Popular crypto analyst Lark Davis says that the altcoin project, which is preparing for the biggest token unlock event in the market, may come under selling pressure. According to reports, this altcoin will hit the market for $26 billion within the year.

Lark Davis warns altcoin investors about upcoming selloff

Popular on YouTube, Davis posted a video warning investors that as of March 2023, 16 million Ethereum (ETH) worth over $26 billion will be eligible to be withdrawn from the market. The analyst also adds that not all coins will be opened at the same time. Similarly, while most investors are looking forward to making a profit from the sale, it can cause a hefty sell-off for investors looking to make a profit.

During the first staking, the price of ETH was $600. However, due to daily limits, it could take almost a year for all Ethereum volalidators to emerge if they wanted to. Davis also says that as part of the staking reward, more than one million ETH will be unlocked within 3 weeks after the unlock starts.

“May be an opportunity to buy”

According to Davis, if investors decide to sell instead of staking after the unlock goes live, it will present a good buying opportunity for crypto investors.

Ethereum (ETH) is currently trading at $1,694.43, about 3x above the initial staking price of $600. It gained around 10% in value compared to the last 7 days.

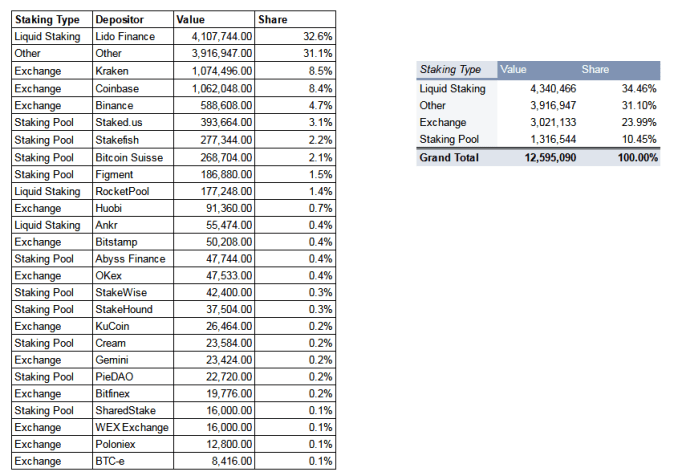

Locked altcoin dispersed to centralized exchanges like Coinbase

Staking, as defined on the Ethereum Foundation’s ethereum.org website, is “the act of investing 32 ETH to activate the validator software.” However, cryptocurrency exchanges like Coinbase and private websites like Lido allow Ether holders to stash and collect rewards without having to meet a minimum of 32 ETH.

Platforms can issue tokens representing users staked ether, also known as liquid staking derivatives. Derivative tokens can be traded or used in other decentralized finance applications while the staked ether they represent is locked and earning interest.

Although the merger escalation took place in 2022, Ethereum users started staking Ether as early as December 2020 to gain access to the validator software as they knew that the staked assets and collected rewards would remain locked until the next update.

Additionally, Staking Rewards, a data provider, estimates that 14% of all Ethereums are currently staked, representing a market of around $29 billion. Validators will finally be allowed to withdraw these assets if they so choose, thanks to the Shanghai upgrade.

Ethereum Shanghai fork is coming

Ethereum’s next major update, Shanghai, will go into effect in March. As Kriptokoin.com, we have included the details in this article.