While Bitcoin is trading at $19,800, it is in the “Extreme Fear” region in the Fear & Greed index.

The Fear and Greed index is an index that measures the mood of users in the market about the course of the market. This index can be used to determine whether users are inclined to buy or sell.

Market Comes to Extreme Fear Zone

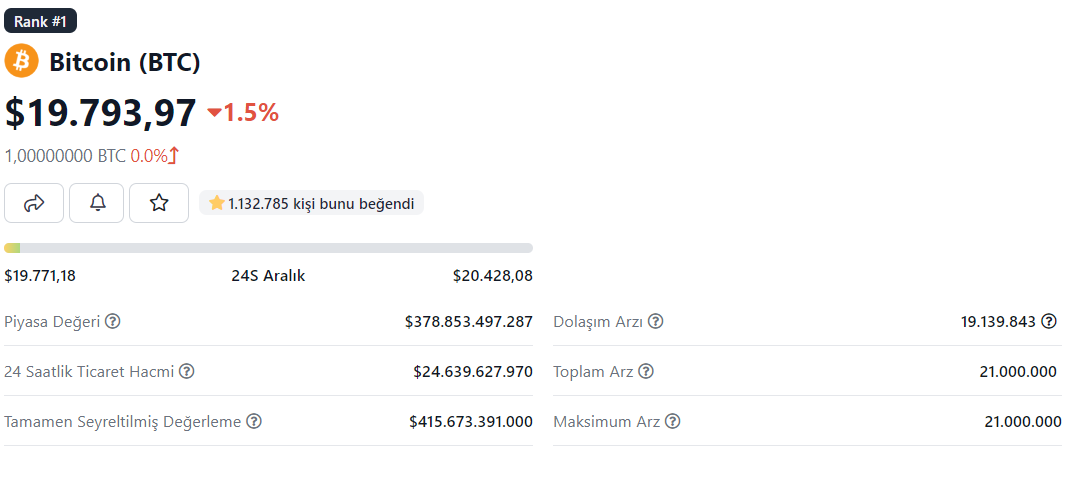

The fact that Bitcoin fell below 20 thousand dollars again and was traded at $ 19,800 caused the views of users to change.

Bitcoin price Source: CoinGecko

Bitcoin price Source: CoinGeckoOn Friday, August 2, Bitcoin dropped from the $20,000 level it managed to hold for a while and fell a bit and came to the $19,800 band. It took several attempts to reclaim $20,000, but Bitcoin failed to hold on to this price line.

Prior to that, the regular employment report came out along with the US unemployment data. The numbers in it were higher than expected, which hit the stock market and with it the cryptocurrency. Additionally, non-farm payrolls were announced as 317,000 additional payrolls versus the expected 350,000. This suggests the Fed Reserve won’t be making much of a turnaround from its current hawk strategy.

In his speech to bankers on August 26, Fed chairman Jerome Powell announced that the US central bank’s hawkish policy would continue. On that day, Bitcoin started its current decline and dropped below the $21,000 level. Although the index in question showed a low value, the website team warned that a time of “extreme fear” in the market could present a good buying opportunity for the asset.

https://twitter.com/BitcoinFear/status/1565859642172915712

Ranging from 20 to 30 until September 1, this index shows 21 as of today and is in the extreme fear zone. Despite the index showing a low value, the index team warned that a time of “extreme fear” in the market could present a good buying opportunity for the asset.