 2016 laid the groundwork for a large symmetrical triangle. It then followed an ongoing uptrend.

BTC bottomed out in 2020. It then skyrocketed from there to an all-time high of $64,374 on April 14, 2021.

In stark contrast to the previous two examples that followed bottoms, BTC is chasing a high today. Not just any peak, but the largest in its history, -$35k.

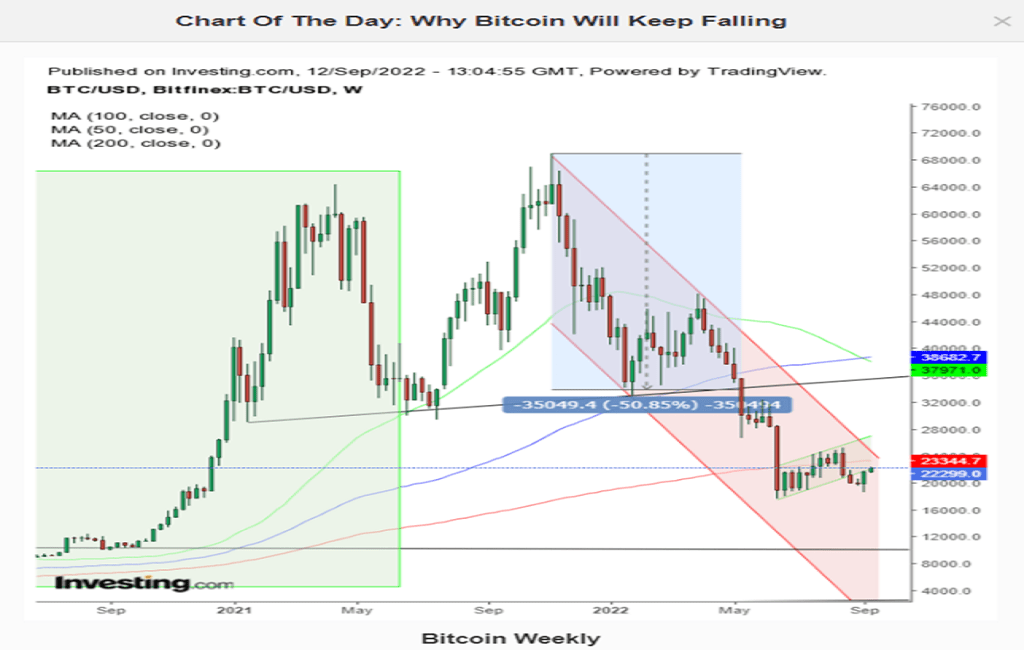

“I will be the first to say when Bitcoin hits bottom!”

Also, as you follow on Kriptokoin.com, the price is finding resistance below the ascending channel. It succumbs to the more prominent falling channel. Note that the price has dropped below the 200-week moving average (WMA) for the second time since March 2020. This is the first time a record has been set since September 11, 2017. However, the weekly price closed slightly below the indicator and returned the following week. Currently, Bitcoin is below the 200 WMA for the fifth week in a row. Also, 50 WMA fell below 100 WMA even during this rally. I’ll be the first to say that when Bitcoin hits bottom. According to the principles of technical analysis, the digital currency has been on a much lower trajectory since January. Price retests the broken ascending channel near the top of the falling channel. It provides a potentially ideal introduction, at least from a risk-reward perspective.

Remember, you need to trade with a plan that includes your timing, budget, and temperament. If you don’t know how to compose, I’ve provided a general example below so you can practice learning about yourself. The principles of technical analysis are statistically based assumptions. There is no way to know if this market will follow the statistics. Therefore, before entering the trade, close your eyes and imagine losing. If you can’t do this, don’t trade. The longer you trade consistently, the better your overall trading will be.