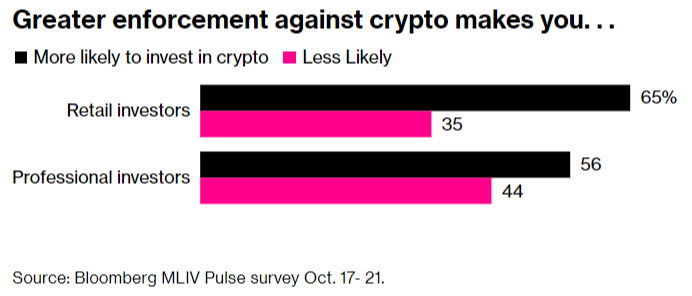

A crackdown by the US Securities and Exchange Commission (SEC) and other observers investigating crypto companies is proving to be a boon for the industry. Market participants say they are more likely to invest in the space after further regulatory action. Respondents in the Bloomberg survey are more optimistic for Bitcoin (BTC) than in July.

Why is SEC regulatory action seen as bullish for crypto?

Almost 60% of the 564 respondents to the latest MLIV Pulse survey said they saw the recent influx of legal action in crypto as a positive sign for the asset class, whose trademark volatility has almost completely disintegrated in recent months. Major interventions include US regulatory investigations by bankrupt crypto companies Three Arrows Capital and Celsius Network, as well as an SEC investigation into Yuga Labs, the creators of Bored Ape’s NFTs.

Chris Gaffney, head of world markets at TIAA Bank, said:

I’m in the ‘yes’ camp. As a professional investor, you need a regulated investment opportunity. The more regulated it is, the more professional traders open the doors to get involved in crypto. The more crypto they can get from the Wild West and traditional investment, the better.

Where will Bitcoin be at the end of the year?

The sentiment extends to Bitcoin (BTC). Most investors were a little more optimistic about crypto than when asked in July. Almost half of those surveyed expect the leading crypto to continue trading between $17,600 and $25,000 by the end of this year. It departs from this summer’s sour outlook, which many say is more likely to drop to $10,000 than to climb to $30,000. To be fair, the participants this time had a larger menu of options than was available in the previous survey. Mary-Catherine Lader, COO of Uniswap Labs, explains in a Bloomberg interview:

Our investors and the market recognized that decentralized protocols have unique advantages that could benefit not only crypto markets but also traditional markets more broadly.

MLIV Pulse: Bull or bear for Bitcoin and altcoins?

As you follow on Kriptokoin.com, Bitcoin has dropped about 60% this year. Bitcoin price has remained between $18,171 and $25,203 since the previous survey was conducted. It failed to break out of this band in any meaningful way. The token hit an all-time high of almost $69,000 on November 10. Since then, the T3 Bitcoin Volatility Index has dropped 33%.

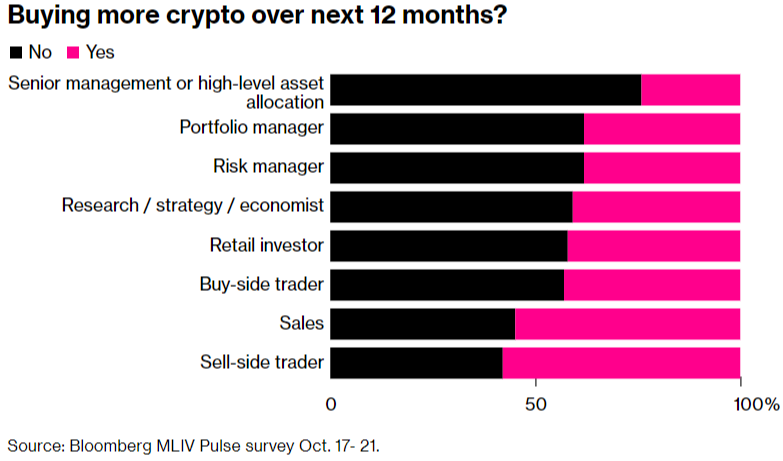

Bitcoin has been strongly correlated with assets at risk and the S&P 500 since March. Investors are scanning crypto with the same brush as everything else in an environment of rising interest rates. That’s why they hardly changed positions in the last three months. Nearly 42% of respondents think crypto’s relationship to tech stocks will remain the same over the next 12 months. However, only 43% say they will increase their digital asset portfolio over the same period.

Cryptocurrencies ‘Ponzi’ or ‘Future’?

Meanwhile, in 2022, when chaos reigned in the first half of the year, it was a tale of two halves for crypto. There were bankruptcies like that of Voyager Digital Ltd. and the $40 billion destruction of the Terra ecosystem. Nearly $2 trillion in total value wiped it from the industry’s record at the end of 2021. In June, the broader macroeconomic environment began to change. Traders turned to more traditional assets like bonds and FX for profit. In this environment, things have changed as the coin is starting to approach its current range limit flat. Fairlead Strategies managing partner Katie Stockton says the low volatility is “probably related to the indecision out there.”

Respondents are also divided about crypto, despite the industry’s relative poor position among traders. When asked to choose a word to describe the field, the two most popular responses were ‘Ponzi’ and ‘Future’. The answers are almost equal between them. Victoria Greene of G Squared Private Wealth says, “It’s almost like a religion. “If you believe, you will always believe, no matter the price or the wind.” Greene concludes with this:

There is a dichotomy between boom and bust. This perfectly describes crypto and the wide range of potential outcomes. There are many unknowns, including the arrangement and platforms, as well as what it actually is and what it will be used for. So, if you are a true believer, you say that this is ‘The Future’. People with a more traditional view say it’s a ‘Ponzi’.