Binance, which went through tough days, approached the lowest level of the year in its market share.

Binance is not smiling in terms of regulators after FTX went bankrupt. US regulators SEC and CFTC are constantly targeting Binance. The final blow to the popular crypto exchange was the lawsuit filed by the SEC recently. The SEC sued Binance and Binance CEO CZ. All these processes led to Binance losing blood.

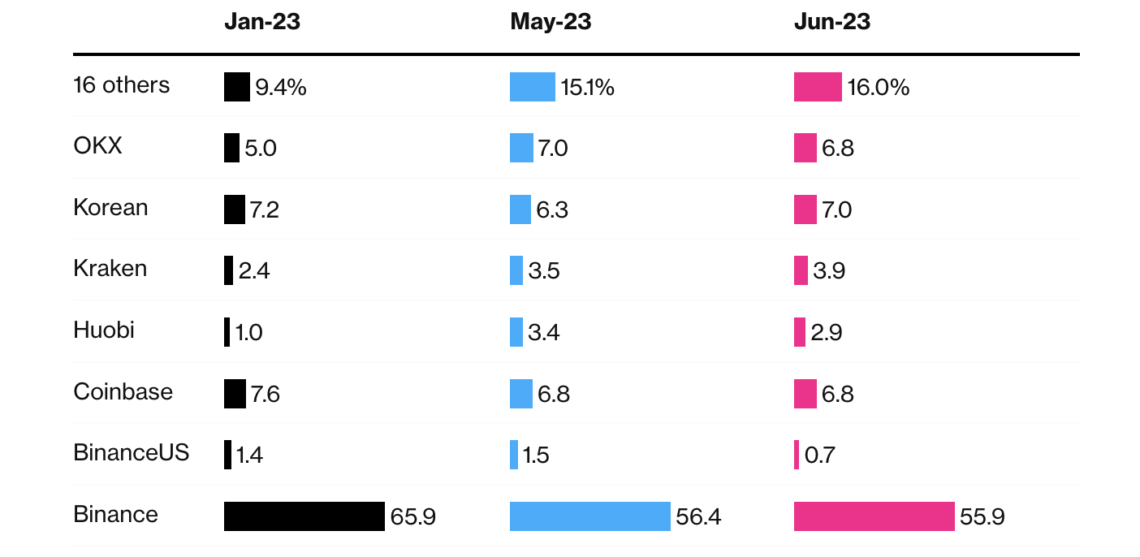

After regulatory pressures, Binance dropped to 56 percent in spot trading market share. Binance had a 53 percent market share last August.

Binance Market Share Declines

Cryptocurrency exchange Binance has slumped to 56 percent in spot trading market share as it bled out after regulatory pressures.

According to Kaiko’s research data, the exchange’s spot trading market share is approaching a one-year low. The data revealed that Binance’s market share in spot trading has changed little from the previous two months. Binance dominates 56 percent of the market share.

Binance’s daily market share fell to 47 percent on April 6, right after a lawsuit filed by the CFTC. However, BlackRock’s application for a Bitcoin ETF and interest from institutions allowed Binance market share to rise to 56 percent. Looking at the Kaiko data, it was the crypto exchange Kraken that made progress in this process.

Earlier, Nansen CEO Alex Svanevik voiced that centralized exchanges would squeeze. According to Svanevik, this squeeze will happen as centralized exchanges remain between institutional and decentralized exchanges. In other words, investors will either turn to ETFs or start trading from decentralized exchanges.