Bitcoin price avoided a larger drop below $18,000 in recent months. This has increased expectations that a market bottom has formed. An army of small Bitcoin investors has been fighting their larger counterparts for months to keep the price above $18,000.

While whales are selling, fish are accumulating Bitcoin

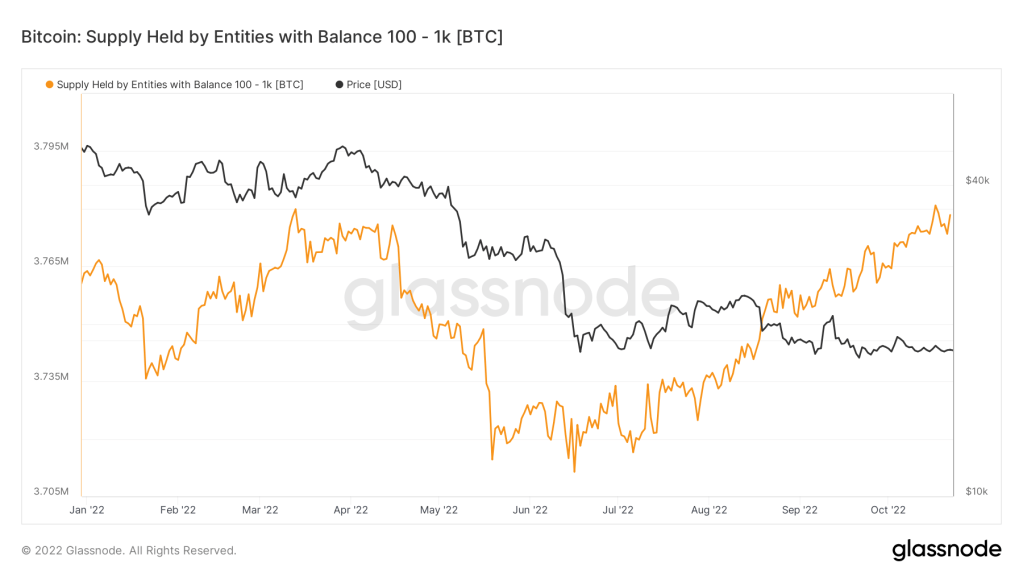

Recently, Bitcoin continues to fluctuate between $18,000 and $20,000. There were some on-chain differences between so-called whales and fish in this environment. Bitcoin fishes are accumulating BTC during the coin’s sideways trend. For example, the net supply of Bitcoin held by addresses with 100-1,000 BTC balances increased from 3.71 million in June to 3.77 million in October, according to data from Glassnode.

Bitcoin supply held by holders with 100-1K BTC balance / Source: Glassnode

Bitcoin supply held by holders with 100-1K BTC balance / Source: GlassnodeSimilarly, the supply of Bitcoin in the hands of addresses with 10-100 BTC balances has also increased. It increased from 3 million to 3.15 million in the same period. The trend is similar among assets holding anything between 0.001 and 10 BTC.

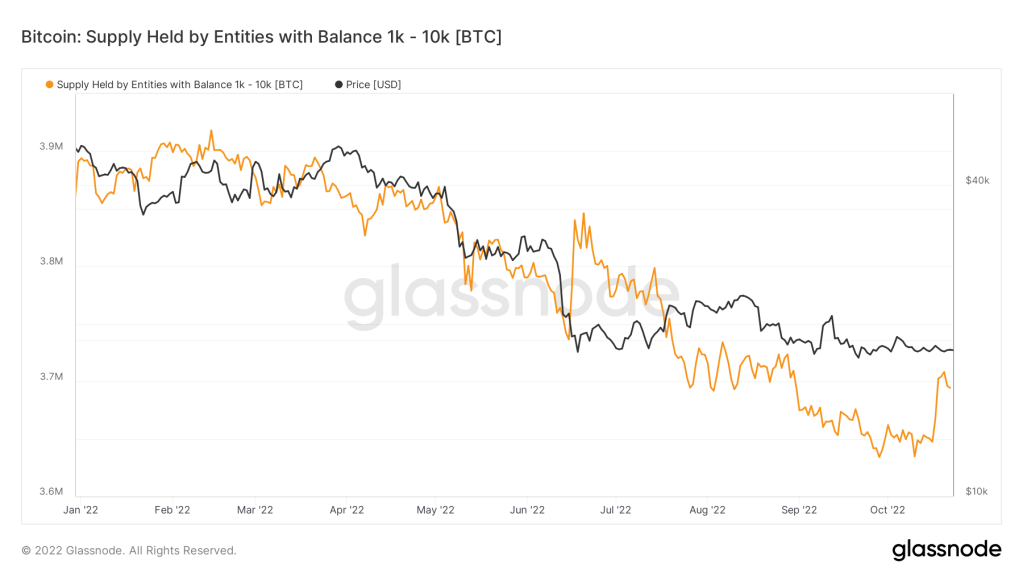

Meanwhile, Bitcoin’s sideways price action coincided with the drop in BTC supply that whales were holding. For example, the supply of Bitcoin held by the 1,000-10,000 BTC group has been falling since June. Accordingly, it decreased from 3.82 million to 3.69 million during this period.

Bitcoin supply held by holders with 1K-10K BTC balance / Source: Glassnode

Bitcoin supply held by holders with 1K-10K BTC balance / Source: GlassnodeAdditionally, the 10,000-100,000 BTC group dropped their BTC holdings from 1.98 million to 1.92 million in the same time frame.

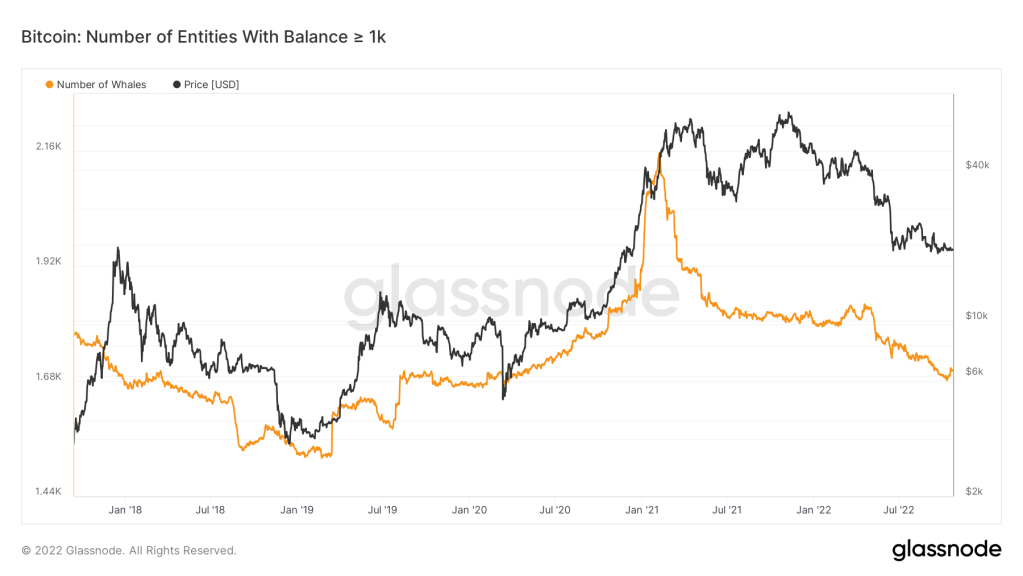

A key interpretation of the aforementioned on-chain data is that fish are more confident than whales about a potential Bitcoin price bottom around $18,000. For now, these small investors absorb the massive selling pressure created by the larger investors. However, as shown below, the downside risk is historically greater with a dwindling whale population.

Number of Bitcoin whales and BTC price / Source: Glassnode

Number of Bitcoin whales and BTC price / Source: GlassnodeInterestingly, one of the few exceptions is when Bitcoin hits an all-time high of $69,000 and the number of whales remains relatively stable. This shows that whales have less influence on the market compared to previous years, especially as the balance in the stock markets continues to hit several-year lows.

Gold and BTC correlation rising

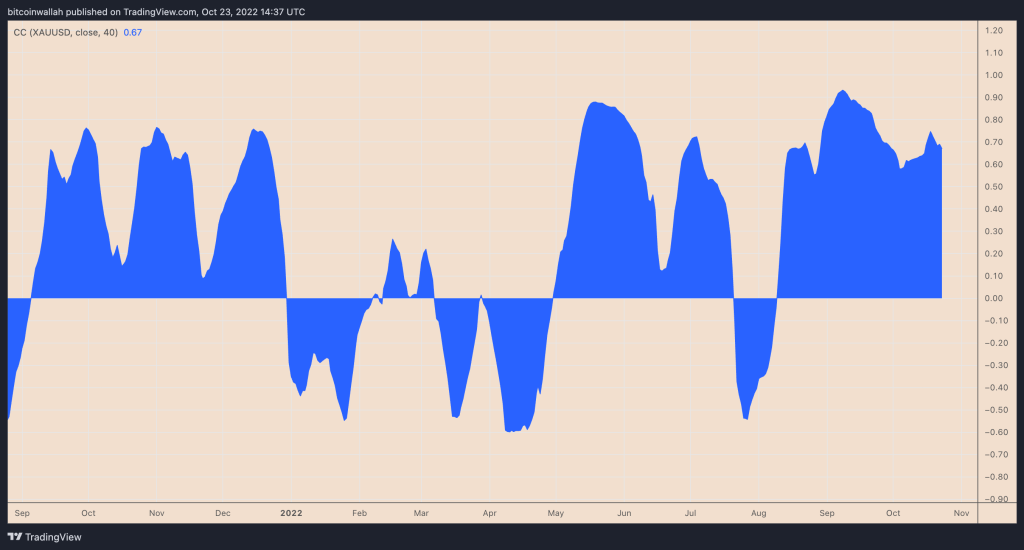

Pisces is piling up amid reports that investors are seeing Bitcoin as a safe-haven asset again. For example, Alkesh Shah and Andrew Moss, digital strategists at Bank of America (BofA), cited Bitcoin’s weakening correlation with U.S. stock indexes and strengthening correspondence on gold’s price movements as a sign that the cryptocurrency wants to keep pace with the “digital gold” narrative in the future. is showing.

In particular, Bitcoin had strong correlations with riskier markets such as the Nasdaq Composite and the S&P 500. However, the 40-day correlation is below record levels compared to a month ago. These are flattening around 0.69 and 0.75 respectively. On the other hand, its correlation with gold rose from zero in August to 0.67 in October. Strategists make the following assessment:

Positive correlation with SPX/QQQ is slowing down. Correlation with gold is rising rapidly. Macro uncertainty and market bottoming continue. In this environment, this shows that investors see Bitcoin as a relatively safe haven.

BTC and XAU 40-day correlation coefficient / Source: TradingView

BTC and XAU 40-day correlation coefficient / Source: TradingViewHowever, others expect BTC price to eventually drop below the $18,000 support level. One of them, independent market analyst Filbfilb, predicts that BTC will fall as low as $10,000. He attributes this to a tight correlation with risk assets and macroeconomic headwinds. Filbfilb is an analyst known in the market for his successful Bitcoin predictions. Check out this article of Kriptokoin.com for the analyst’s accurate predictions.