Binance reduced its spot market share to 34 percent due to decreases in transaction volumes and money outflows.

Binance suffered losses in spot market share following legal battles and changes to the platform. Previously, Binance implemented zero transaction commissions on spot Bitcoin and Ethereum trading. The end of this campaign led crypto traders to move away from Binance.

Legal problems with Binance CEO CZ also contributed to the exchange’s loss of market share. The SEC and CFTC have been on Binance’s side since last year.

Problems are on Binance’s neck: Loss in spot market share!

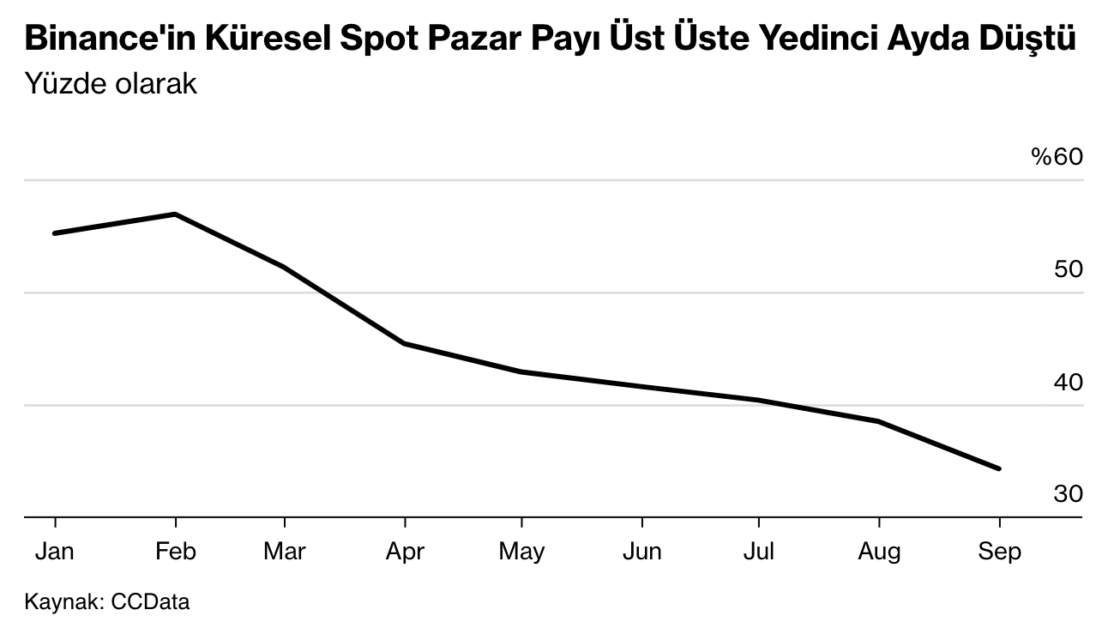

According to research by CCData, Binance has been experiencing a decline in its spot market share for seven months. With the recent market share decline, the share of the stock market in the pie was 34.3 percent in September.

Binance has suffered withdrawals of 12,320 BTC and 198,200 ETH since August. These assets, which left the stock exchange, were distributed to other stock exchanges. Coinbase was one of the exchanges that profited from this turmoil. Coinbase’s transaction volume increased by 9 percent last month.

CCData research analyst Jacob Joseph evaluated Binance’s blood loss as follows;

The suspension of zero-fee trading promotions for popular trading pairs, coupled with concerns about regulatory scrutiny on the exchange, contributed to this decline.

According to Joseph, the market share lost by Binance shifted to exchanges such as HTX, Bybit and DigiFinex. These exchanges experienced user increases.

Binance’s legal battles and CZ’s constant need to deal with these issues have become the main driver of losses in market share. Users have prioritized reliability in recent months.