The CFTC is preparing to sue a DAO. Here is the development that alarmed the DeFi altcoin market…

CFTC sues this DeFi altcoin project

The Commodity Futures Trading Commission launched a controversial attack on a DAO. This could have serious consequences for DeFi. The CFTC also filed a federal civil enforcement action against the Ooki DAO under the same charges. Buddha is equally important. Because it will be the first lawsuit a regulatory agency has filed against a DAO. The legal implications of the CFTC winning the case sets a dire legal precedent for management token holders of other crypto projects, including many DeFi protocols.

In the lawsuit, the CFTC alleges that the Ooki DAO has transferred control over the protocol to the community in an attempt to circumvent regulation:

The primary goal of bZeroX in transferring control of bZx Protocol (now Ooki Protocol) to bZx DAO (now Ooki DAO) was to try to make bZx DAO application-proof due to its decentralized nature. Simply put, the bZx Founders believed they had found a way to violate the Laws and Regulations and other laws without result.

“But the bZx Founders were wrong,” the CFTC said. He claimed that “DAOs are not immune from sanctions and cannot break the law with impunity.”

Which projects are at risk?

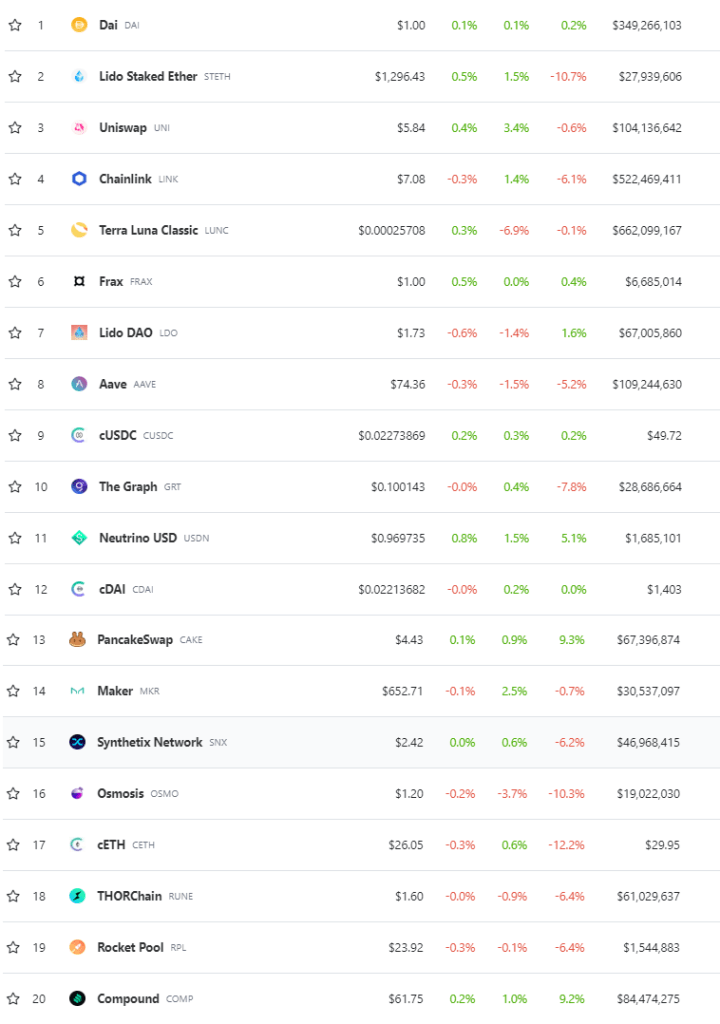

Popular DeFi protocols like DAI and Uniswap will be at risk if the CFTC gains the upper hand in the legal process. Listed below are the biggest DeFi projects that will have a direct impact on the lawsuit.

Possible implications of the lawsuit for DeFi investors

The CFTC influences the DAO as an unincorporated association. It says its members have unlimited liability and are fully responsible for any of their actions. This argument is specifically about not caring that the Ooki Protocol is an unattended protocol. Therefore, it cannot comply with existing regulations designed for centralized financial institutions. It cannot be closed by members of the DAO or any other party.

Winning the case in court, the CFTC will set a legal precedent much easier for the agency to target other decentralized derivative protocols such as Synthetix, GMX, dYdX, Injective, Gains Network and Perpetual Protocol. If this happens, SNX, GMX, DYDX, INJ, GNS and PERP token holders who vote on any governance proposal could be liable for potentially illegal operations of the protocol and be subject to prosecution.

The CFTC’s move comes after the agency showed renewed support for becoming its primary regulator over cryptocurrencies. In August, US Senators enacted the Digital Commodities Consumer Protection Act, which aims to close regulatory loopholes. If passed, the DCCPA would make the CFTC the leading regulatory body for cryptocurrencies.