While regulatory problems continue at full speed in the cryptocurrency industry, developments continue. On the one hand, global regulators have announced that they are continuing their research, on the other hand, companies are asking for regulatory clarity. At this point, the Fed, one of the most critical regulators, had recently sought public comment on CBDCs. The answers to these questions were analyzed.

Source

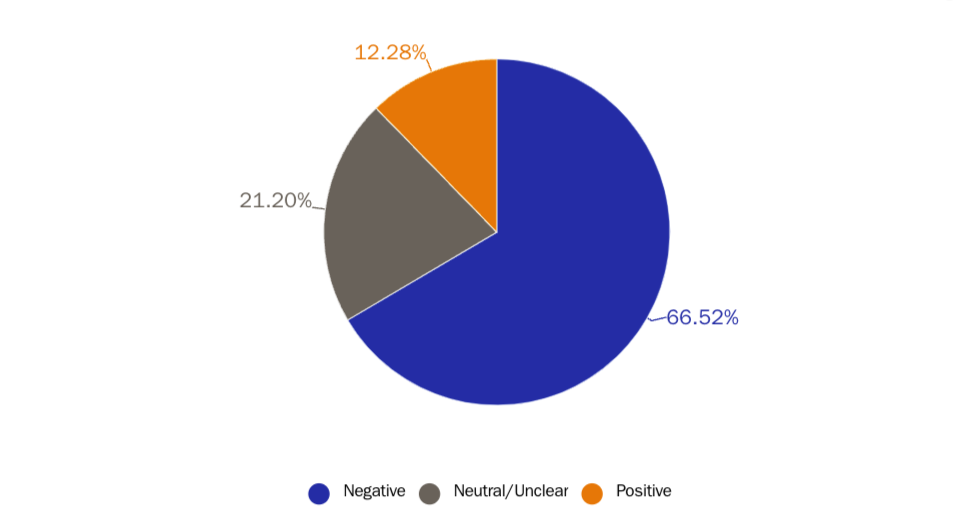

SourceMajority Negative Answers to Fed’s CBDC Questions

On June 24, the Fed released answers to questions it asked the public about CBDCs. The answers to these published questions were analyzed by the Cato Institute. As a result of the analysis, more than 2,000 responses to the Fed’s CBDC questions were examined. However, according to the results of the analysis, 66 percent of the 2,052 commentators opposed this idea, while keeping an anxious stance on the CBDC.

The most common concerns in the comments made were financial privacy, financial pressure and the risk of intermediation in the banking system.

However, there were other views in the responses to the Fed. Large businesses working in finance, technology, and compliance have been the most interested in a CBDC. Institutional commentators made up 34 percent of the second to last group and 86 percent of the final comment group.

On the other hand, another remarkable part was that many banks and credit union letters questioned the motivations of the Fed. This group stated that there was no apparent benefit justifying the introduction of a CBDC. In its own comment letter, the Banking Policy Institute (BPI) added:

Many of the potential benefits cited by proponents of a CBDC are unclear and, moreover, many are mutually exclusive and therefore cannot be realized simultaneously.

In the light of all these developments, Fed officials, who will be responsible for the creation and protection of a digital dollar, said that no action can be taken on this issue without the signatures of Congress and Biden administration.