As Bitcoin sees the second-largest bank failure in United States history, digesting major macroeconomic news, it begins a new week. Here are some developments to watch out for this week…

Bitcoin price volatility remains flat at monthly close

Classic volatility accompanied Bitcoin’s move to a new weekly and monthly candlestick after April’s sideways trajectory. After closing the month at $29,300, BTC/USD plunged rapidly as bid liquidity was withdrawn from the Binance order book. On the other hand, according to Material Indicators, this was responsible for seeing local nightly lows of $28,289 on Bitstamp. Bitcoin thus achieved its “leap” goals for some, including Michaël van de Poppe, founder and CEO of trading firm Eight, who noted the potential power returning to altcoin markets. Van de Poppe said, “Bitcoin failed to hold $29,200 after multiple tests. It hit $28,300 for a bounce game. The good side; altcoins are bouncing more solidly,” he summarized.

#FireCharts 2.0 (beta) shows that when $29,150 was getting filled the bid ladder below was pulled and moved lower. #BTC price action sliced through the freshly open hole of illiquidity like a hot knife through butter.

Seeing these moves play out in near realtime is a great way… pic.twitter.com/CnvRLRNcwc

— Material Indicators (@MI_Algos) May 1, 2023

A day ago, Van de Poppe had warned that Bitcoin would not be able to continue its uptrend if $30,000 was not recovered and correctly predicted the eventual reversal level. Meanwhile, popular trader Crypto Tony confirmed that he expects the $28,300 support to prove itself before taking a position. While the same level is important to other traders, including Ninja, Sun Tzu agreed that long-term downside possibilities remain without a clear entry into the $30,000 region.

Standard chop on #Bitcoin in the weekend.

No breakout above $30K = no trigger for continuation.

Holding above $29.2K, and still facing a potential correction to $28.3K as the ideal trigger for new longs. pic.twitter.com/3GJY8wImR9— Michaël van de Poppe (@CryptoMichNL) April 30, 2023

JPMorgan takes over First Republic Bank in second largest US bank bankruptcy

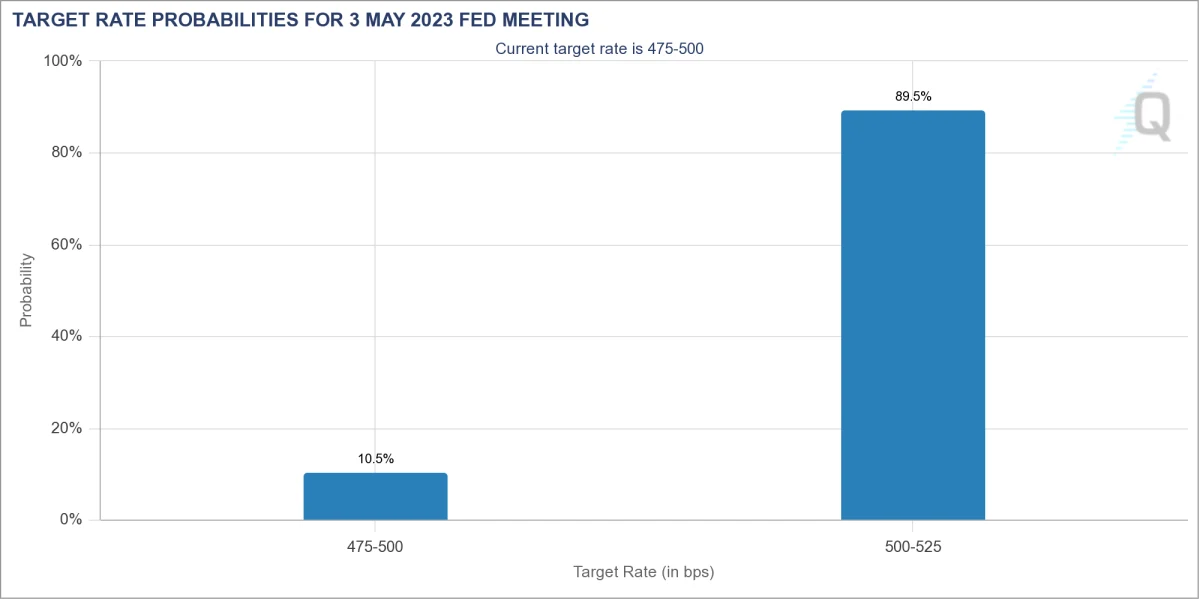

Unlike last week, macroeconomic events will come to the fore in the coming days, with the US Federal Reserve meeting to decide on interest rate changes. Despite being heavily priced in by the markets, the 0.25% increase expected to be announced at the Federal Open Market Committee’s (FOMC) meeting on May 3 is still not warranted. The table remains complex. The banking crisis, which has been going on since March, poses an even greater threat as the Fed continues to hike rates despite growing signs that a recession is imminent.

First Republic Bank (FRB), whose shares lost 75% in April alone, was transferred to a trustee by the US Federal Deposit Insurance Corporation (FDIC) as of May 1. Credit institutions, including PNC Financial Services Group, JPMorgan Chase, and Citizens Financial Group, were among the banks bidding for the FRB, and JPMorgan eventually took over. Reports previously indicated that the deal should be finalized and announced before Asian trade could begin, but this took longer.

While expectations are hanging in the air, attention is focused on the Fed, which under the current conditions risks to unsettle the banking sector even more with a new interest rate hike. The US may be stuck between a rock and a hard place, as Arthur Hayes, the former CEO of crypto trading giant BitMEX, warned late last month. “Expect the Fed to resolve this issue by supporting a larger slice of US bank balance sheets. The money writer goes to brrr,” Hayes said in an episode of Twitter activity on April 29, echoing the now-familiar long-term BTC price target of $1 million. Wednesday’s FOMC meeting is also eagerly awaited.

April surpasses February Bitcoin price performance

Despite the current coldness over BTC’s price strength, April managed to avoid taking the title of worst month of 2023. Data from monitoring resource Coinglass shows that the overall return for BTC/USD is 2.8%. These left February behind with no notable gains while maintaining Bitcoin’s “green” record for the year so far. On the weekly timeframes, however, the chart looks less appetizing, with the weekly candles highlighting the stubborn nature of the $30,000 resistance. While some remained optimistic, popular Twitter account Mickybull Crypto considered the weekend price action a standard chart feature.

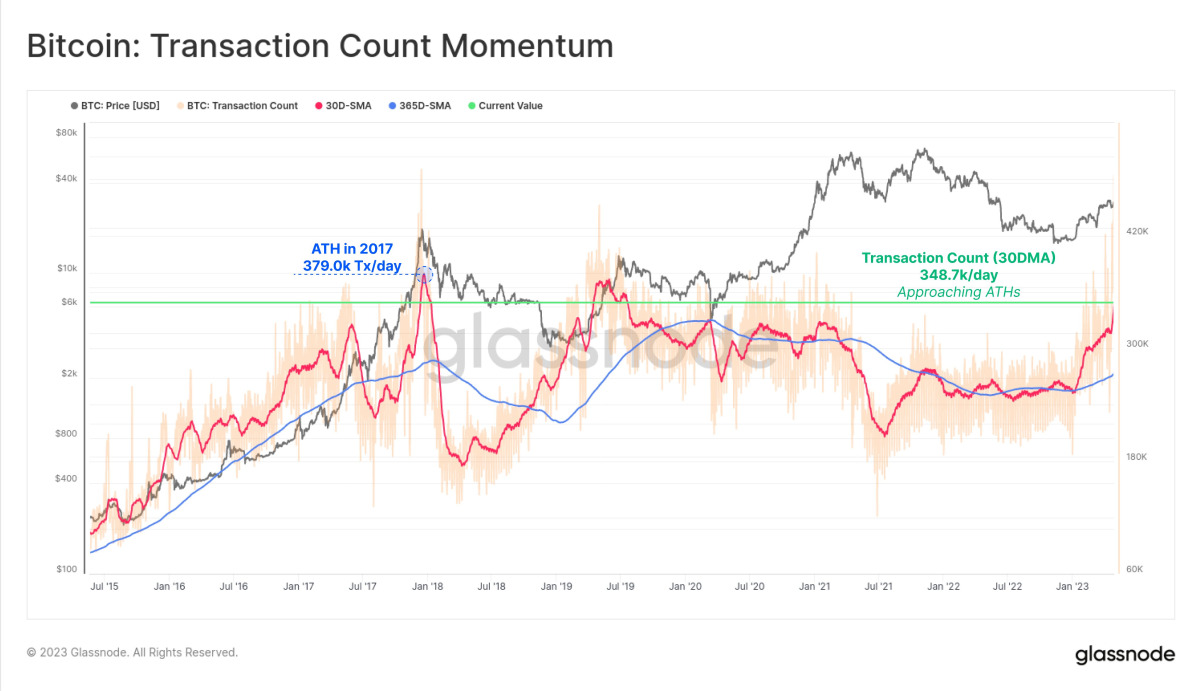

Events on the Bitcoin network challenge the market

On-chain activities tell an intriguing story about Bitcoin’s growth during its comeback in 2023. The daily number of transactions for Bitcoin as recorded by on-chain analytics firm Glassnode, among others, is approaching all-time highs after seeing an “explosive” increase this year. In a Twitter thread exploring the overall strength of the BTC price uptrend, Glassnode acknowledged that on-chain volume hasn’t matched it yet. Glassnode analyst Checkmate remained optimistic that Bitcoin would continue to rise and that late 2022 lows would mark a local bottom.

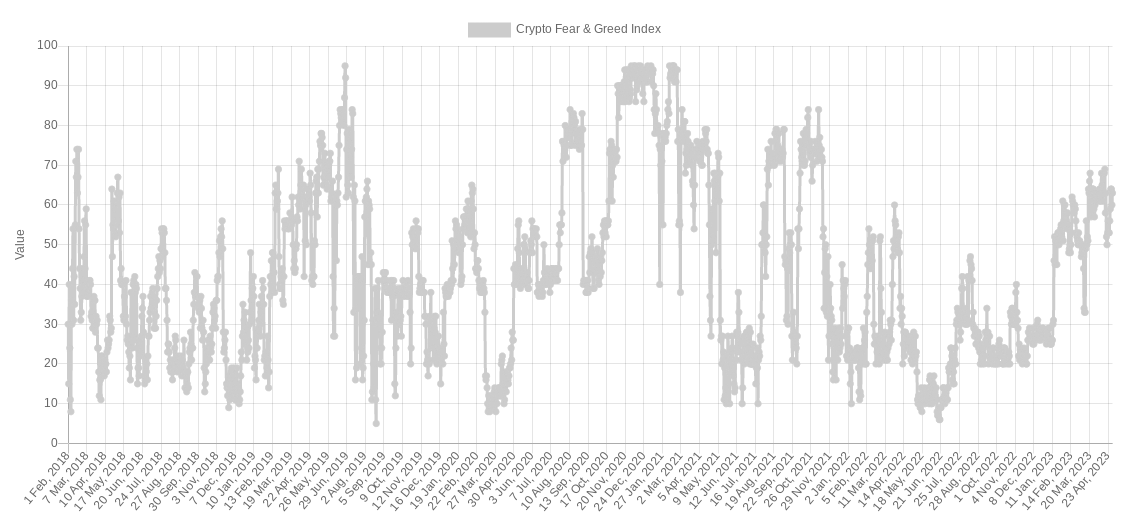

Greed in the crypto market is approaching its highest levels in recent years

As the price fluctuated, the crypto market sentiment turned bullish after the late-April drop. Recent data from the Crypto Fear and Greed Index shows that “greed” in the market last reached an all-time high of $69,000 with Bitcoin in November 2021. A lagging indicator, Fear & Greed, however, shows the ease with which sentiment is currently affected by relatively minor market changes. This reiterates the importance of current resistance levels, especially for Bitcoin and Ethereum. Both assets face key lines in the sand at $30,000 and $2,000, respectively.