Bitcoin watched over $ 81,000 on Wednesday. According to Glassnode’s weekly report, both Bitcoin’s on-Chain liquidity and futures open interest rate decreased. The report revealed that the current market decline may not be a decrease signal. Glassnode analysts showed that long -term holders LTH) as a reason) have not yet received a large part of their profits.

Bitcoin futures operations and on-achin liquidity are decreasing!

Bitcoin continues to be traded in a price range of $ 80,000 – $ 84,000 with a 25 %drop from $ 109,114, which is the highest level of all time. The current delay in the recovery of the BTC is due to the lack of capital inflows to support higher prices. Bitcoin’s liquidity also took place in serious contraction. This led to an increase in price volatility.

Glassnode said Bitcoin’s warm supply volume (one week or shorter BTC amount) is decreased by more than 50 %. This said that this pointed out a decrease in trading appetite among investors. Similarly, Bitcoin witnessed a decrease in futures activities supported by a 35 %decline in open interest rates in recent months.

Bitcoin entrances to the stock market have decreased!

The report also emphasized that there was a significant decrease in the entrances of Bitcoin to the stock market. During the market summit of BTC, entrances in all stock exchanges were recorded on 58.6 thousand BTC per day. However, this figure is now about 26.9 thousand BTC per day. This reflects more than 54 %decrease.

This decrease points to a more printed short -term Holder group, which has greatly contributed to the last contraction in the market. “When we evaluate the 30 -day sum of short -term Holder losses, we see that most of the new investors surrender under the pressure of the enormous decline, G says Glassnode.

30 -day losses of BTC short -term owners. Source: Glassnode

30 -day losses of BTC short -term owners. Source: GlassnodeCompared to the short term, long -term holders are still bulls!

The short -term Holder group suffered a $ 7 billion loss in this cycle. This was the longest continuous loss period in the cycle. However, when compared to sales in the previous loops, short -term Holder losses have not yet had a stronger effect on the market. “The scale of unprecedented damages is less severe than those who happened during the 2021 May sales and 2022 markets, G says Glassnode.

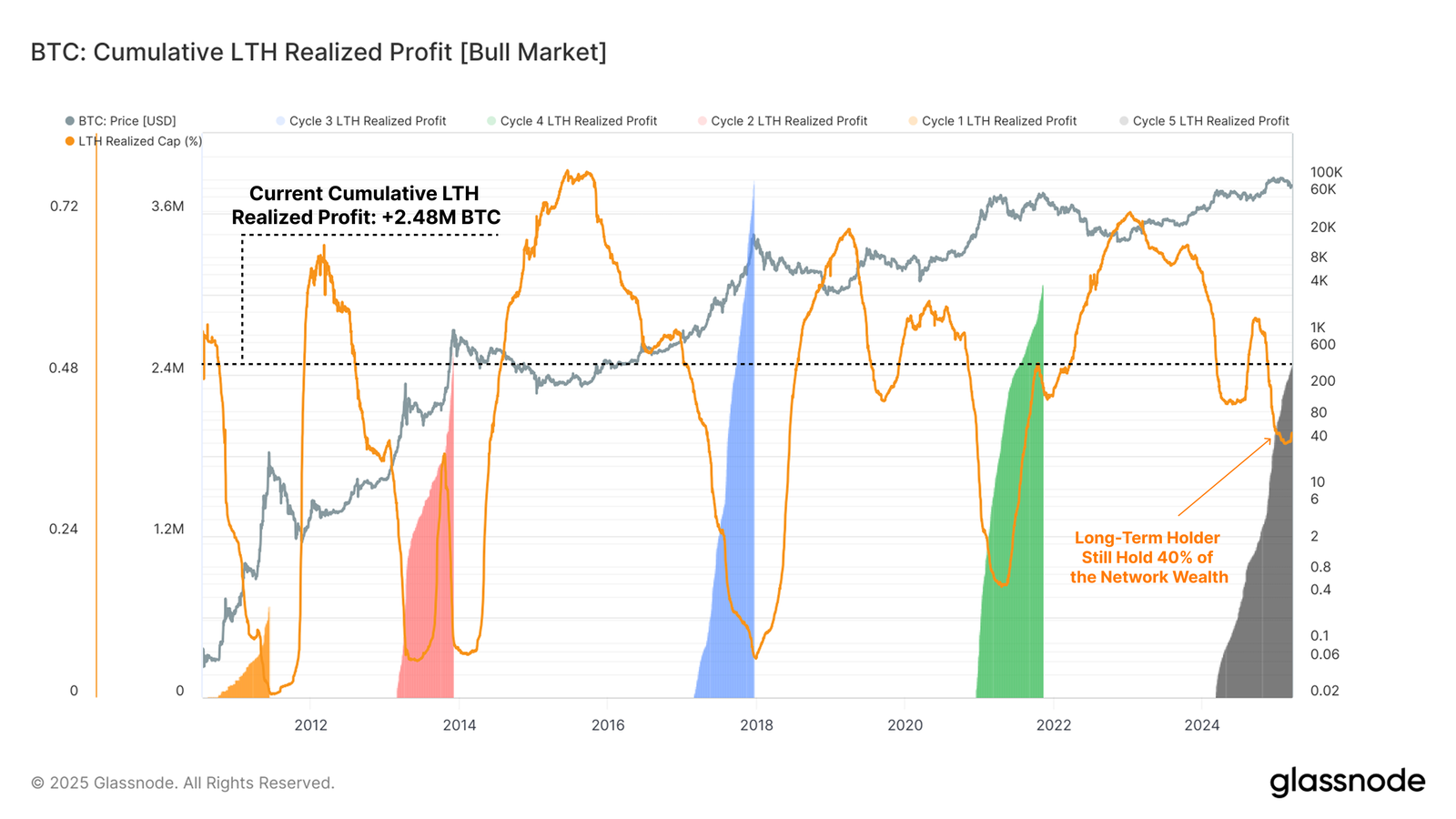

Unlike the behavior of short -term holders, long -term holders still have the expectation of rise. Despite the latest market corrections, this group showed more requests to protect their profits. Glassnode said that this may indicate a slight change of sensitivity that shows that the market has not entered the decline phase.

BTC Cumulative LTH profit (bull market). Source: Glassnode

BTC Cumulative LTH profit (bull market). Source: GlassnodeTaurus markets are usually limited to strong profit purchases between long -term holders. This points to a complete transition to the decline behavior. However, despite Bitcoin’s fluctuation in recent weeks, it continues to maintain most of the LTH group profits. This shows that long -term holders may still be waiting for a new rally in later years.