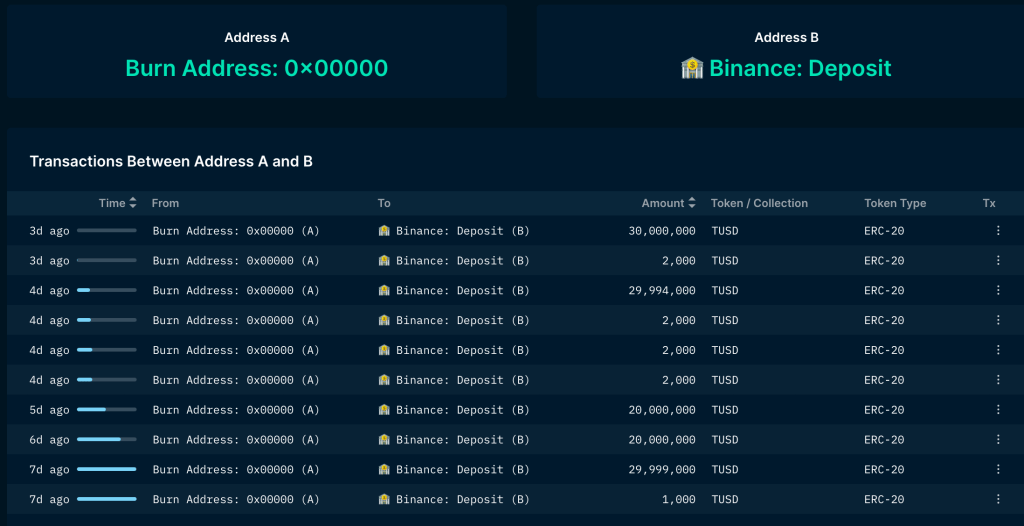

According to data received by analytics platform Nansen, Binance has minted $130 million worth of altcoins in the past week.

Altcoin is on the rise with the press

Backed by a growing role on crypto exchange giant Binance, the TrueUSD (TUSD) stablecoin has become the fifth largest stablecoin by market cap. Blockchain data from crypto analytics firm Nansen shows that Binance, the world’s largest crypto exchange by trading volume, has minted nearly $130 million worth of TUSD in the past seven days.

According to crypto money experts, these investments made without knowing the separation of TRU and TUSD triggered the rise of TRU. According to Kriptokoin.com data, TRU, which has increased more than 70% from $ 0.065 in a week, is trading at $ 0.093 with an increase of 41% in the last 24 hours.

The circulating supply of the TrueUSD stablecoin has surpassed $1.1 billion in recent gains, according to data from crypto price tracker CoinGecko, the highest level since August. Crypto data platform DefiLlama has shown that TUSD ranks fifth in market capitalization, up 15% from last week, with native stablecoin frax (FRX) from decentralized finance protocol Frax Finance.

TUSD is a dollar-pegged stablecoin issued by crypto firm ArchBlock, formerly known as TrustToken. Its value is fully backed by fiat assets, according to blockchain data provider ChainLink’s proof-of-reserve tracking tool. This altcoin said that in 2020, Asian conglomerate Techteryx bought the intellectual property rights of TUSD, separating the stablecoin from the decentralized lending protocol TrueFi.

The stablecoin market has been reorganized

The resurgence of TrueUSD came as Binance increasingly relied on the token after the BUSD stablecoin became a prime target in US regulatory pressure. TUSD’s increased presence on Binance represents a significant comeback six months after Binance removed TUSD from the platform’s trading pairs among other stablecoins to consolidate trading liquidity and boost BUSD.

US-based regulated BUSD issuer Paxos announced that it will stop issuing BUSD on February 13, citing pressure from the New York Department of Financial Services (NYDFS), a regulator. It was also reported that the U.S. Securities and Exchange Commission (SEC) is preparing to sue Paxos for issuing unregistered securities.

Regulatory interest in BUSD is huge in the $135 billion stablecoin market as top stablecoins including Tether’s USDT, Circle’s USDC and TUSD compete to divide BUSD’s once $16 billion market share. initiated a reorganization.

Crypto research firm CryptoQuant said last week that TUSD foreign exchange reserves saw a 39% increase between February 13 and February 22, mostly driven by Binance. Coinbase, which launched USDC in partnership with Circle, announced on Monday that it will delist BUSD after failing to meet listing standards.