These altcoin bulls hope that the launch will help a number of other crypto companies and financial institutions get involved in Ethereum. As Kriptokoin.com, we have compiled the developments for this altcoin for you.

Altcoin community embraces new network

The Ethereum community seems to have embraced the bullish view of Coinbase’s newly announced layer-2 network Base, which has been described as a ‘big vote of confidence’ and ‘turning point’ for the Blockchain network.

Secured on Ethereum and powered by the layer-2 network Optimism, Base aims to eventually become a network for building decentralized applications (dApps) on the blockchain. According to Coinbase CEO Brian Armstrong, the layer-2 network is currently in the testnet stage.

0/ 🔵 Hello world.

Meet Base, an Ethereum L2 that offers a secure, low-cost, developer-friendly way for anyone, anywhere, to build decentralized apps.

Our goal with Base is to make onchain the next online and onboard 1B+ users into the cryptoeconomy.https://t.co/Znuu3o3pJw

— Base (@base) February 23, 2023

Members of the crypto community, such as Bankless Show host Ryan Sean Adams, believe the move is a ‘big vote of confidence for this altcoin’ and could set a precedent for cryptocurrency companies and financial institutions to use Ethereum as their preferred settlement layer.

Coinbase’s new choice

Coinbase has approximately 110 million verified users and has partnered with 245,000 companies in more than 100 countries since its founding in 2012. According to CoinGecko, the cryptocurrency exchange is the second largest exchange after Binance in terms of trading volume.

“If Coinbase converts 20% of its 110 million verified users to Tier 2 users in the coming years, that alone would be 10 times the total number of crypto native users,” Adams added. Adam also praised Coinbase for opting for the open-source Base and believes the new layer-2 network will bring even more demand for block space on Ethereum.

Coinbase announced Base, a new L2 (based on the Optimism L2)

L2s continue to dominate the industry

– Almost all txs in crypto are on L2s

– Almost all TVL in crypto are on L2s

– More devs working on L2s than basically every L1Sidechains (which aren't L2s) are a waste of time

— Sebastien Guillemot (@SebastienGllmt) February 23, 2023

Meanwhile, Sebastien Guillemot, co-founder of blockchain infrastructure company dcSpark, suggested that Coinbase made a wise decision to go with tier 2 instead of a standalone sidechain. He states that ‘almost all’ cryptocurrency transactions and value locked in Ethereum are at tier 2 these days.

Ryan Watkins, co-founder of crypto-focused hedge fund Syncracy Capital, described the news as a ‘turning point’ in the Ethereum aggregation ecosystem in a tweet on Feb. He added that ‘probably no one’ is better positioned than Coinbase to engage the next 10 million users and institutions on Ethereum. Still, not everyone was optimistic.

Opens the door to SEC scrutiny

Gabriel Shapiro, general counsel at investment firm Delphi Labs, explained in a Twitter post on Feb. 23 that launching a centralized layer-2 network ‘opens the door’ to unwanted SEC scrutiny.

Shapiro’s concerns come as the SEC has stepped up enforcement efforts against several stablecoin issuers and more recently staking service providers.

overall, if indeed Coinbase's motives are regulatory in nature, it's not only a bad step for them, but could threaten dangerous collateral damage to the rest of the ecosystem

if their motives are regulatory, they should've waited till all the infra can be really decentralized

— _gabrielShapir0 (@lex_node) February 23, 2023

Regarding the launch of Base, the attorney noted that especially if the SEC finds a vulnerability to disclose, it could be ‘a bad step for them’ and cause ‘collateral damage’ to the rest of the ecosystem.

NFT mining offered

Coinbase has recently launched a layer 2 network called Base on Ethereum. To celebrate this milestone, the company has released a free NFT called ‘Basic, Introduced’ through Zora, a platform focused on Web3 tools and NFT printing. Anyone can print one NFT per wallet, and the printing period will close on Sunday, February 26.

Nearly 64,000 NFTs have been printed since the launch of the base network, which has contributed to the rise in Ethereum gas fees. Within three hours of the Coinbase announcement, users spent over $271,000 in gas fees to print NFTs.

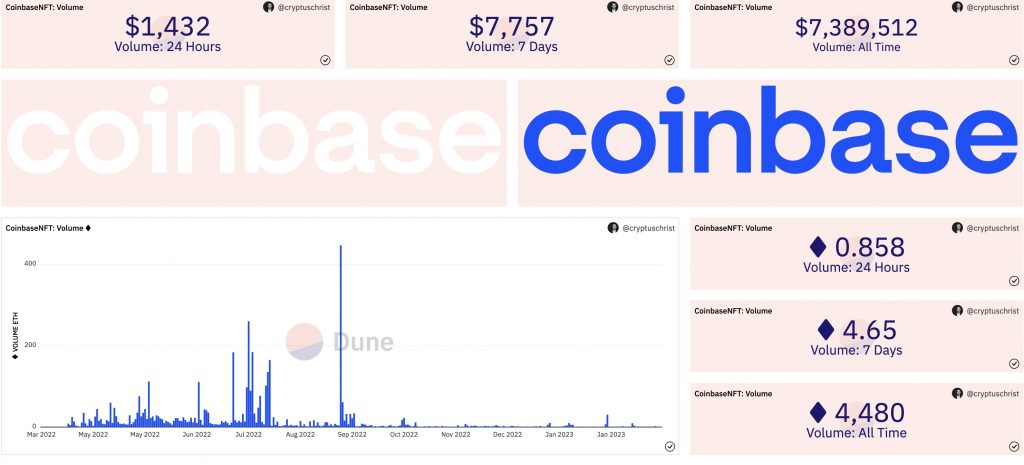

Coinbase’s move to issue NFTs through Zora instead of its own market raises questions about the company’s strategy in the NFT market. Despite being one of the biggest players in the cryptocurrency industry, Coinbase’s NFT trading volume has remained modest, with trading volumes under $8,000 last week. That figure pales in comparison to Blur’s $596 million in trading volume over the same period, even outpacing OpenSea, the once-dominant NFT market on Ethereum.

According to Coinbase COO Emilie Choi, the company has not given up on its NFT goals despite the recent layoffs. The number of NFTs minted is increasing even though Coinbase has not provided any benefit or benefit for the Basic NFT in the future. Most are currently selling for relatively low prices of around 0.01 ETH (about $16) each, but some are for around 1 ETH. For example, NFT #888 sold for 0.888 ETH (about $1,455) this morning and the buyer listed it for 8,888 ETH (about $14,700).