The 200-week moving average is likely to see another test from the next bulls, according to signals from the exchange’s orderbook composition. US stocks finished with modest gains during the week of Wall Street trading. After that, Bitcoin (BTC) consolidated higher on July 16.

Can Bitcoin bulls reclaim the 200-week moving average?

As you follow on Kriptokoin.com, BTC varies between $ 20,500 and $ 21,400 over the weekend. Last week there was the shock of US inflation data. This led to weakness in risk assets. Subsequently, BTC thus retained most of its reversal from weekly lows.

The classical breakout and fraud scenario on weak liquidity stands out in after hours trading. According to crypto analyst William Suberg, this means it could accompany Bitcoin’s weekly close. The analyst looks at order book data from Binance, the largest global exchange by volume. He notes that the data shows key resistance clustering around $22,000 should the bulls attempt to push the market higher.

However, according to Material Indicators, there is a distinct possibility that Bitcoin could challenge its 200-week moving average (WMA), a key bear market trendline that lost as support a month ago.

Popular trader and analyst Rekt Capital also comments on the latest developments. “It is easy to be up in BTC on a green day and down on a red day,” the analyst says. The analyst makes the following assessment:

However, BTC still ranges between $19k and $22,000. This will continue until any of these levels is broken. In-range movements aren’t important enough to dictate changes in emotion.

Meanwhile, crypto markets closed the longest in ‘extreme fear’, according to the Crypto Fear & Greed Index. Therefore, this sentiment set an unpleasant record this week.

Miners feel pinch

CryptoQuant is an on-chain analytics platform that monitors miner behavior. An analyst at CryptoQuant has sounded the alarm about a potential sale. Binh Dang said that 14,000 BTC was transferred from miner wallets on July 15. It showed that the phenomenon was worth watching, though not particularly a sales indicator. Also, one of CryptoQuant’s Quicktake market updates highlights:

At this point, we cannot be sure whether this distribution is positive or negative. That’s why we need to pay attention to the next few days.

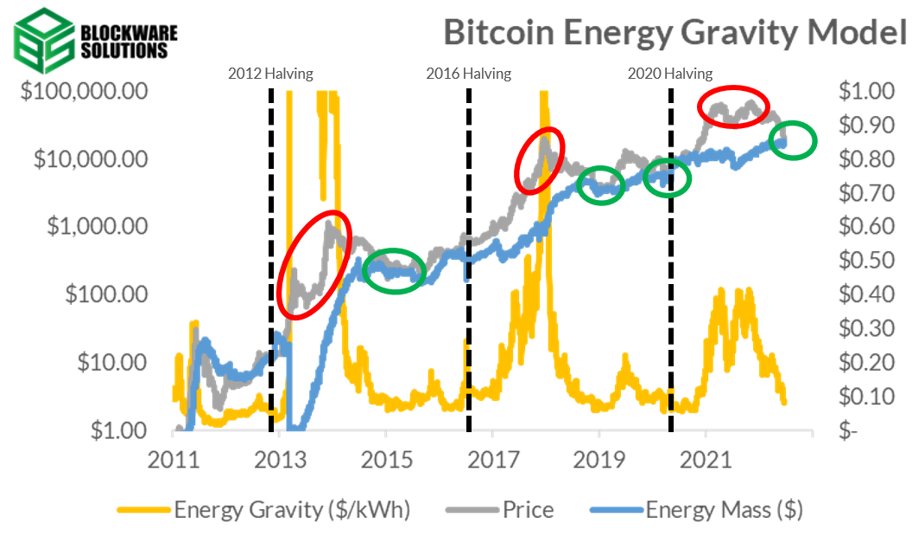

The Energy Gravity Model is a new indicator that covers Bitcoin production costs. This metric showed that miners could pay relatively low amounts of energy to profit at current BTC spot prices. The creator of the model, BlockWare analyst Joe Burnett, made the following statement in a Twitter thread:

Bitcoin Energy Gravity is the maximum USD price ($/kWh) that modern mining rigs are willing to buy electricity for profit. That is, the breakeven electricity rate. From this maximum bid price, it is possible to better understand when the Bitcoin price is overgrown and when the price is nearing the bottom.

Bitcoin Energy Gravity Model / Source: Joe Burnett / Twitter

Bitcoin Energy Gravity Model / Source: Joe Burnett / Twitter