Israel declared war against Hamas. Bitcoin has fallen about 2% since the conflict. This led to speculation on the reaction of Bitcoin and altcoin markets amid the volatility. Crypto analyst Miles Deutscher notes that despite the initial volatility that affected the S&P 500, markets generally recover quickly after wars.

Crypto analyst expects volatility for Bitcoin and altcoins

As you follow from Kriptokoin.com, the cryptocurrency market suddenly turned red. Israel’s declaration of war against the Palestinian military group Hamas was effective in this. Following this development, the crypto community has been speculating on how Bitcoin (BTC) and the broader altcoin markets will react. Market volatility tends to increase during geopolitical crises such as war or other military conflicts. During this period, the price of commodities such as oil and safe haven gold increases. On the other side, investors prefer to stay away from riskier assets like stocks and crypto. Famous crypto analyst Miles Deutscher talked about the impact on the S&P 500 due to the Israel-Palestine war. The analyst shared the following assessment on social media platform X:

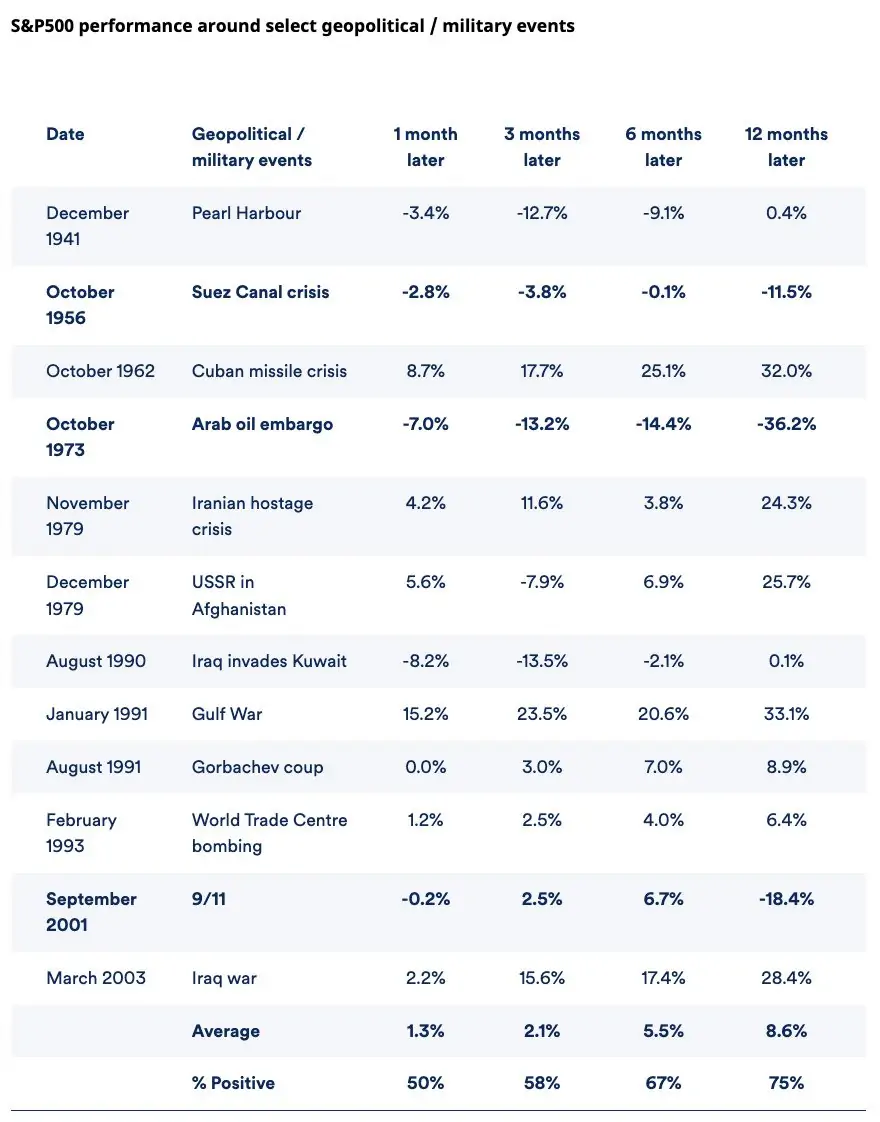

Data shows that although there may be initial volatility, markets generally recover quickly from wars and other geopolitical shocks.

The screenshot below shows that although there was uncertainty in the first month of the conflict, the market began to turn positive after three months in most cases. In 75% of cases, the S&P 500 was positive 12 months after the military incident. The data covers military conflicts from Pearl Harbor in December 1941 to the Iraq war in March 2003. However, during these periods Bitcoin was not yet alive.

The performance of the S&P 500 around military conflicts. Source: X

The performance of the S&P 500 around military conflicts. Source: XBitfinex Alpha expects high volatility in the short term

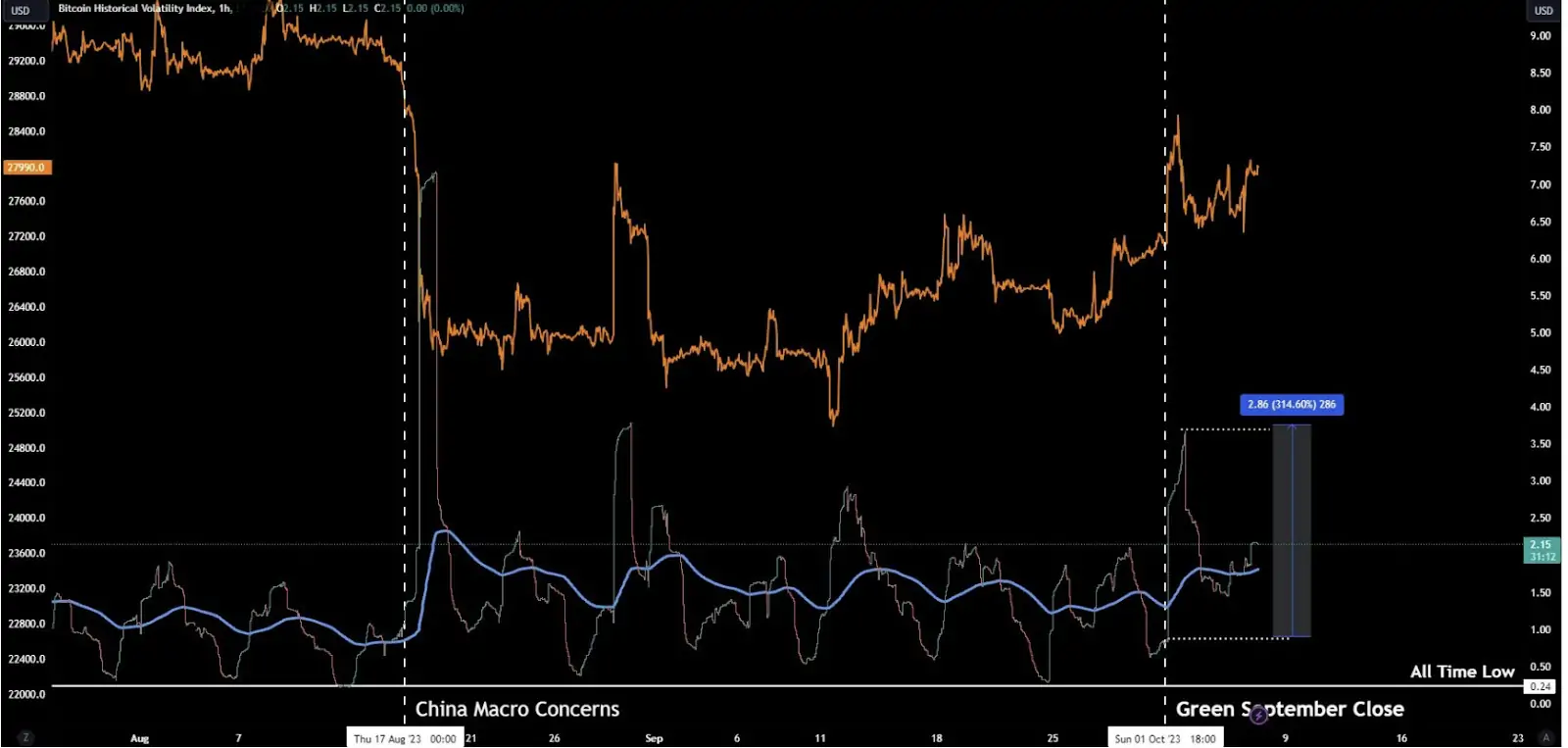

The cryptocurrency market has not witnessed major geopolitical conflicts other than the Russia-Ukraine war. Therefore, it is difficult to determine the isolated impact on Bitcoin and other crypto assets. However, there is a correlation between Bitcoin and the S&P 500 index. As a result, Bitcoin, along with the S&P 500, is likely to fluctuate over a short period of time. Meanwhile, the Bitfinex Alpha report suggests there will be “high volatility” in Bitcoin’s price movement. The screenshot below shows that daily historical volatility remains above the 200-day exponential moving average (EMA).

Bitcoin historical volatility index. Source: Bitfinex

Bitcoin historical volatility index. Source: BitfinexMeanwhile, the Bitcoin price has fallen by nearly 2% since Saturday, when the Israeli-Palestinian war began. However, BTC managed to stay above the critical support of $27,000.

![]()

Follow us on Twitter, Facebook and Instagram and join our Telegram and YouTube channels to be instantly informed about the latest developments!