Bloomberg commodity analysts say that Ethereum (ETH) is undervalued significantly and its three biggest altcoin competitors all show solid potential. Here are the details…

Bloomberg draws attention to the rivals of the leading altcoin Ethereum

In the latest Crypto Outlook report, Bloomberg strategist Mike McGlone is trying to predict the value of an investment based on projections of future cash flows. Based on his model, he says that Ethereum remains undervalued in the long run. The report uses the following statements:

Traditional investors can discover that the rules of the game have changed with Ethereum turning into a cross-asset with a unique mix of equity, commodities and monetary features. One of our discounted cash flow models is currently hitting an Ethereum value of $6,128, a 110 percent increase from current levels.

Analysts note Ethereum’s massive revenue stream through transaction fees, which they say have increased by over 200 percent each year since the blockchain’s inception. Commodity strategists also say that the trend signals for Solana (SOL), Terra (LUNA) and Avalanche (AVAX), which are touted as “Ethereum competitors” as we have reported by Cryptokoin.com, are bullish.

SOL, LUNA and AVAX: Risk appetite is back

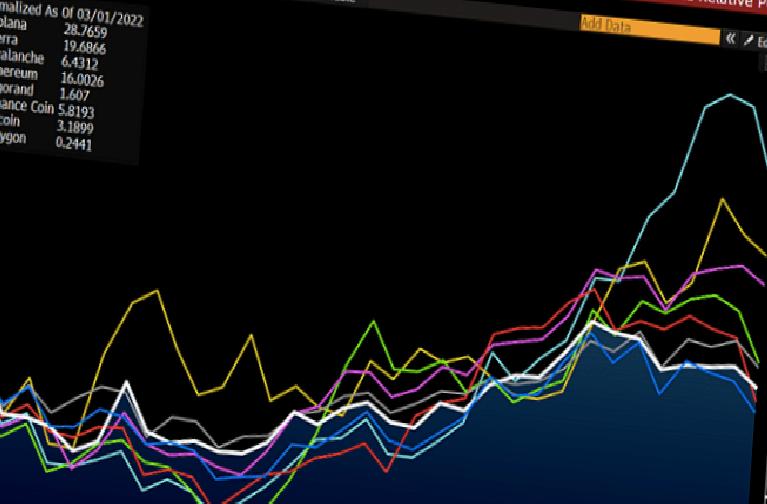

Analysts, along with three ETH rivals, have seen the apparent superior performance of major cryptocurrencies of other major layer-1 chains during the broad market leap over the past few weeks.

Alternative tier-1s such as Solana, Terra and Avalanche report broader March monthly returns of around 1.5-2x the benchmark asset (ETH), even after taking into account higher volatility. led the market recovery. This improvement in technical breadth is a healthy sign that risk appetite is returning.

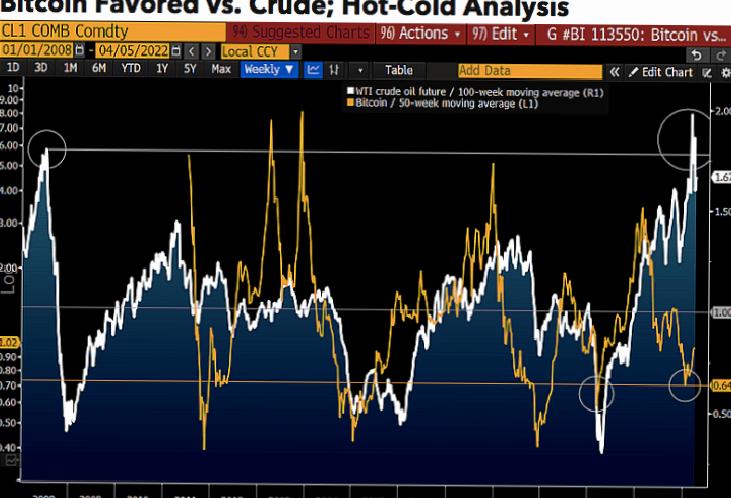

As for Bitcoin (BTC), commodity strategists look to the historical performance of crude oil to gauge what the next trend might be. Analysts, who view both assets as commodity markets, suggest that the relatively high prices of crude oil compared to Bitcoin’s discount could mean that the price of BTC will rise as it returns to the average.