Bitcoin still follows the legendary model created by Jean-Paul Rodrigue. Also, crypto analyst Benjamin Cowen says that Bitcoin will come under selling pressure due to this macro factor.

According to the model, Bitcoin should make a splash in the coming weeks

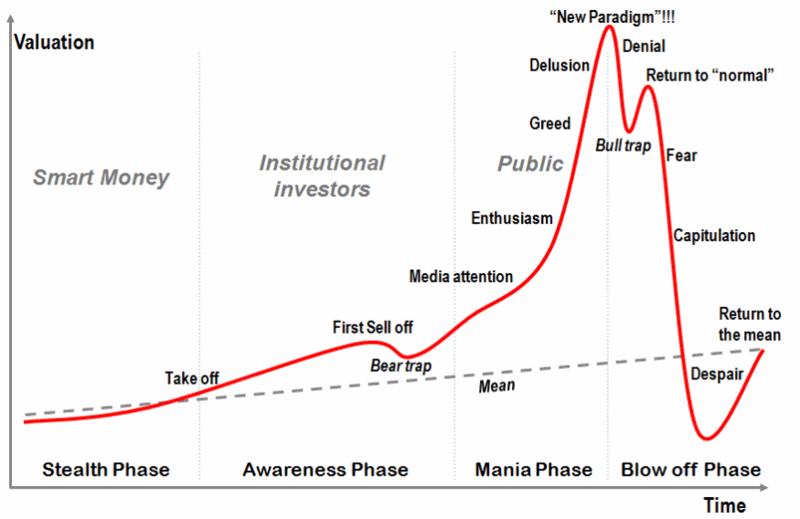

One of the world’s most popular patterns, known as ‘bubble stages’, was developed by professor Jean-Paul Rodrigue. It is especially helpful during the lack of fundamental events happening in the digital asset industry. It’s also still considered a viable tool for making loop-based predictions.

According to the model, the cryptocurrency market is currently capitulating to a stage of despair, which is the final stage before the ‘return on average’ part where assets or entire industries gradually begin to recover.

Source: Wikimedia

Source: WikimediaBitcoin once reached $1,300 during the 2013-2015 correction period. He then made a new ATH. This period guided the model we mentioned. The traceback began in the first months of 2014 and lasted until October 2015.

Sometimes entities don’t exactly follow the textbook definition of the bubble stages model. However, they still go through different stages in the market. In keeping with the cyclical nature of the bubbles, Bitcoin should bounce off in the coming weeks, right after the consolidation we see today. Or else it will take another blow and fall once again.

Bitcoin (BTC) market position today

Both the overheating of the entire industry and the macroeconomic structure of the financial markets have caused the sell-off we’ve seen in the cryptocurrency market in the last few months. Investors are no longer willing to accept the risks posed by investing in digital assets. It also prefers stable options such as bonds that offer better rates. Most crypto investors are currently waiting for the rate hike meeting to be held in July.

“Bitcoin will be under selling pressure due to this macro factor”

As you follow on Kriptokoin.com, US inflation data exceeded expectations. Analyst Benjamin Cowen says the new US inflation data could point to an ongoing bear market for Bitcoin (BTC). Also, Cowen says he believes the Fed will remain financially hawkish until inflation falls.

The analyst hopes that BTC will reach $100,000 by 2023. But he says this is not a likely scenario in the current situation. Also, Cowen notes that the US dollar is in a bull market. He says that when Bitcoin falls, the dollar normally rises and vice versa. The analyst makes the following statement:

As long as the dollar stays in this macro bullish trend, I think it’s safe to assume that Bitcoin will come under some selling pressure here. And not just Bitcoin, but general risk assets. If that’s the case, the case of Bitcoin actually being in a bear market is still valid.