The news that the world’s largest asset management company BlackRock is preparing for a new Bitcoin ETF had an impact on crypto prices. In hot developments, another trillion dollar company is laying the groundwork for a spot Bitcoin ETF. How will the news affect the price?

Invesco re-applies for spot Bitcoin ETF

Investment management company Invesco, which has $1.49 trillion under management, once again took action for a Bitcoin ETF in light of BlackRock’s application. Invesco first applied for a Bitcoin ETF in the fall of 2021. Now, in the light of BlackRock’s application, it has taken action again.

Invesco’s filing states that the absence of a spot Bitcoin ETF has led investors to riskier alternatives. This was the work of bankrupt crypto companies like FTX, Celsius Network, BlockFi, and Voyager. Invesco further stated that approval for such a spot Bitcoin ETF is not related to the regulation of the spot Bitcoin market, but is dependent on an oversight sharing agreement with an important and regulated market. He particularly emphasized the importance of protecting investors.

https://twitter.com/EricBalchunas/status/1671271876339933184

iShares makes moves on Bitwise and WisdomTree

After BlackRock and Invesco, a few more companies came to the fore with the ETF news. Leading companies such as iShares, Bitwise, and WisdomTree filed for Bitcoin ETFs within the week. WisdomTree has previously applied for a spot Bitcoin ETF twice. His first application was blocked by the SEC in December 2021. His second application was rejected in October 2022 for fraud and market manipulation. WisdomTree currently controls approximately $83 billion in assets.

How do ETF filings affect Bitcoin price?

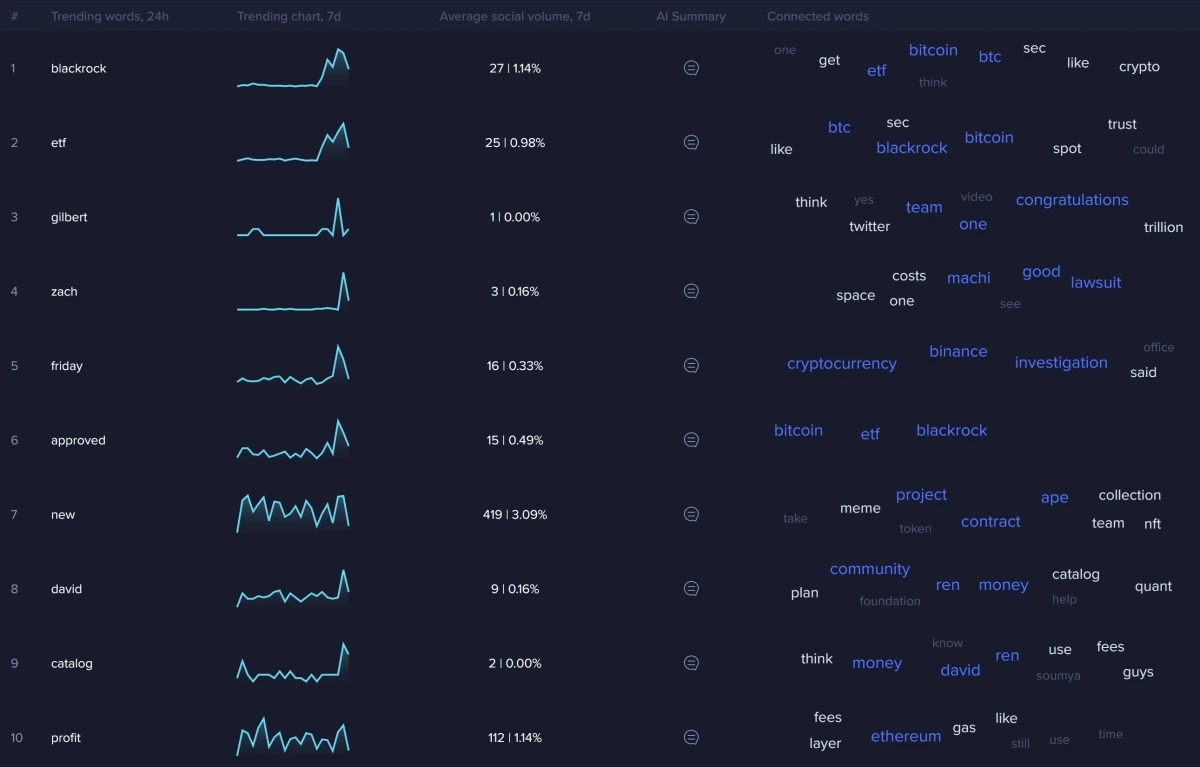

As we quoted as Kriptokoin.com, the reports published by Santiment last week showed that Bitcoin ETF news was accepted among investors. The upward momentum since last week came at a time when the words BlackRock and ETF were frequently used on social media.

Also, Santiment’s June 20 tweet revealed that BTC whales have been quite active lately. Notably, wallets holding 1,000-10,000 BTC have accumulated a total of $3.5 billion since the first week of April.

https://twitter.com/santimentfeed/status/1670967185446158336

The accumulation trend continued throughout the printing period, as evidenced by Santiment’s graph. While Bitcoin’s supply on exchanges has fallen sharply, its off-exchange supply has increased. This is considered a typical ascension. Moreover, the total number of BTC holders has also increased over the past week. Besides, the number of unique tokens also reached a peak of around 7 weeks, according to the Santiment report. This also looked encouraging for the future of BTC.