Binance CEO CZ, who does not leave crypto investors alone in bear markets, listed 3 items for those who are having a hard time financially in his latest tweets.

“Work harder, earn more, borrow money, save”

The cryptocurrency market has been in bears’ control since the November 2021 peak. The bankruptcy of Terra and FTX last year drove prices closer to historic lows. But experienced investors are used to such harsh conditions.

One example includes the famous cryptocurrency crash of December 2017, where investors saw Bitcoin drop from $20,000 to $3,200 in a matter of days. Binance CEO CZ underlined in his tweets last month that the market has always survived these crashes:

https://twitter.com/cz_binance/status/1639480860339478528

In his latest tweets, this time he is addressing individual investors who are having a hard time financially. Binance CEO lists the following 3 things you should do when “you run out of money”:

Typically, when you run out of money, you can: 1- work harder to earn more, 2- borrow more, 3- reduce expenses/spending. Usually people think of 3 first, but I hardly see anyone talking about it these days. Due to my limitations, I think in simple terms.

https://twitter.com/cz_binance/status/1659828951575937024

Binance CEO ran out of money?

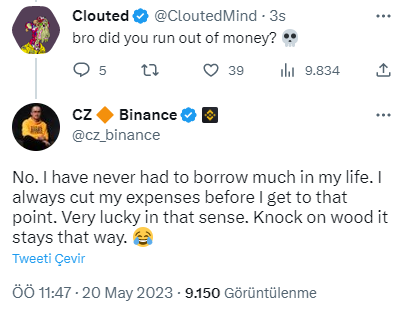

CZ’s tweet above got a witty response from @CloutedMind, a blockchain developer. Clouted asked if the Binance CEO had run out of money to find out if he was in trouble. CZ gave a confident answer to this question:

No. I’ve never had to borrow money in my life. I always cut back on my spending before I get to that point.

When will the bear market end? Here’s what historical data says

Economists use ‘bear markets’ for 20% or more that last for at least two months. The opposite of a bear market is the ‘bull market’, which is characterized by gains of 20% or more for two months.

In terms of Bitcoin, the leader has experienced four consecutive months of growth, an unprecedented event in crypto history. Historically, this trend has never led to new lows. This suggests that for some experts, the Bitcoin bear market may indeed be near the end.

Known for its S2F model, PlanB says that Bitcoin’s rise in January confirms that the 4-year cyclical price floor is now over. From here, he predicts that Bitcoin will reach between $100,000 and $1 million in 3 years. According to the popular analyst, we will be above $32,000 in the next Bitcoin halving cycle.

"BTC bottom is in, 2024 halving >$32k, 2025 bull market >$100k" scenario could look like this. Note the $100k-$1m yellow range estimate for 2025. I explain this scenario/chart here: https://t.co/2OqA6OTRWt pic.twitter.com/ckj9x6NWb0

— PlanB (@100trillionUSD) January 30, 2023

Meanwhile, bull markets are often doomed to institutional investors. Purchases of these whales create bullish sentiments among investors. Current data shows that the wallet balances of shrimp, a smaller class of investors than whales, have reached ATH. They currently hold more than $1.3 million in BTC.

The #Bitcoin supply held by Shrimp Entities (<1 BTC) continues to relentlessly rise, expanding to an ATH of 1.31M coins.

The cohort is currently experiencing a significant expansion of +26K coins per month, with only 202 (3.9%) trading days recording a larger monthly growth. pic.twitter.com/Fa2QCHxZPO

— glassnode (@glassnode) May 18, 2023

You can take a look at crypto analyst Bluntz’s latest BTC technical analysis in this article of Kriptokoin.com.