Bitcoin (BTC) has been stuck between 81,000 and $ 85,000 for the last week. The fact that the price is consolidated at this level points to a high -risk struggle between bulls and bears. If $ 85,000 cannot turn into a strong support level, the probability of BTC will decrease to $ 78,000 again. However, a strong wave of purchase can take the price to higher levels.

Does Bitcoin’s bottom level occur?

In the last two days, there has been half a billion dollar entrance to Bitcoin ETFs. This shows the increasing interest of corporate investors to BTC for the first time in March. At the same time, the change in the fear index is remarkable. The index moved from the level of “extreme fear” to “fear” level. Historically, this indicates that BTC may have found the bottom level.

In addition, long -term investors (LTH) continue to accumulate. On March 16, 167,000 BTC was taken at an average of $ 82,000. However, despite this strong accumulation, Bitcoin is still difficult to exceed $ 85,000. The use of high leverages maintains support levels and also increases sales pressure.

Weak demand and high leverage creates risks

Bitcoin’s current price movements are supported by a low purchase volume, especially in the Binance Spot market. In order to turn the 85,000 dollar level into a strong support area, more institutional purchases and increasing volume are needed.

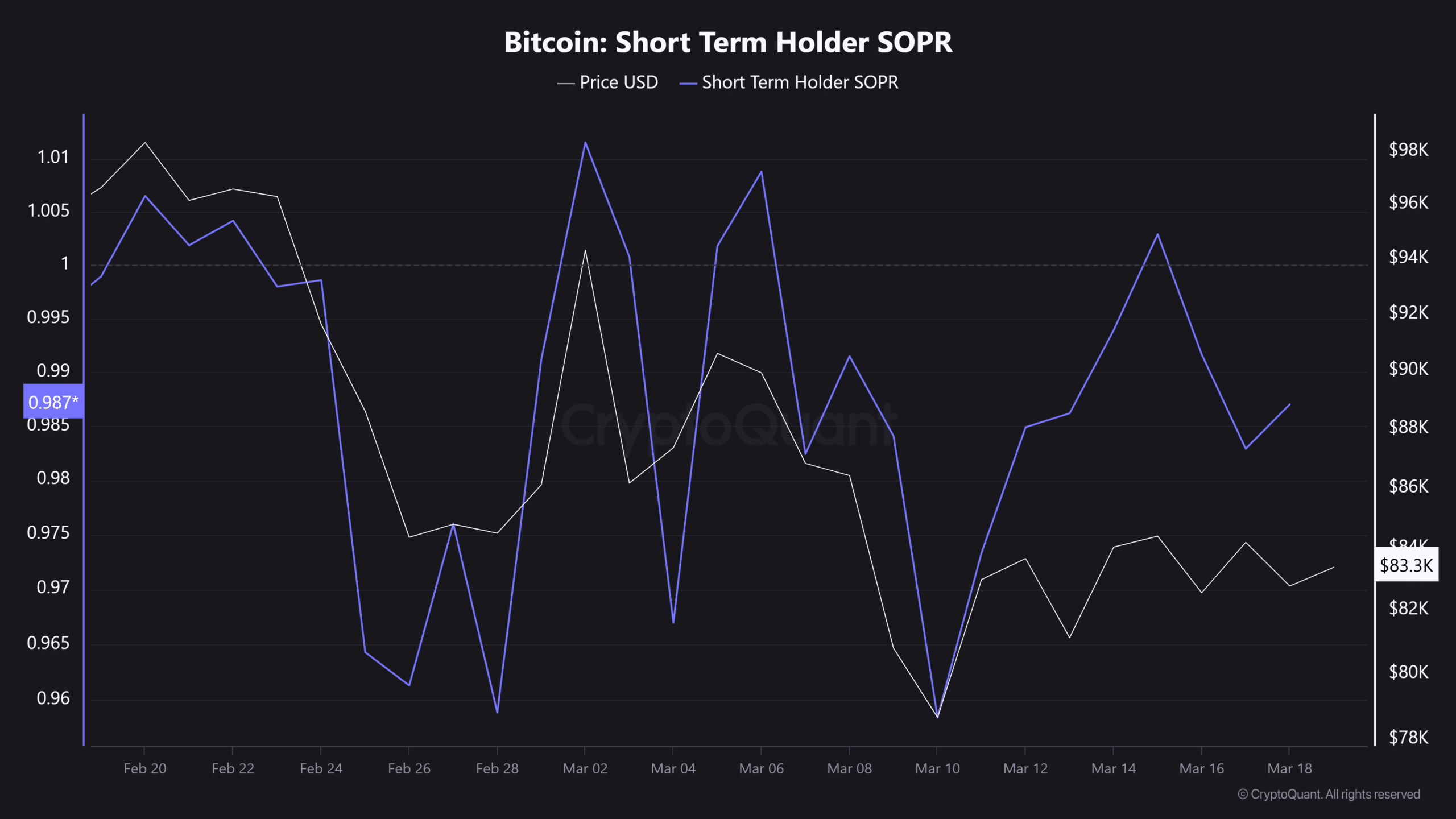

However, short -term investors (STH) are cautious in the Bitcoin market. According to the data, the expenditure profitability rate of STHs (SOPR) has returned to negative. This shows that short -term investors sell at the loss and the sales pressure increased. If Bitcoin’s leverage long positions are quickly liquid, a withdrawal towards $ 80,000 may be inevitable.

Can Bitcoin exceed $ 85,000?

Bitcoin needs to create a strong purchase momentum to overcome $ 85,000. If investors and institutional actors continue to purchase, the price may break this resistance. Otherwise, the current sales pressure may cause Bitcoin to retreat to $ 80,000.

Increased leverage use and weak spot demand in the market indicate a short -term course for Bitcoin. However, if long -term investors continue to make purchases and ETF entrances increase, bulls may take over the superiority and Bitcoin may move towards new summits.