Analyst Jonathan Morgan examines week-to-week levels for the meme-themed altcoin Shiba Inu (SHIB) and the leading cryptocurrency Bitcoin. Here are the crypto analyst’s predictions for Shiba Inu and BTC…

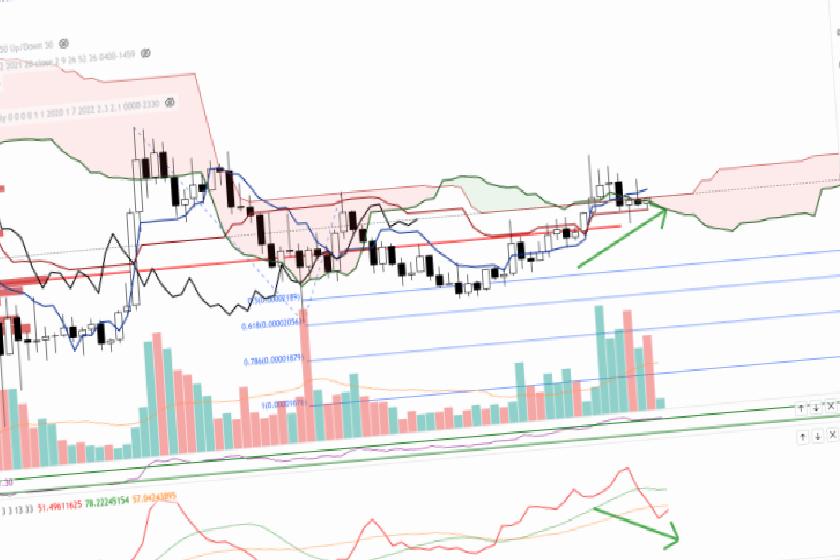

What are the levels to watch for SHIB price?

Shiba Inu price triggered the Ideal Taurus Ichimoku Breakout, which has not occurred since October 2021. However, Shiba Inu’s price action needs to close at or above $0.000027 on the daily chart to confirm this formation, according to analyst Jonathan Morgan. A hypothetical long entry identified two weeks ago was triggered at $0.000028 and continues to rise. Morgan states that the stop loss for this long setup on the Shiba Inu (SHIB) is $0.000024 and the profit target is $0.000040.

The original profit target of $0.000040 will likely be extended by another 10 to 15 percent, according to analyst Jonathan Morgan. A theoretical short setup remains valid for the SHIB price, according to the analyst. According to Morgan, the entry will be a sell stop of $0.000021, a stop loss of $0.000025 and a profit target of $0.000010. Furthermore, the analyst states that the short entry will be invalid if the current X column in the altcoin moves to $0.0000030.

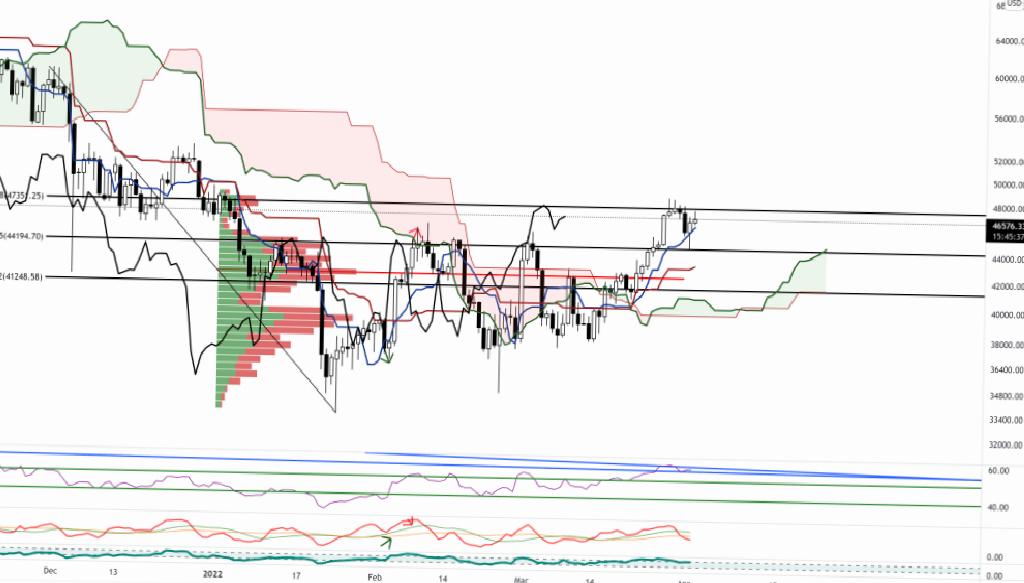

Analyst: Bitcoin is positioned to confuse the bulls and bears

Bitcoin price action shows that the daily support against Tenkan-Sen remains in the $48,000 value area, according to SHIB analyst Jonathan Morgan. shows repeated resistance to An uptrend becomes more likely as BTC approaches the $48,000 resistance. However, limited price action should be expected over the weekend as Bitcoin will likely bounce between the $48,000 and the 61.8% Fibonacci retracement and the $46,000 and Tenkan-Sen.

Alongside the Shiba Inu (SHIB), Bitcoin price is expected to continue its rise despite attempts to move lower on Thursday and Friday. According to Jonathan Morgan, whose analysis we consulted as Kriptokoin.com, the $ 48,000 price level remains the strongest resistance area for Bitcoin to close above. While the upside potential is likely limited to the $48,000 value area, downside risks seem more significant.