Binance, the world’s largest cryptocurrency exchange by trading volume, announced that it has activated 4 altcoins for cross and isolated margin services. It also adjusted the tick size of some cryptocurrencies for spot trading. Here are the details…

Binance updates tick size of some altcoins

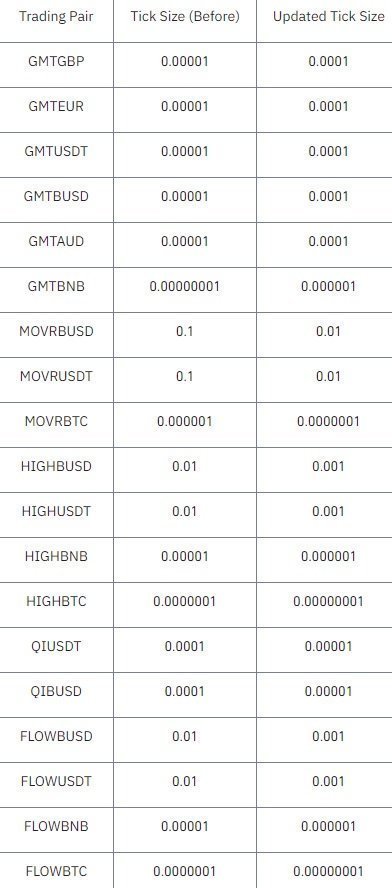

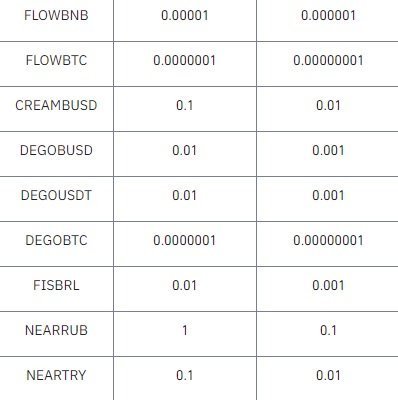

Binance will adjust the tick size of certain spot trading pairs to increase market liquidity and improve the trading experience. The update in question will be effective from 1 August, 10 pm. With the change of the tick size, certain zeros in the unit price of the trading pairs will be deleted. Tick size will also change via API. API users can use GET/api/v3/exchangeInfo for the latest tick size.

Tick size update will not affect existing spot trade orders. After the approval size is updated, the orders placed before the update will continue to match the original approval size. In the list below you can see which couples this update may affect:

New additions to the Cross and Isolated margin area

Binance has added FIDA and LDO as new loanable assets on Cross Margin and Isolated Margin. Also added to Cross Margin FLM and KMD as trading pairs.

- New cross-margin pairs: FIDA/BUSD, FIDA/USDT, FLM/USDT, KMD/USDT, LDO/BUSD, LDO/USDT

- New isolated margin pairs: FIDA/BUSD, FIDA/USDT, LDO/BUSD, LDO/USDT

So, what are the features of these cryptocurrencies?

- Bonfida (FIDA): Bonfida; The serum fills the gap between Solana and the user. The flagship Serum is GUI. Solana Data brings analytics to the field. Bonfida API is used by some of the biggest market makers in the field.

- Lido DAO (LDO): Lido is a liquid staking solution for Ethereum. Lido allows users to spend their ETH with no minimum deposit or infrastructure maintenance; allows them to use while participating in chained activities. As we reported on Kriptokoin.com, LDO has recently lost value with Ethereum’s divergence from staked Ethereum.

- Flamingo (FLM): Flamingo is a decentralized finance (DeFi) platform based on the Neo Blockchain and Poly Network interoperability protocol. It combines several DeFi applications into a single ecosystem. It provides a cross-Blockchain asset gateway. It also offers a pool of liquidity (swap) on a Blockchain. It has a Blockchain asset vault, perpetual swap trading platform, and a decentralized management organization (DAO).

- Komodo (KMD): Komodo is an open source technology provider that provides all-in-one Blockchain solutions for developers and businesses. Komodo develops technologies that enable anyone to launch branded decentralized exchanges, cross-protocol financial applications, and independent blockchains.