Just a few years after the U.S. Treasury announced the first sanction on two Bitcoin addresses, 398 more addresses entered the list. Thus, the number of addresses under the sanction reached 400.

The number of Bitcoin addresses under the sanctions is increasing

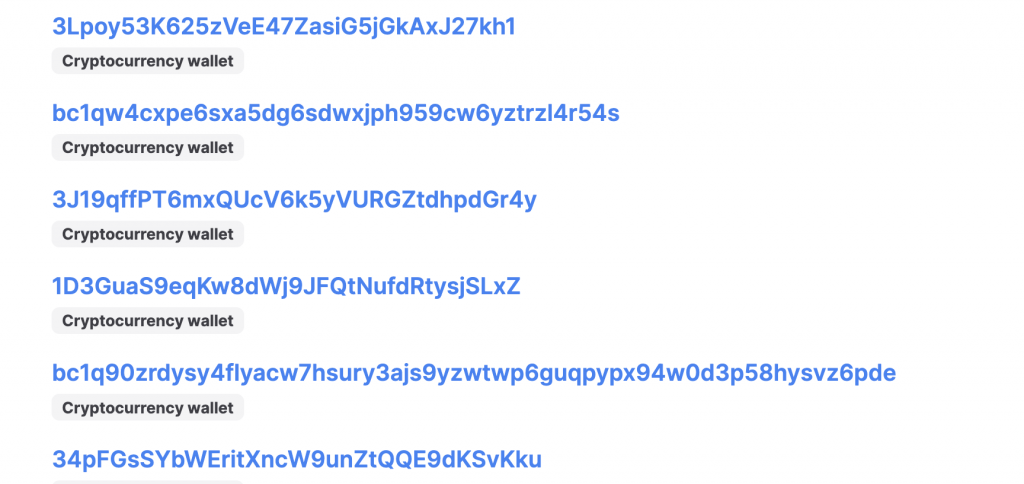

OpenSanctions uses over 50 sources to track sanctioned assets. As Cryptokoin.com reported, the number of Bitcoin addresses under sanction has reached 400, according to its latest report.

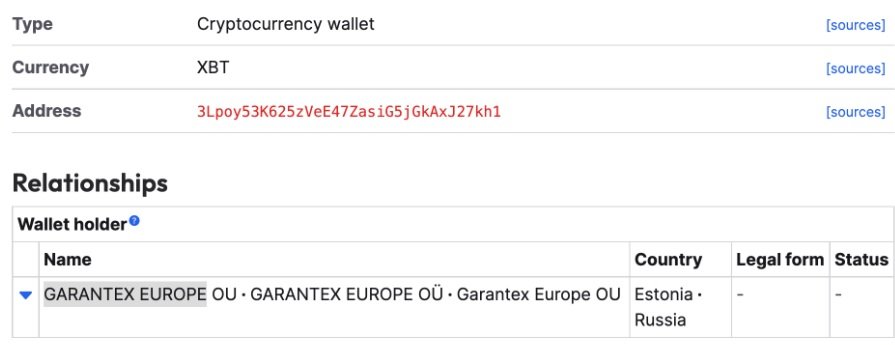

For example, the address ‘3Lpoy53K625zVeE47ZasiG5jGkAxJ27kh1’, which OpenSanctions claims to belong to GARANTEX EUROPE, an Estonian and Russian subsidiary, is on OFAC’s black list.

This is an address we randomly picked from hundreds of addresses. By the way, it’s a little unclear how they name the pseudo-anonymous Bitcoin addresses. We have not checked the accuracy of this data. But their code is open source on GitHub. So anyone can verify. The only crypto resource listed is ransomwhe.re, a site that collects addresses known to be linked to ransomware payments.

They are tracking such outstanding 7,508 ransomware theft addresses. This makes it a potential data mine, especially for the app but also for the exchanges. But they don’t list any resources like ChainAnalysis. As such, the confirmed Bitcoin addresses come directly from the Treasury, presumably the ID attribution, with OpenSanctions potentially acting as more aggregators.

Yet the public, while anonymous, the nature of Bitcoin clearly gives way to more complex systems that track money. It could potentially be very difficult to commit crypto crimes in the future, as the address can be frozen by everything else if it is flagged by these systems and not the network. However, it is possible for Bitcoin to still move. For example, a certified Russian entity could transfer cryptocurrencies to an innocent third party in Russia, China or India.

For example, the address mentioned above moved their Bitcoins. However, they sent it to an address that received 343 Bitcoins, even though its final balance is now zero. This is also quite interesting. Moving from here is riskier in terms of detecting guilt. If that 3EV address were part of the sanctions and said it wasn’t OpenSanctions then it would be easy as any transfer would be checked for innocence out of suspicion. However, now it is necessary to somehow determine this.

It is necessary to take into account the very fast-moving nature of Bitcoin

As you can imagine, nothing is outputting at this 3EV address. So we have no idea who he is. It’s possible that exchanges or companies that specialize in blockchain analysis do this. But most of the time they probably don’t. Most transfers from this address are also for very small amounts. However, with one of the transfers and only two hops, we reach a rather large address. The best part about it is that this 13x address also has a final nothingness balance. Continuing from here is a little more interesting with some smaller addresses under 1,000 BTC.

At this point, however, we are a long way from where we started. Some corroborative evidence is required that any of these last addresses have something to do with the address on the list. All indicate that you can confirm the address. But can you confirm Bitcoin? Also, would it be counterproductive to publish addresses in this list instead of a semi-characteristic special list for exchanges?

Because at the network level you can’t fully implement anything. That’s why moving the old system to the new one without making any changes will probably work on the surface. But in fact it misses many nuances. When it comes to this specially approved address, it is necessary to take into account the very fast-moving nature of Bitcoin. This requires a new system. For example, it’s clear that the sanction doesn’t quite work. Because it is easy to lose track of some movements of cryptocurrencies afterwards.