Bitcoin bear market bottom targets show below $14,000 as BTC climbs above $16,000. The leading crypto remained undecided on November 24. Meanwhile, one analyst is highlighting the $12,000 BTC price target.

$12,000-14,000 ‘main target’ for Bitcoin bottom

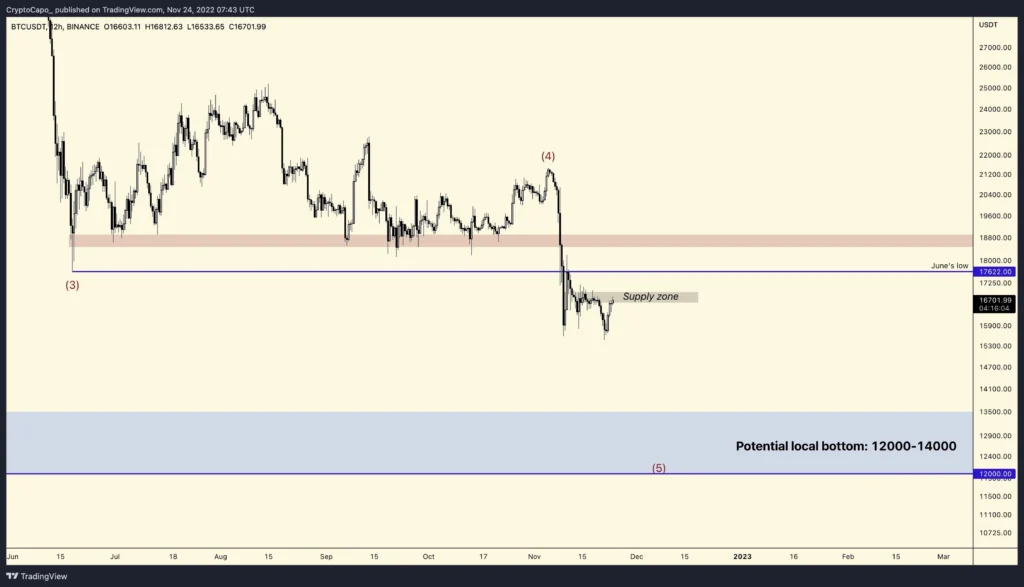

While there is an eerie calm in the market, Bitcoin is trading around $ 16,500. BTC still failed to convince analysts that better times are on the way. Popular analyst Crypto Capo suggests that it is only a matter of time before the decline starts again. The analyst is known for knowing about Bitcoin dips. Check out this article of Kriptokoin.com for accurate predictions of Crypto Capo. In both high time frames (HTF) and low time frames (LTF), the picture is bleak. The analyst makes the following statement:

HTF: showing lower lows and lower highs after breaking the monthly redistribution range. Also, below June low and in supply zone. LTF: There is weak trend caused by short squeeze (bull trap). Volume is dying. $12,000-140.00 remains the main target for local bottom formation.

BTC caption / Source: Crypto Capo / Twitter

BTC caption / Source: Crypto Capo / TwitterMeanwhile, multiple BTC price predictions continue to call for a bear market bottom below $14,000. Responding to Crypto Capo, fellow analyst Gert van Lagen suggests a potential upside resistance/support reversal at $18,100 as a bullish sign.

The analyst wrote that BTC, which has risen from current levels to hold there, will make a ‘triple bottom’ for 2022 at $ 15,480, the lowest level of the last two years. “Only if he breaks $18.1k he qualifies,” emphasizes Van Lagen.

Analyst: 99.9% probability GBTC has Bitcoin

Meanwhile, in crypto circles, there is talk of the fate of the Digital Currency Group (DCG), its subsidiary Grayscale, and the Grayscale Bitcoin Trust (GBTC). In addition, this issue remains an important topic of discussion for the crypto market. James Seyffart, an analyst at the Bloomberg Intelligence exchange-traded fund (ETF), also contributed to the issue. The analyst said the voluntary liquidation of the $10.5 billion GBTC “unlikely” despite the nerves of the market. “It doesn’t look like it’s on the table to me,” Seyffart wrote.

The analyst admits his disappointment with the fund’s cut to the Bitcoin spot price. However, he makes an assessment taking into account the available material. Accordingly, he concludes that the probability of holding the mentioned BTC through Coinbase is ‘99.9%’. According to data from monitoring resource Coinglass, the GBTC spot price reduction was 39.2% as of November 24.

BTC chart with GBTC premium and asset holdings / Source: Coinglass

BTC chart with GBTC premium and asset holdings / Source: Coinglass