On-chain data shows that the Bitcoin stock market whale rate has increased sharply recently. This is also a sign that could mean a decline for the price of the asset. Meanwhile, the drop that followed a large market sell order on Binance cleared millions of dollars’ worth of futures positions.

Bitcoin bear signal: Stock market whale rate rises

As noted by an analyst in a CryptoQuant post, whales may be putting money to sell right now. The “stock market whale ratio” is an indicator that measures the ratio between the sum of the top 10 listings to stock markets and the total stock market listings. It can be assumed that the top 10 transactions to exchanges came from whales, so the value of this ratio tells us what percentage of the total transfers to these platforms were made by whales.

When the value of this indicator is high, it means that a large percentage of the stock market entries are currently coming from these huge holders. Such a trend could have a bearish effect on the price as it could be a sign of a mass sale of whales. On the other hand, the lower values of the metric indicate that these investors make up a healthier portion of stock market entries. This type of trend can be bullish or neutral for the price depending on some other factors. Here is a chart showing the trend in Bitcoin stock whale rate over the past few years:

The value of the metric seems to be quite high lately / Source: CryptoQuant

The value of the metric seems to be quite high lately / Source: CryptoQuantAs seen in the chart above, the value of the indicator has increased sharply over the past few days and is now at 0.64. This means that currently 64% of total stock market entries come from whales alone. The chart highlights the quantity, the points where the metric has seen such spikes before, as well as how the cryptocurrency price reacts to such events.

It seems that many of these examples proved bearish for the price of the cryptocurrency. Because when the being was realized, it reached its climax. This means that selling pressure from whales was behind the drop during these events. However, there were other examples that did not have a noticeable effect on the price. Some of these came after major movements in the asset’s value. Therefore, they may have been caused by the exchanges drawing more liquidity to their platforms.

This means that the latest high stock market whale rate does not necessarily mean a drop for Bitcoin. However, given that these spikes in whale inflows occurred at a time of rising prices, it is possible that these deposits were made to profit from the current high prices. If this is indeed the case, BTC could face a bearish in the near term.

Bitcoin drops to $ 29,000 with a sudden sale

Bitcoin dropped more than 3% to below $30,000 in just 15 minutes yesterday. While the sell-off didn’t appear to be due to any immediate underlying cause, an unusually large sell order on Binance and an unexpectedly high UK March inflation figure of over 10% may have affected market sentiment.

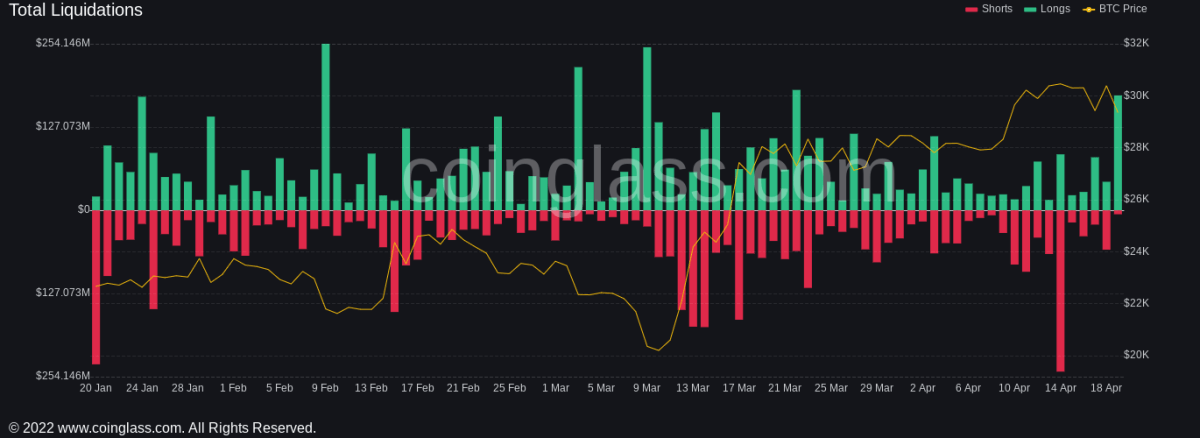

You can also have ‘long squeeze’ in the mix. More than $25 million in Bitcoin futures has been liquidated. Long positions or bets on rising prices made up 98% of the positions. “The higher-than-expected UK CPI may have put pressure on risky assets, including BTC,” said Vetle Lunde, senior analyst at K33 Research. But the weight of the backlash has been much, much more severe than for other asset classes,” he says.

Prominent fake crypto trader 52kskew points out that the 16,000 Bitcoin sell orders, worth over $467 million at current prices, precede the dump that may have started the long squeeze. “16,000 BTC is an unusual size to be sold on Binance spot alone, usually this type of sale happens before bad news hits,” the trader said in a follow-up tweet.

https://twitter.com/52kkew/status/1648611581826326528

Leading crypto sees a “nice” pullback!

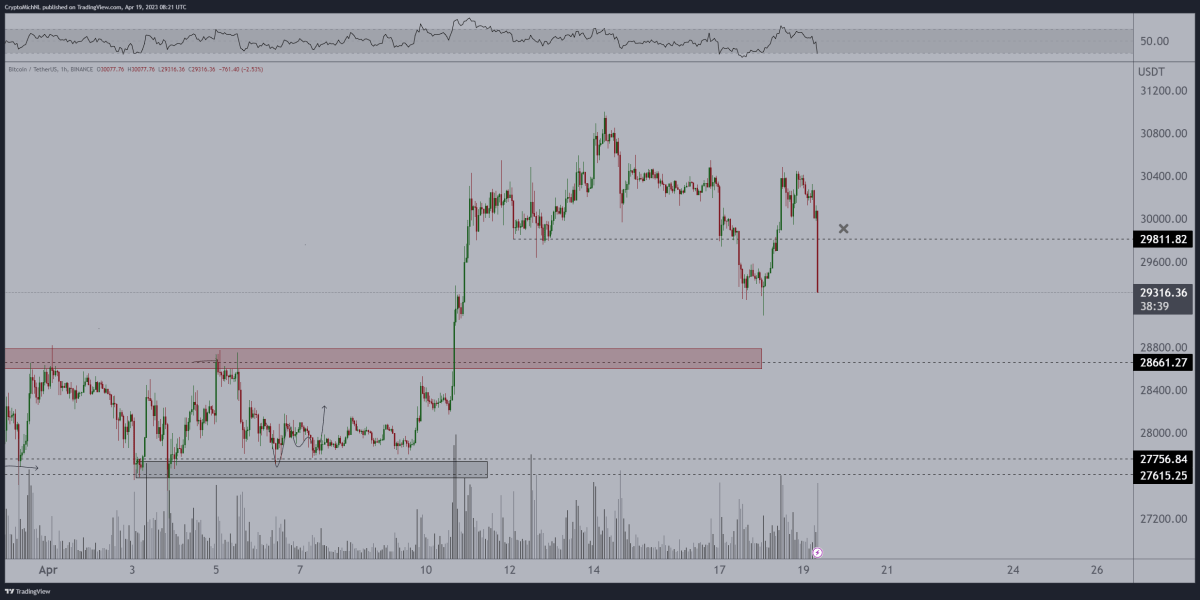

The sudden move came after an equally strong rebound above the $30,000 mark the day before and the bulls were ultimately unable to sustain higher. As volatility bounced back, BTC thus dropped to its lowest level since April 10, seeing its latest challenge to the upside. “The markets are undergoing a deep correction as Bitcoin fails to hold at $29,700-29,800 and is dragged down by a series of liquidations,” said Michaël van de Poppe, founder and CEO of trading firm Eight Global.

BTC annotated chart / Source: Michaël van de Poppe

BTC annotated chart / Source: Michaël van de PoppeHours ago, monitoring resource Material Indicators pointed to changing conditions on the Binance order book, arguing that the outcome could change either way as the bulls or bears take a profit. Among traders, some participants, such as bull trader Crypto Kaleo, remained optimistic. “Remember that dips are gifts,” the trader told his Twitter followers, calling the pullback “beautiful” as he tagged the lows of the range.

Longs drop to “squeeze” as liquidations increase

Conditions were ugly for Long BTCs and liquidations piled up quickly. At the time of this writing, total crypto long liquidations for April 19 on platforms tracked by datasource Coinglass were approximately $175 million.

Crypto liquidation chart / Source Coinglass

Crypto liquidation chart / Source CoinglassThese come after a painful day for shorts as BTC rallied above $30,000.