British banking giant Barclays says the partial Ripple victory of July 13 is good news for cryptocurrency exchanges. However, ARK Invest, an institutional whale, prefers to close its positions.

Barclays says Ripple’s decision is “gradually positive” for Coinbase

Last week, JPMorgan analysts also said in a report on the Ripple case that the result was an overall win. Barclays agreed with this view in Monday’s research report. Bank analysts said the result was “gradually positive” for Coinbase (COIN).

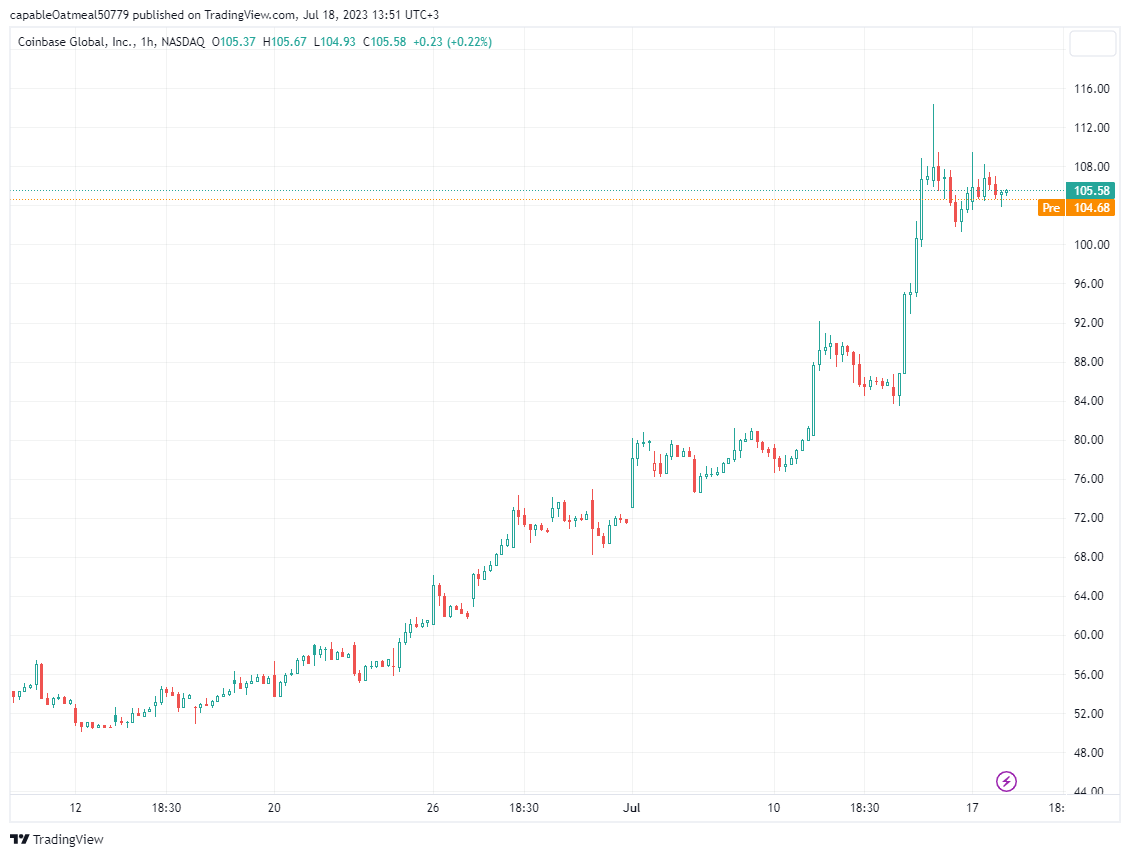

“Given the comment that in some cases, a token may not be a security, we see the decision gradually as positive for Coinbase,” Barclays analysts wrote in the report. In the same report, the crypto exchange raised its price target for the stock from $61 to $70. The COIN price surpassed the $100 threshold just one day later.

On June 6, the US regulator SEC also filed a lawsuit against Coinbase, a day after the Binance lawsuit. The stock of the stock market fell to $ 45 at that time. Cathie Wood-backed ARK Invest was among the institutional investors who evaluated the decline. The company purchased $21.6 million worth of Coinbase shares on June 7. The purchase, which had an average price of $51, was followed by profit purchases in the following weeks.

ARK Invest prefers to sell despite positive Coinbase atmosphere

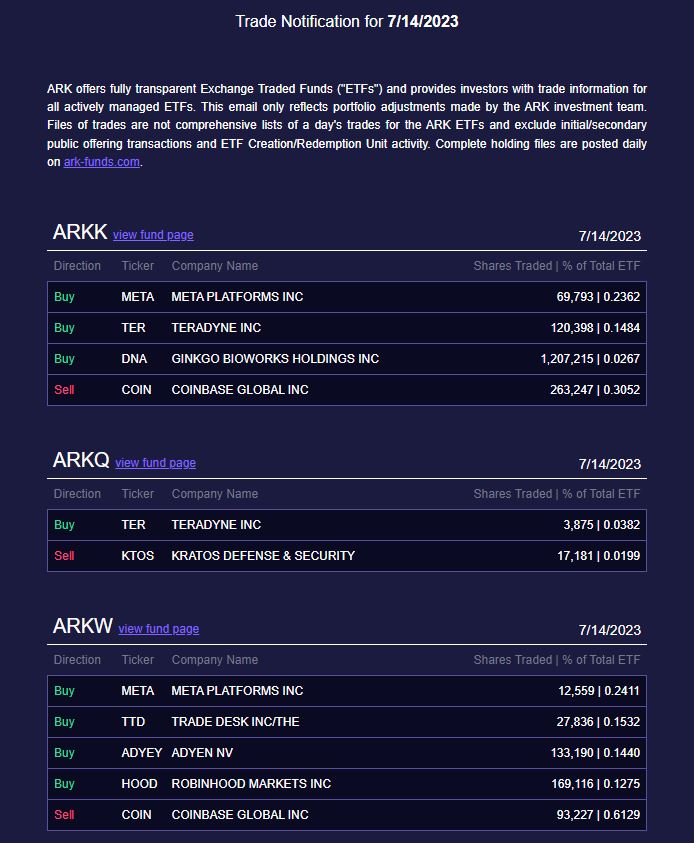

ARK Invest, one of the largest institutional cryptocurrency whales, ended its bottom purchases with high profits on Monday. The company has also turned some of its positions into profits in the past weeks. Finally, additional selling came as the COIN price pushed new highs at $107 on Monday.

According to the data, ARK Invest has sold 248,838 shares, which is just over $26 million from the COIN’s closing price on Monday. Meanwhile, COIN has been in a strong uptrend since $45. ARK Invest announced on July 14 that it has sold 480,000 shares of COIN across three funds, worth $50.5 million at the closing prices of the day. The previous week, it sold $12 million as the stock rallied.

Wood recently told Bloomberg Daybreak Asia, “We are very positive about Coinbase, especially in light of Ripple’s court ruling against the SEC. We just take the profits. We are reallocating capital to some survivors.”

Ripple lawsuit faces appeal risk

Meanwhile, according to a report from former SEC executive John Stark, the Ripple case could be appealed and overturned. As we quoted as Kriptokoin.com, Stark says the court decision is on “shaky ground”. The same report stated that the Ripple lawsuit decision is “ripe for appeal” and will likely be overturned.

Some thoughts on the SEC/Ripple decision. https://t.co/A94kHlGI9N pic.twitter.com/lcwWML49kO

— John Reed Stark (@JohnReedStark) July 14, 2023

Ripple CEO Brad Garlinghouse says the SEC’s appeal process will take years. Garlinghouse predicts that even if the legal process starts again, the accident will be the new crypto market. In an interview with Bloomberg on July 15, Garlinghouse specifically addressed the new accusations against the SEC. He accused the SEC of being a “bully”.