Bitcoin and other cryptocurrencies are likely to witness an increase in volatility following the Fed’s interest rate decision. What are the important levels to watch in major altcoins including Bitcoin and XRP? Crypto analyst Rakesh Upadhyay examines the charts of the top 10 cryptocurrencies to find out.

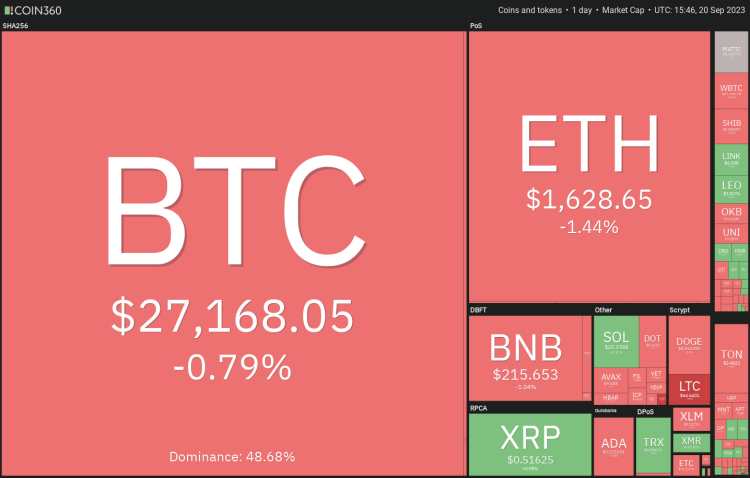

An overview of the cryptocurrency market

Bitcoin’s recovery faces a sell-off above $27,000. However, long-term investors were not surprised and continued to accumulate. Glassnode data shows that Bitcoin’s inactive supply has been at all-time highs since July. However, this upward trend is not reflected in corporate activities. Investors have reduced their cryptocurrency exposure and are sitting on the sidelines waiting for more clarity on the regulatory and macroeconomic front. Asset manager CoinShares reported that outflows from exchange-traded products reached $455 million in the last nine weeks.

Daily cryptocurrency market performance. Source: Coin360

Meanwhile, analysts are divided on Bitcoin’s near-term price movement. John Bollinger, creator of Bollinger Bands, states that Bitcoin may initiate an upward move. But he adds that it is “too early to answer.” Volatility will likely increase after the Fed decision. Therefore, traders need to be careful not to fall into a bull or bear trap. It is better to wait on the sidelines and enter after volatility decreases and a directional move begins.

BTC, ETH, BNB, XRP and ADA analysis

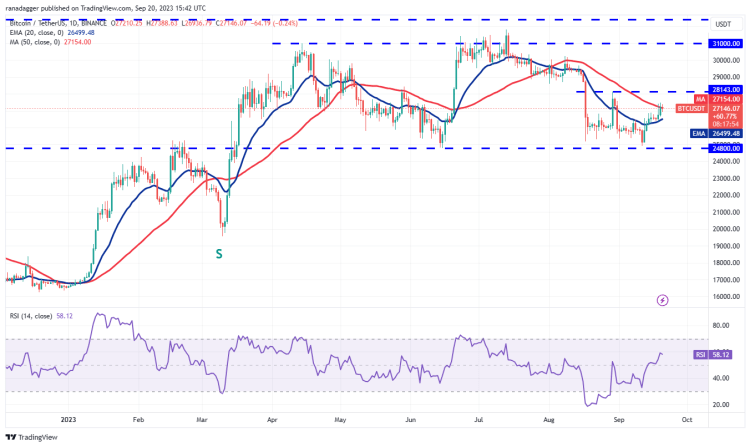

Bitcoin (BTC) price analysis

Bitcoin faced stiff resistance at the 50-day simple moving average ($27,154). This shows that the bears are trying to stop the recovery. The upward 20-day exponential moving average ($26,499) and the relative strength index (RSI) in the positive zone indicate that the bulls are in control.

If the price bounces back from the 20-day EMA, it will increase the possibility of a rally above the 50-day SMA. If this happens, it is possible for BTC to rise to $28,143. Conversely, if the price declines and breaks below the 20-day EMA, it will indicate that the bears remain active at higher levels. A breakout and a close below $26,000 could accelerate the sell-off. It is possible that this could sink BTC towards the important support at $24,800.

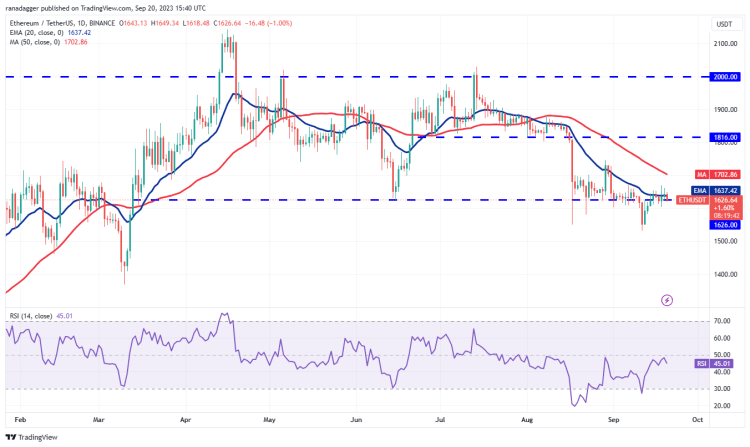

Ethereum (ETH) price analysis

Ether has been trending above the $1,626 breakout level for the past few days. However, the bulls failed to overcome this strength.

The long wick on the September 18 and 19 candlestick indicates that the bears are selling higher. The horizontal 20-day EMA ($1,637) and the RSI just below the midpoint suggest a balance between buyers and sellers. A rally above $1,680 could tip the advantage in favor of the bulls. It is possible for ETH to rise as high as $1,745 later. On the contrary, a break below $1,600 would indicate that the bears have not given up yet. It is possible that this could push ETH to $1,530.

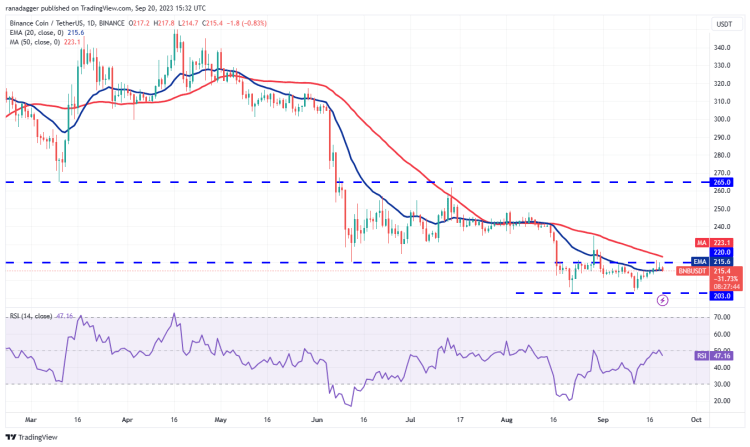

Binance Coin (BNB) price analysis

Buyers attempted to push BNB above the overhead resistance of $220 on September 18 and 19. However, the bears successfully defended this level.

A slight advantage in favor of the bulls is that they did not allow the price to fall below the 20-day EMA ($215). This shows that the bulls are buying small dips as they expect the upward move to extend further. If buyers clear the zone between $220 and the 50-day SMA ($223), it is possible that BNB could start a rally towards $235. If the bears want to prevent an upward move, they will need to pull the price below the 20-day EMA. This is likely to keep the price between $203 and $220 for a while.

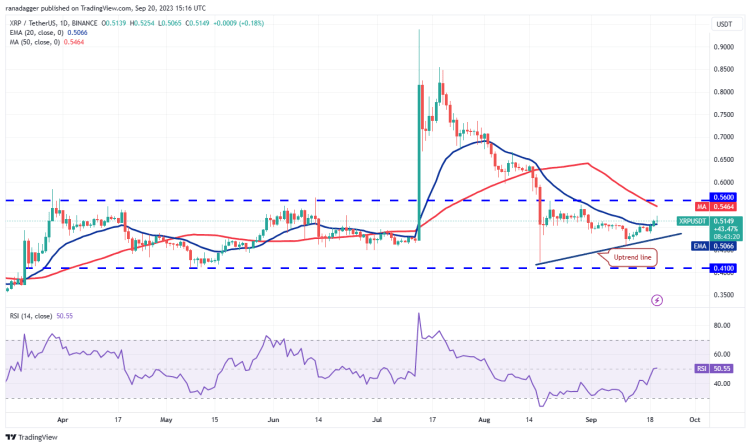

Ripple (XRP) price analysis

XRP price rose and closed above the 20-day EMA ($0.50) on September 19. This shows that XRP bulls have the upper hand.

If the price remains above the 20-day EMA, it will indicate that the bulls are trying to turn the level into support. This would open the doors for a potential rally to the overhead resistance at $0.56, where the bears will most likely stall. XRP price action of the last few days is showing signs of forming an ascending triangle formation that will complete with a breakout and close above $0.56. Buyers will need to keep the XRP price above the uptrend line to maintain the setup.

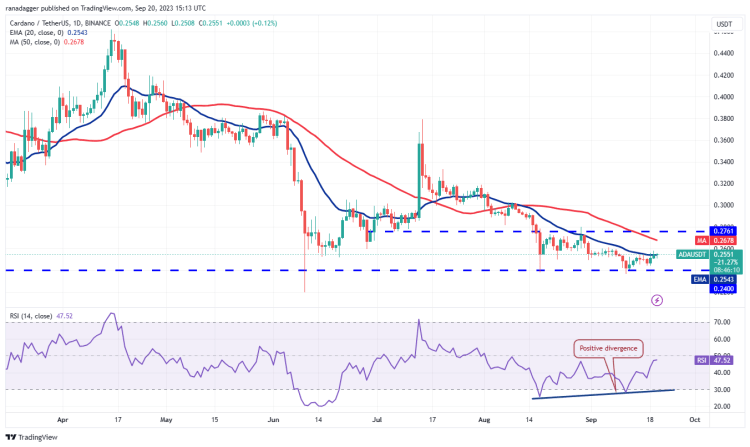

Cardano (ADA) price analysis

The bulls have been trying to push Cardano above the 20-day EMA ($0.25) for the past few days. But the bears do not agree to this.

The flattening 20-day EMA and the RSI just below the midpoint indicate a balance between supply and demand. If buyers continue to hold the price above the 20-day EMA, ADA price will attempt to rise towards the overhead resistance at $0.28. Alternatively, if the price falls sharply from the current level, it would indicate that the bears are selling in relief rallies. A breakout and close below the $0.24 support will indicate the beginning of the next leg of the downtrend. The next support on the downside is at $0.22.

DOGE, SOL, TON, DOT and MATIC analysis

Dogecoin (DOGE) price analysis

Dogecoin has been trading near the 20-day EMA ($0.06) for the past few days. This shows that the bears are defending the level aggressively.

One small positive point in favor of the bulls is that they did not allow the price to fall below $0.06. This shows that the bulls are trying to break through the overhead hurdles. If the 20-day EMA gives way, it is possible for DOGE to rise to $0.07 and then to $0.08. Instead, if the price falls sharply from the current level, it would indicate that sentiment remains negative and traders are selling on rallies. The bears will then aim to sink the price below $0.06 and pull the critical support at $0.055.

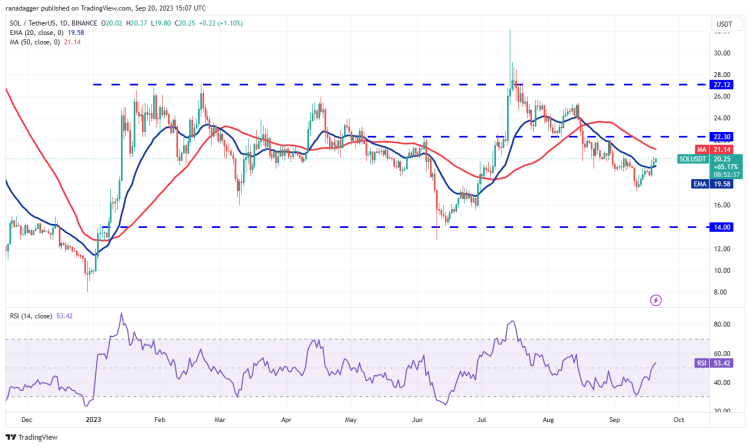

Solana (SOL) price analysis

SOL struggled to break above the 20-day EMA ($19.55) for several days. The altcoin finally broke through this barrier on September 18.

The 20-day EMA is flattening out and the RSI is just above the midpoint. This shows that the bears have lost control. Buyers will try to push the price towards the 50-day SMA ($21.14) and then the overhead resistance at $22.30. This level is likely to attract strong selling by the bears. This positive view will be invalidated in the near term if SOL declines and breaks below $18.50. SOL is likely to retest strong support at $17.33 later.

Toncoin (TON) price analysis

Toncoin (TON) is currently in a strong uptrend. The bulls are trying to strengthen their position further by pushing the price above $2.59. But the bears held their ground.

Although the bullish move faced a sell-off near $2.59, the bulls gave no ground to the bears. This shows that traders are holding their positions because they expect another rise. It is possible for TON to reach $2.90 above $2.59 and eventually $3.28. Upward sloping moving averages indicate an advantage for buyers. However, the overbought level on the RSI warns of a possible correction or consolidation in the short term. An initial support for TON price on the downside lies at $2.25. Also, the next level to watch out for is $2.07.

Polkadot (DOT) price analysis

The bulls are struggling to push DOT above the $4.22 breakout level. This shows that demand decreases at higher levels.

The bears will try to strengthen their position by pushing the price below the immediate support at $4. If they succeed, DOT risks falling to the important support at $3.90. A breakout and close below this level could initiate the next leg of the downtrend. Instead, if the price turns up from the current level and rises above the $4.22-4.33 resistance zone, it is possible that it could lead to a ‘short squueze’. It is possible for DOT to first reach the 50-day SMA ($4.50) and then rise to the downtrend line.

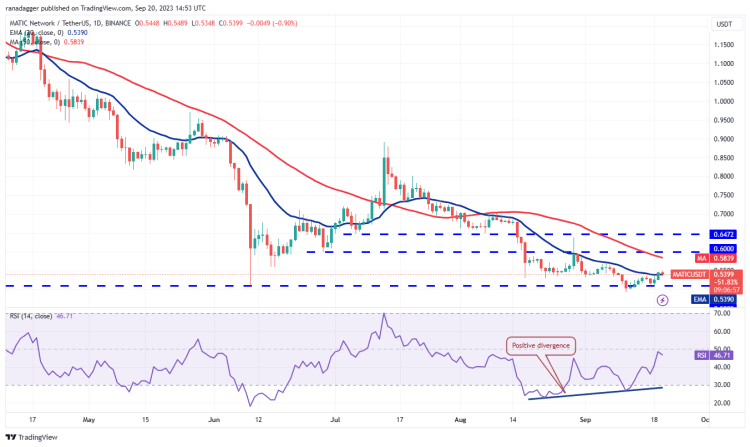

Polygon (MATIC) price analysis

MATIC rallied on September 19, closing above the 20-day EMA ($0.54). This shows that the bulls are attempting a comeback.

Still, the 20-day EMA is likely to witness a tough battle between bulls and bears. If the bulls hold the price above the 20-day EMA, a rally to the overhead resistance of $0.60 and then to $0.65 is possible. Conversely, if the bears pull the price back below the 20-day EMA, it will signal that higher levels continue to attract selling. The bears will then try to increase their advantage by pushing the price below $0.49.