MiCA, the EU’s landmark cryptocurrency law, was published in the official gazette today. The new law will enact licensing, stablecoin and anti-money laundering rules next year.

MiCA published in the official gazette: The date has been announced

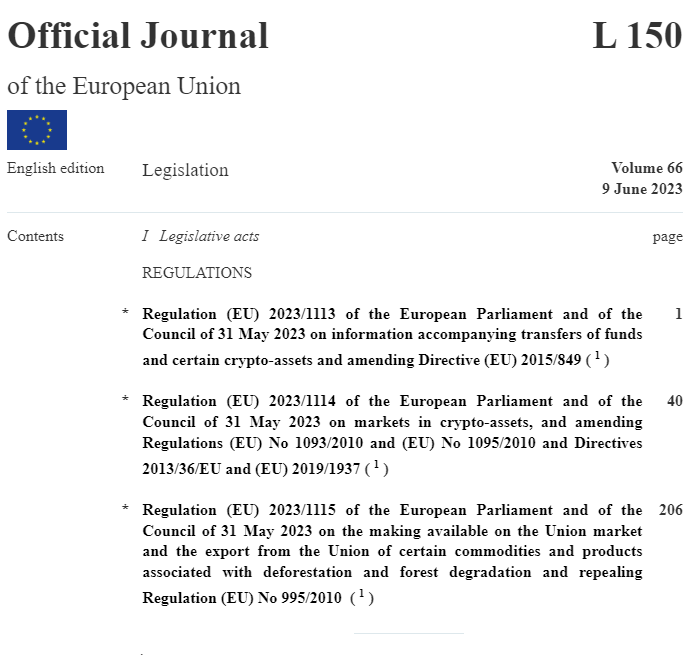

The European Union’s Crypto Asset Markets law (MiCA) was published in the Official Journal of the European Union (OJEU) on Friday. Thus, the countdown has begun for the important crypto licensing rules to come into effect.

The publication of the 200-odd-page law marks the official entry of a bill into the EU’s statute book. Legally, the two laws come into effect within 20 days. Its new provisions will enter into force on 30 December 2024, and some provisions will enter into force on 30 June 2024.

The entire law, published along with the relevant legislation, requires crypto wallet providers to identify their customers when transferring funds. It offers licenses to crypto companies such as exchanges and wallet providers to operate across the blockchain. It also introduces new governance and financial requirements for stablecoin issuers. The new law will officially enter into force on December 30, 2024.

As we quoted as Kriptokoin.com, the bill was accepted last month.

What does MiCA mean for centralized exchanges?

The EU’s new cryptocurrency law comes at a time when the market is facing significant uncertainty, with the US regulator SEC suing Binance and Coinbase (COIN). Binance CEO CZ has previously reported that they will gladly support the new regulation. Peter Grosskopf, co-founder of Unstoppable Finance, predicts that MiCA will benefit the crypto industry. According to Grosskopf, the regulations introduced by MiCA will bring a number of benefits to the industry:

- Investment and employment in the EU: If external companies come to the EU, these companies will have to register with an EU company. This will have a direct impact on areas such as job creation and tax payments.

- Creating a safe space. Unlike other jurisdictions, many jurisdictions’ cryptocurrency regulations can be overly strict. For example, the US enforces regulations through sanctions. Grosskopf says the EU will become a safe space for the crypto sector compared to other regions. It also predicts that innovators from all over the world will start building their businesses here.

https://twitter.com/cz_binance/status/1649018863298703361

The MiCA (Market in Crypto-Assets) bill includes new rules brought by the European Union to regulate crypto money markets. The main focuses of the law are as follows:

- Detailed definitions and scopes about cryptocurrencies will be determined

- It will introduce new rules for authorization and registration

- Capital adequacy rule is introduced to stock exchanges

- New rules to keep investors safe

- New rules for stablecoin companies and stablecoins