TRON Founder Justin Sun said that a $2 billion reserve fund will be deployed to protect TRX from rising short-term interest. Many crypto leaders outline plans and methods to combat worsening market conditions. Altcoin prices continue to fall, despite Terra co-founder Do Kwon announcing that UST will be revived.

The next target after UST may be this altcoin

As quoted by Kriptokoin.com, the Tron network recently launched a stablecoin, USDD, similar to UST. After LUNA, Justin Sun says TRON (TRX) could be the next target. TRX short funding has reached 100% on Binance, according to TRON CEO. Tron Dao Reserve plans to spend $2 billion to prevent problems now and defend price action. Justin Sun says in the following tweet:

TRX’s short financing on Binance is over 100 percent annualized. The target after LUNA seems to be TRX. trondaoreserve will distribute 2 billion USD to fight them.

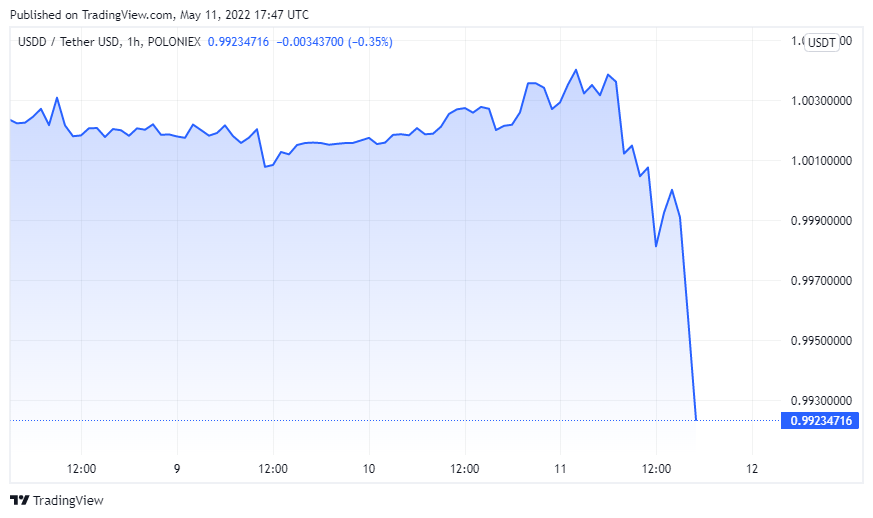

Stablecoin giants like USDT, USDC and BUSD also show divergences

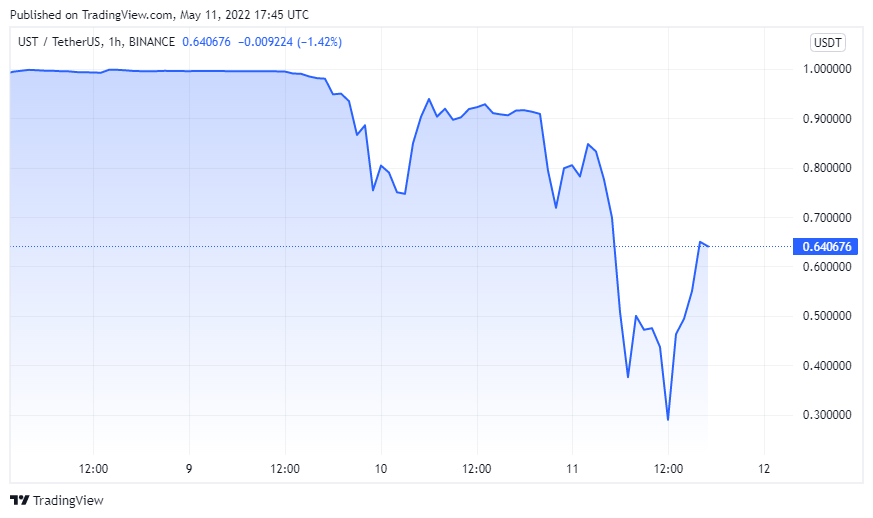

Shortly after the UST, most stablecoins diverged somewhat. Tether (USDT), USDC and BUSD are the most stable stablecoins in the market. Terra’s stablecoin, UST, which is tied to the dollar, has lost 68% in the last 24 hours. It is trading at $0.6634 at the time of writing.

According to Tron founder Justin Sun, the USDD price has remained stable despite the recent market turmoil. The total capitalization of Stablecoin is $270 million while the total capitalization of Tron Dao Reserve is $10 billion. At the time of writing, USDD price is trading slightly lower at $0.992. According to Sun, Tron’s funding rate on Binance currently stands at -0.3448 percent, or -1.0344 percent APR.

Stablecoins have a new member: TRX

USDD is now available in BitTorrent’s Multichain Cross-chain interoperability. The company made the announcement earlier this week. Bridges between BitTorrent, Ethereum, Fantom and Avalanche networks now allow users to exchange USDD with each other. According to the networks, stablecoins form a strong alliance with five other TRON-based cryptocurrencies.