Goldman Sachs analysts say that Bitcoin and the crypto market may see some relief. But this relief only adds to the short- and medium-term turmoil. A recent report from banking institutions claims that the crypto market moves with the US stock market and is therefore affected by the macroeconomic environment.

Why can Bitcoin only return to $28,000 by the end of 2022?

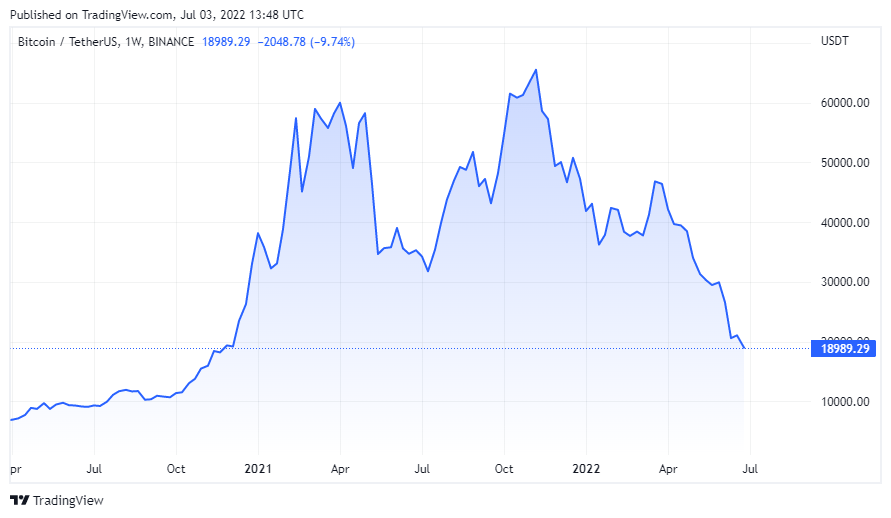

This analysis is by Marion Laboure and Galina Pozdnyakova. Experts predict a 30% rally for Bitcoin by the end of 2022. This rally is still a long way from Bitcoin’s previous ATH level of around $69,000.

The report does not provide reasons to support the decline theory. Analysts say Bitcoin’s relationship with the stock market will continue to play against it. They also believe that the price of BTC will lag in terms of performance, while predicting a bounce in stocks.

Goldman Sachs analysis for the stock market predicts a potential jump to January 2022 levels. Meanwhile, Bitcoin could reach $28,000, which is over $10,000 from January 2022 levels.

Why will BTC underperform on the stock market?

The reason for this is unclear. As usual for legacy institutions, analysts reject Bitcoin’s fundamentals. At the same time, they compare the leading crypto to the diamond market:

By marketing an idea rather than a product, they’ve laid a solid foundation for the $72 billion annual diamond industry they’ve dominated for the past eighty years. What is true for diamonds is true for many goods and services, including Bitcoins.

Analysts wrote about the factors that add to the complexity of measuring value in Bitcoin and other cryptocurrencies, and why this could increase its downside risk:

Fixing token prices is difficult because there are no common valuation models like those in the public equity system. Also, the crypto market is highly fragmented. Crypto freefall could continue due to the complexity of the system.

What do analysts expect for Bitcoin in the short term?

Experienced analysts say that Bitcoin and cryptocurrencies will continue to follow the stock market. Arthur Hayes, former CEO of crypto exchange BitMEX, expects this correlation to contribute to the BTC price drop.

However, at some point during 2022, the crypto market will begin to separate from equities and the main US stock indices, the S&P 500 and the Nasdaq 100. The bullish momentum for cryptocurrencies is supported by both the decline in the value of the legacy. Hayes’ thoughts on this subject, which we also quoted as Kriptokoin.com, were as follows:

For me to raise the flag on selling fiat and buying crypto before an NDX crash (30% to 50% down) correlations across all timeframes need to trend significantly lower.