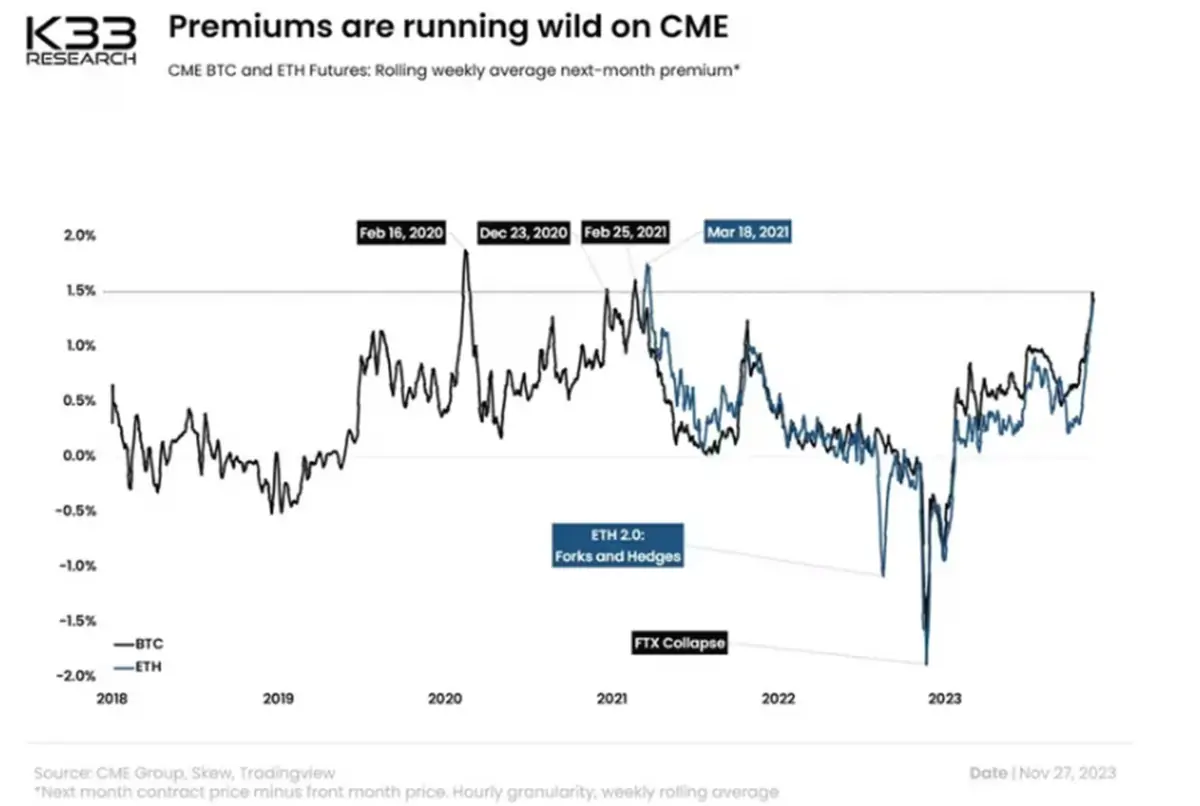

The difference between “next month” and “front month” futures prices of Bitcoin and Ethereum increased to the highest level since 2021 last week. This situation, called contango, shows that there is an upward trend for 2 cryptocurrencies.

There is a very strong bullish sentiment for these 2 cryptocurrencies!

A rare pattern has recently emerged in the Chicago Mercantile Exchange’s (CME) futures market tied to Bitcoin (BTC) and Ethereum (ETH). This indicated a strong investor trend towards leading cryptocurrencies. A futures contract is a legal contract to buy or sell the underlying asset at a predetermined price on a specific future date, called the maturity date. Futures markets are often in Contango, a term used to describe situations where the futures price rises above the spot price, with more distant futures trading higher than closer futures. An increase in buying pressure usually causes Contango to widen.

According to data from K33 Research, BTC and ETH futures experienced the same situation recently. Additionally, the so-called “next month” contract traded at a significant premium to the “front month” contract, a rare occurrence since 2018. The next month contract has the maturity date closest to the current date. The next contract is defined as the next month contract. Vetle Lunde, senior analyst at K33 Research, shared the following assessment for cryptocurrencies:

This indicates that there is a very strong bullish sentiment in CME and the desire to add long positions is leading to an increase in return premiums.

CME sentiment is very bullish

The CME futures in question are 5 BTC and 50 ETH in size, respectively. At the time of writing, contracts expiring in December are in the front-month contracts category. Those expiring in January represent the following month’s contracts. As you follow on Kriptokoin.com, November cryptocurrency contracts expired on Monday.

A high premium next month indicates an upward trend. Source: K33 Research

A high premium next month indicates an upward trend. Source: K33 ResearchThe weekly spread between next and first month BTC and ETH contracts recently increased to 1.5% on an annualized basis. Additionally, this is the first time such a situation has occurred for the two cryptocurrencies since the bull market in 2021. The market has witnessed this pattern only four times so far. Three of these occurred during the bull run. One occurred a few weeks before the Covid-induced crash of March 2020. Contango in both markets narrowed slightly on Monday, according to Lunde. However, it continued to indicate an upward trend. In this context, Lunde makes the following comment:

A significant contraction was seen in Contango yesterday. 7,000 BTC worth of open interest in the December contract was closed, wiping out the backlog for ETH, which reached an all-time high nominal open position last week after seeing a similar pattern to BTC. Yield premiums continue to remain in double digits. So CME’s sentiment is very bullish.