Bitcoin registered $24,000 on August 17 amid ongoing concerns that a pullback is imminent. Data from TradingView shows that BTC gained 3.25% before it melted roughly $600. After the Fed meeting minutes, analysts update their forecasts for Bitcoin.

“Bitcoin ready to break significant resistance on weekly chart” despite drop

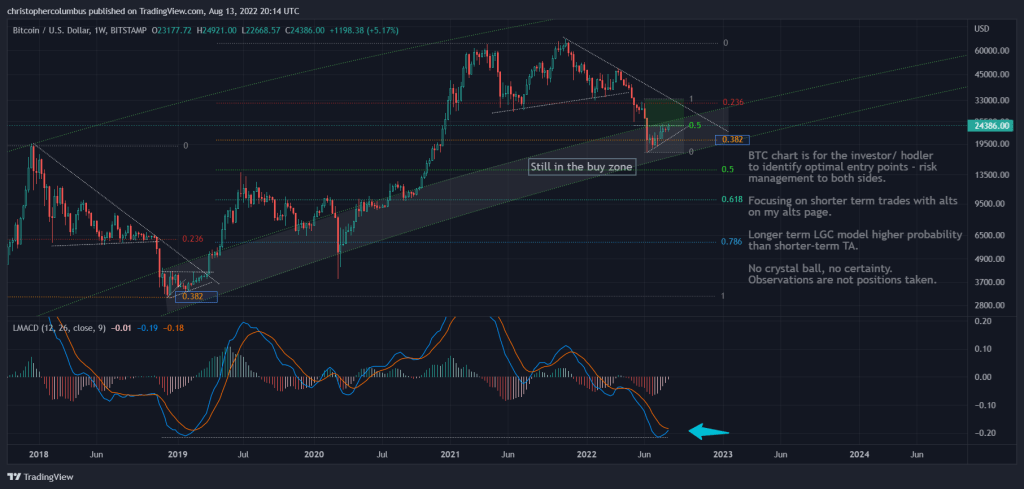

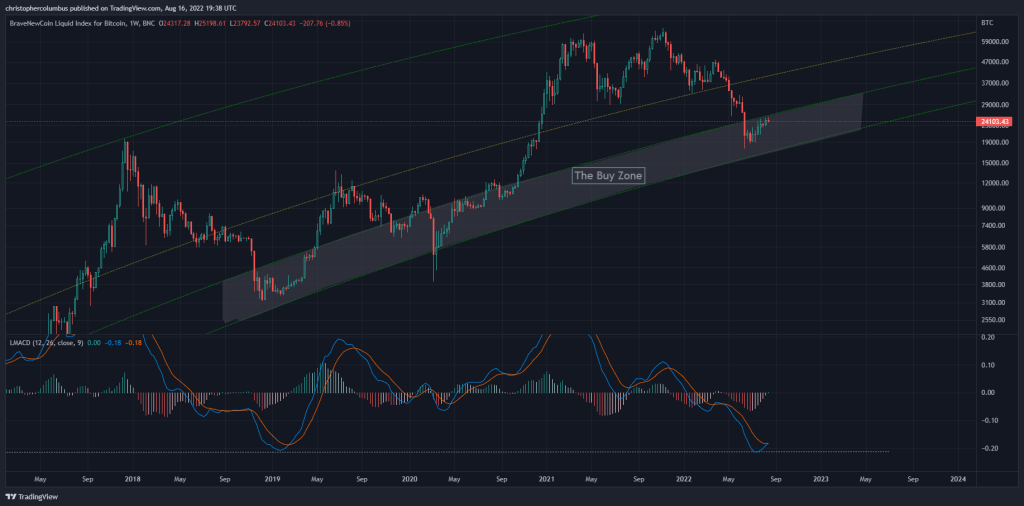

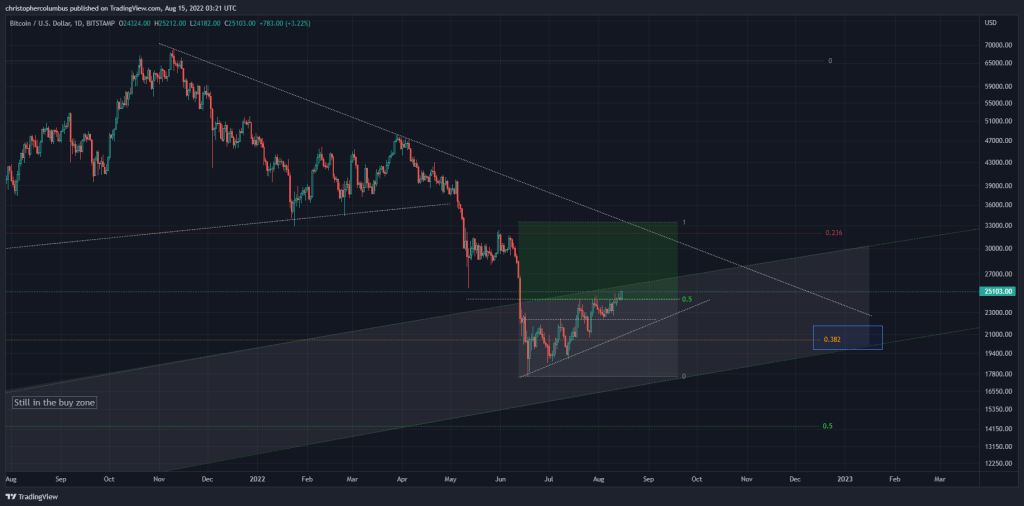

Knowing about the May 2021 Bitcoin crash, crypto analyst Dave the Wave said that BTC bulls are starting to gain the upper hand. The crypto oracle tells his 123,600 followers that Bitcoin is poised to conquer a key resistance area on the weekly chart:

A lot of upside pressure is forming at the resistance level… Bullish

Check out Dave the Wave’s accurate predictions here. Looking at the analyst’s latest chart, we see that BTC is facing resistance near $24,400. BTC is currently trading with a sharp decline at $23,416.83.

Technical indicators are putting ample upside pressure for BTC

The crypto analyst also says that the moving average convergence divergence (MACD), a trend reversal indicator, has recovered. Looking at the indicator, Dave the Wave also highlights that Bitcoin has bounced from a historical support level:

Hello, the weekly MACD cross is bullish from an oversold position.

The $30,000 path for Bitcoin is open after this resistance

The most recent bounce of the MACD from the same zone was in 2019 when BTC dropped to $3,000 before rising to 14,000. According to the analyst, a break of the $24,400 resistance will trigger a strong rally for BTC above $30,000. According to the analyst:

It wouldn’t be surprising to see some FOMO buying begin at some point. It usually happens when a significant resistance level is broken.

No success for bitcoin bulls

Unlike Dave the Wave, veteran investor Peter Brandt evaluated the downside scenarios for Bitcoin. The veteran is eyeing an ongoing ascending wedge formation for Bitcoin with $20,700 as the starting point. On-chain tracking resource Material Indicators is less convinced of the staying power of the current rally.

By uploading a snapshot of Binance’s order book on August 16, it has now caught the resistance preventing Bitcoin from making any further gains. He also added that the setup “looks like previous local summits”:

Bid liquidity is a bit weak, but this tends to change after support fades.

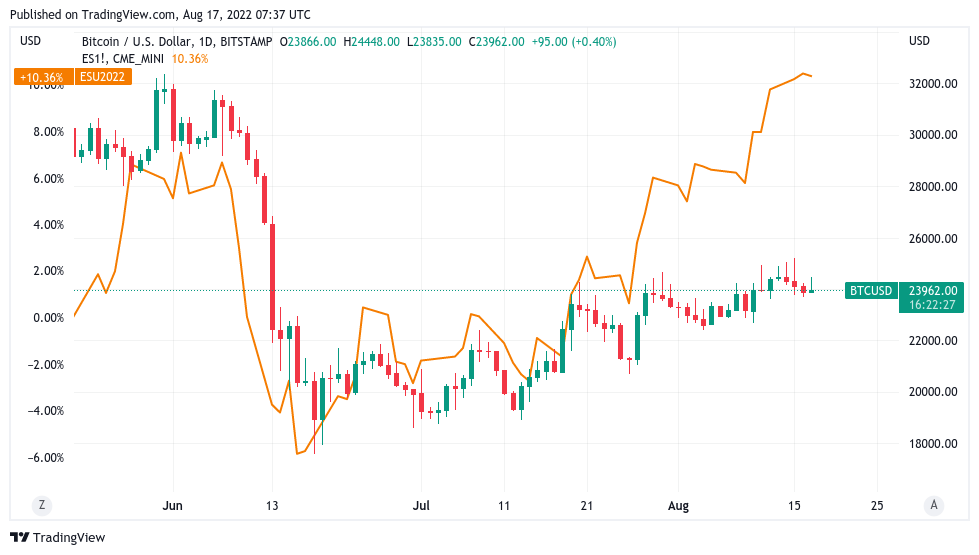

Meanwhile, popular Twitter analyst Trader Il Capo shared his predictions that include BTC reaching a maximum of $25,500 before falling significantly. Fellow analyst Crypto Chase has marked the overwhelming BTC performance against stocks, especially the S&P 500, since July. Crypto Chase wrote of their recent analysis:

The ES largely fulfilled my prediction. BTC, on the other hand, is only really struggling amid a rising S&P500 (ES). Even a bear like me would expect much more from BTC. I think this shows how weak crypto is still and this big coin definitely prefers the S&P500 over crypto atm.

As you follow on Kriptokoin.com, Bitcoin has lost around 2.11% in the last 24 hours. It is currently trying to hold the $23,400 level.