The first publicly traded Bitcoin (BTC) mining company has filed for bankruptcy. So, it’s time to start talking about the capitulation of BTC miners. Crypto expert Dominic Basulto takes the issue and explains what it means for the BTC price.

BTC miner capitulation is now obvious

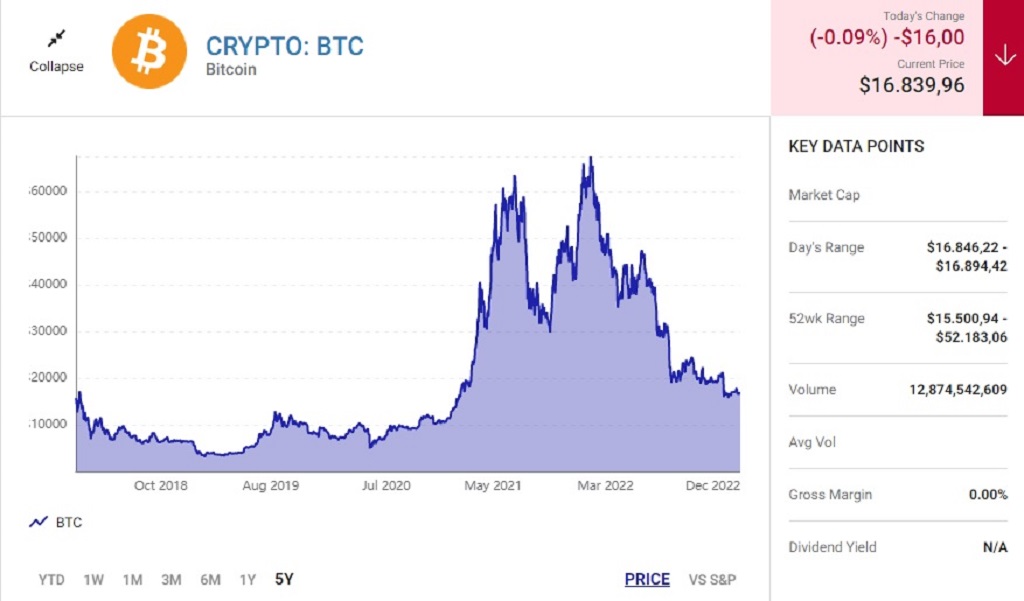

As you follow on Kriptokoin.com, Bitcoin (BTC) miners are struggling with difficulties. But this could be good news for anyone hoping for a Bitcoin rally. With the BTC price falling and the energy price rising, BTC miners had a hard time making money in 2022. While profit margins are shrinking drastically, some are now shutting down their operations altogether in a process known as Bitcoin miner capitulation. The most obvious sign so far of capitulation of Bitcoin miners is Core Scientific filing for bankruptcy protection under Chapter 11 on December 21.

What Bitcoin miner capitulation means for the future price of Bitcoin. There are two different schools of thought on this. These include both the bear scenario and the bull scenario.

Bearish scenario for Bitcoin

The bankruptcy of BTC miners is bad for the Bitcoin price. Creating this bear scenario is easy. Most obviously, any failure in Bitcoin mining contributes to the overall bearish trend in the Bitcoin market. Wall Street investment banks will no longer recommend Bitcoin mining stocks as outliers. Also, they will no longer recommend Bitcoin. Thus, everything related to BTC will start to look like a ‘sell’.

The downward spiral really begins when Bitcoin miners start shutting down operations. We’ve already seen this with several bankruptcies in the BTC mining industry. For example, in September we saw Compute North, which provides data, hosting services and infrastructure to Bitcoin mining companies, filing for Chapter 11 bankruptcy. Investors immediately began to control which BTC miners were significantly connected to Compute North.

In the worst-case scenario, BTC miners will actually start going bankrupt. And when they do, they will have to liquidate everything, including Bitcoin assets. Predictably, this puts more selling pressure on the Bitcoin price. Therefore, some traders are predicting that Bitcoin will fall as low as $10,000 based solely on fears of the capitulation of BTC miners.

Bull scenario for bitcoin

It is good for BTC price that BTC miners go bankrupt. This bull scenario is more difficult to create. Because it requires a leap of faith for new crypto investors. Historically, the capitulation of BTC miners has been one of the best signs that we are close to reaching the bottom of the market. For example, in the 2018 Bitcoin cycle, BTC miner capitulation started when BTC dropped to $6,000. Then it went up to $3,000. Then a new BTC rally started.

So, from this perspective, we may be preparing for another BTC rally. As BTC price rises from the bottom, BTC mining will become profitable once again. All mining companies that manage to avoid going bankrupt in this cycle will be able to participate in the upside potential. Then, as BTC miners become more profitable, Wall Street investment banks will start recommending them. So the cycle will start again. Of course, past performance is no guarantee of future performance. So be careful not to rely too much on historical price data.

The bull state of BTC miner capitulation also includes crypto market-specific factors such as the overall BTC hash rate, which is a measure of how much computing power is used to mine BTC at any given time. Core Scientific specifically cited the ‘increase in the global BTC network hashrate’ as a key factor when it filed for bankruptcy. The bullish situation also includes analysis of the amount of BTC currently held in the digital wallets of BTC miners. According to analysts, miners are not abandoning Bitcoin at this time. So this is also a positive sign for BTC price.

Is BTC suitable for investment right now?

Bitcoin miner capitulation is an interesting starting point to consider what will happen to Bitcoin in the next 12 months. While there is certainly room for debate as to what this particular signal means for BTC, I am definitely in the camp that considers the capitulation of BTC miners to be a positive sign for the future price of Bitcoin. I am bullish on BTC both in the short term and in the long term.

Core Scientific’s bankruptcy filing is certainly a cause for concern. However, the company specifically said that the bankruptcy would not disrupt operations. BTC will not liquidate its assets. He will also try to hold on to his life for the next BTC rally to come. This sums up what many BTC investors have to think about right now. It’s possible that bad news is good news when it comes to BTC. If Core Scientific bankruptcy is a sign of the capitulation of BTC miners, then the market could eventually bottom out. Now there is only one way to go from there: Up.