Chainlink, after the identified three -month program, a 19 million Link Token’s lock, worth approximately 269 million dollars. The latest Token version drew attention in the midst of concerns about a significant process, including a high -profile trader on the Hyperliquid platform.

Chainlink’s last link lock opening process attracted attention!

The lock was sent to Binance, 14,875 million LINK, worth 212.9 million dollars of a total of 19 million toks. Since the largest percentage of LINK’s trading volume is in Binance, this has the potential to add liquidity to the stock market. The remaining 56.2 million dollars worth 4,125 million LINK was moved to the multiple signature wallet labeled 0xD50. Since Chainlink has been constantly watching this model for years, this token distribution is not new.

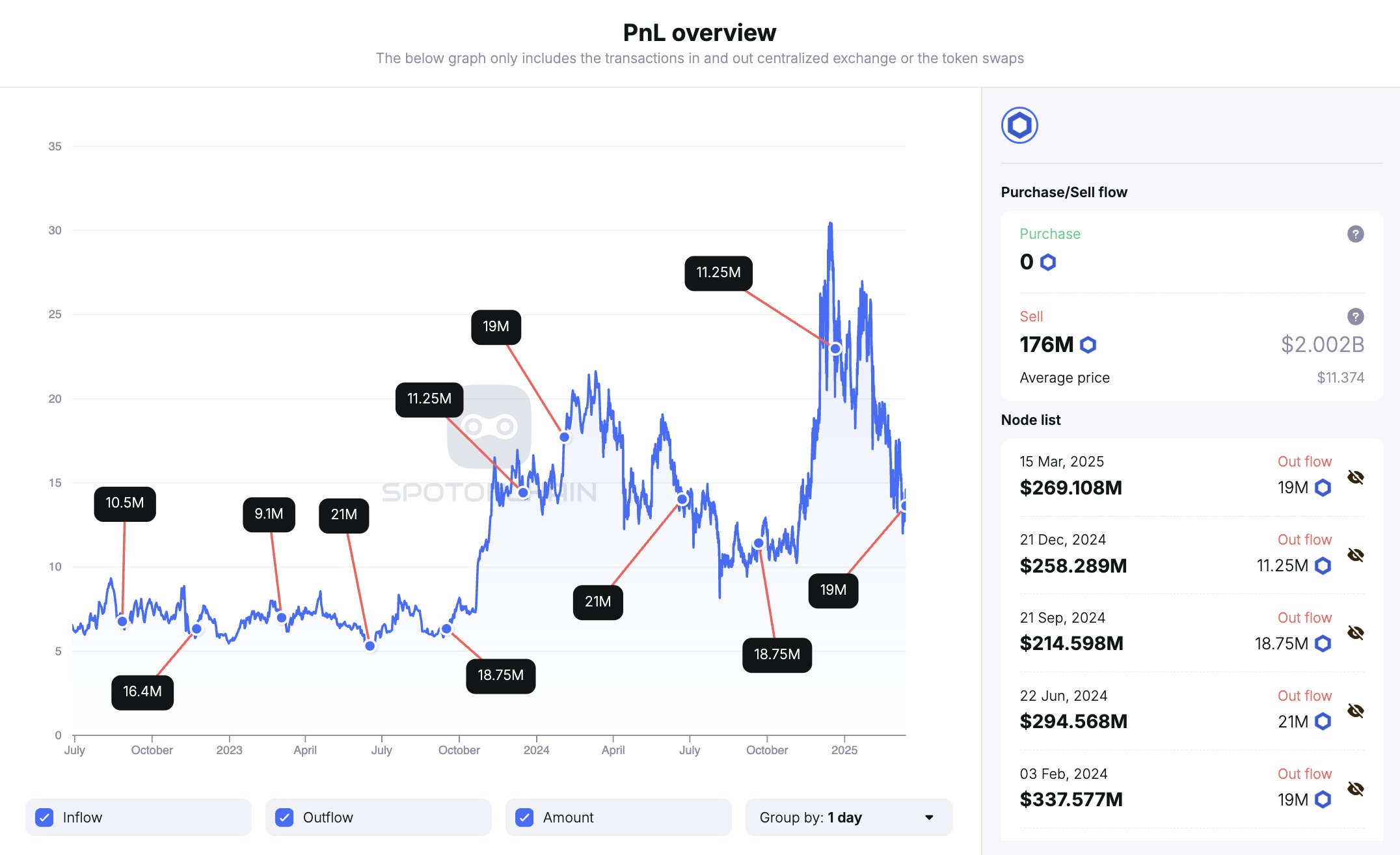

The data of Spotonchain, the analytical platform, reveals that Chainlink has been unlocked by approximately 2 billion dollars at that time and 176 million dollars worth $ 2,43 billion at that time since August 2022.

Chainlink’s Link Token three -month lock opening. Source: Spotonchain

Chainlink’s Link Token three -month lock opening. Source: SpotonchainOf these, 151.3 million LINK was transferred directly to Binance at an average price of $ 11.41. In spite of these transactions, Chainlink keeps 342.5 million links worth $ 4.7 billion in various supply contracts that are not in circulation.

Hyperliquid whale returns to Link

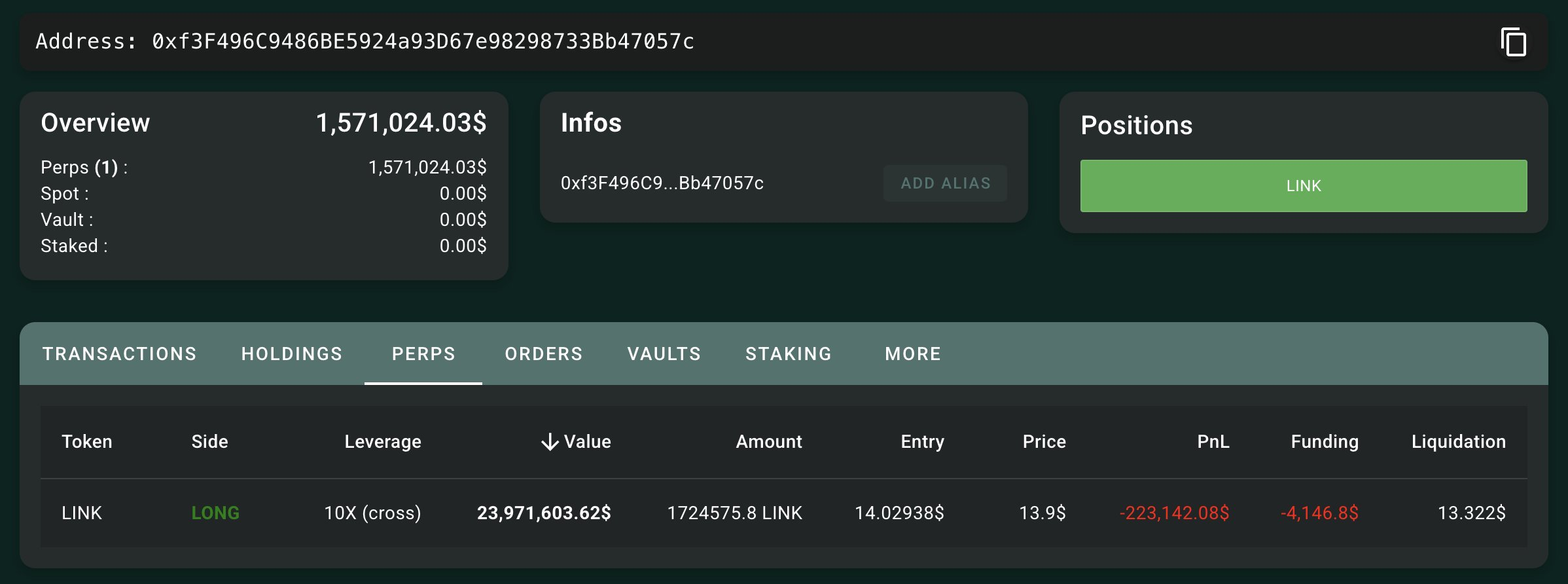

On-Chain Intelligence Company, Lookchain, detected a high-profile whale that shifted its focus to LINK. Trader, known as “ETH 50X Big Guy, drew attention with its leverage transactions that resulted in a $ 4 million loss for Hyperliquid. On March 14, this whale entered the Long position in LINK with a leverage of 10x leverage and performed transactions in Hyperliquid and GMX, a two major permanent stock markets. In addition, the whale purchased 863,174 LINK for 12.1 million USDC.

Hyperliquid mysterious trader’s Long position in Link. Source: Lookonchain

Hyperliquid mysterious trader’s Long position in Link. Source: LookonchainHowever, Blockchain data shows that stablecoins gradually reduce their levels of link assets through multiple small swaps only a few hours after the whale’s long position.

This trader first tested Hyperliquid’s trading frame on March 12th after he tested it in an aggressive way. The platform was forced to announce the upcoming risk management changes by suffered a loss of $ 4 million. In the meantime, these events did not seriously affect the price of LINK.