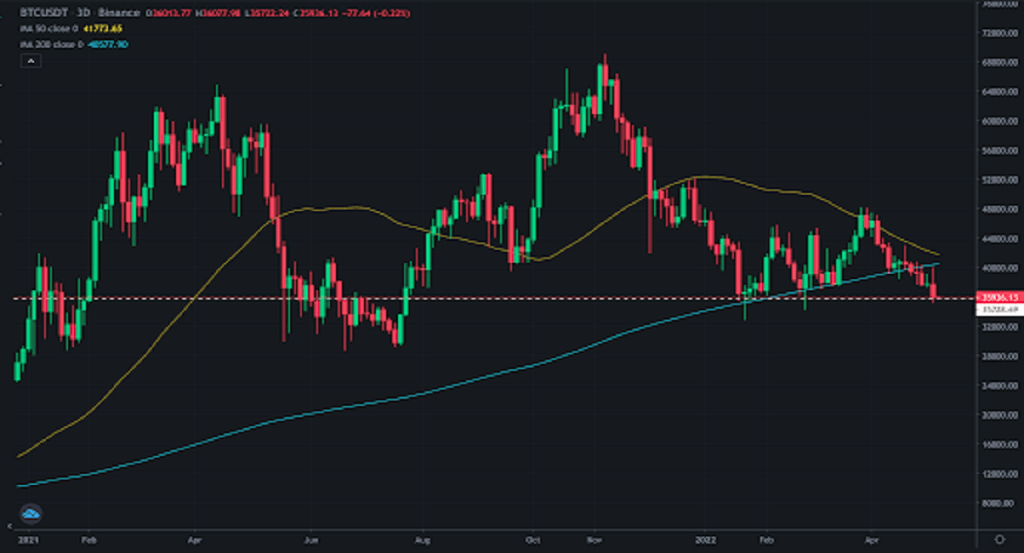

Bitcoin, cryptocurrencies and other financial asset markets plunged heavily on Friday after bloodshed in US markets. Analysts have been watching carefully for the past few months to see if BTC will form a 3-day death cross.

Another Bitcoin death cross on the horizon?

Famous YouTuber Steve from Crypto Crew University gives an in-depth analysis of the formation of a 3-day death cross. Steve states that all this started happening in early January, and BTC leverage reached an all-time high. In addition, the analyst states that investors are taking more risks in the crypto market.

“It is not a pleasant sight for bulls when you see the 3-day death cross,” the analyst explains:

Still, the death cross was exactly yesterday Bitcoin What pops up in the price charts of . This is the first thing on the minds of all technical analysts.

Recently, Bitcoin’s 50-day average dropped below its 200-day moving average, triggering a death cross signal and a cause for concern for some investors.

Could there be a BTC bull run by the end of the year?

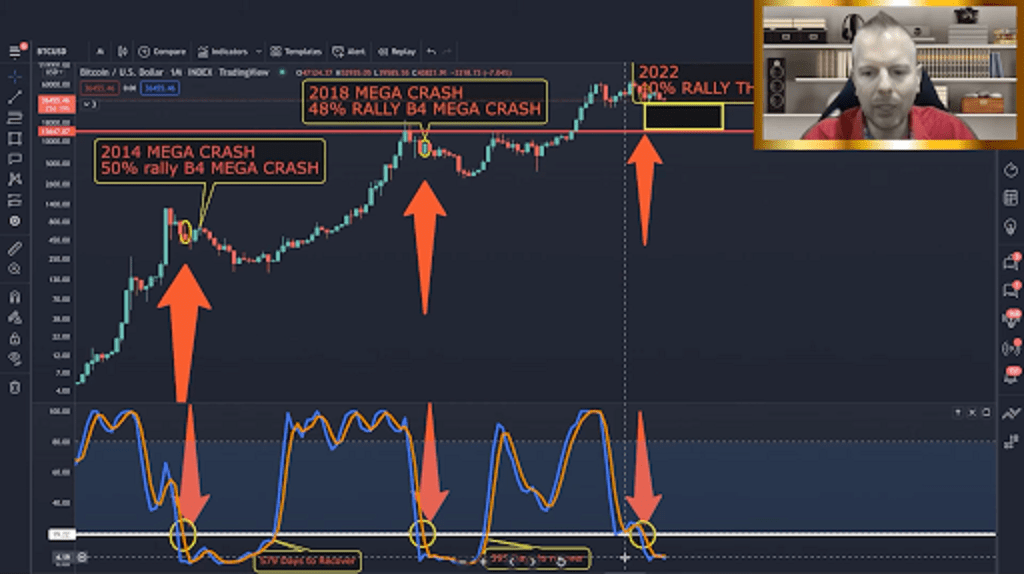

With reference to the chart below, the Stochastic RSI is bottoming out. The same model also appeared in 2014 and 2018. During this time, the BTC price increased by about 50% before a mega crash.

Thus, the same pattern emerged in 2022, Bitcoin price increasing 40% before falling heavily. The analyst says that in both 2014 and 2018, it took about 100 days for BTC to grow its next bull run. Therefore, if history repeats itself, we can expect a bull run until the end of the year. According to

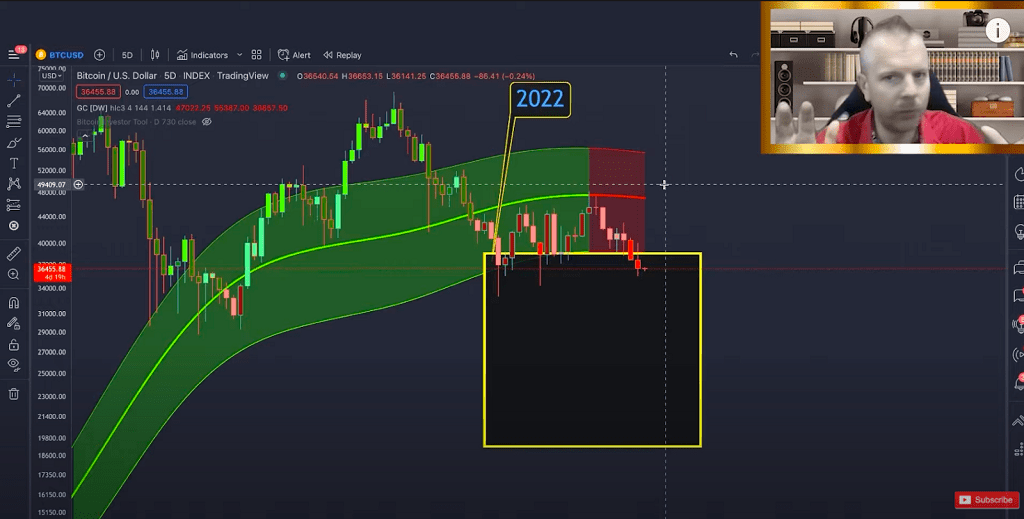

Gaussian Channel, in the above chart, the bearish turmoil will end when the red area turns green. Currently rejected from the median line. According to analysts, when we enter the gold zone, which is the best buying opportunity for traders.

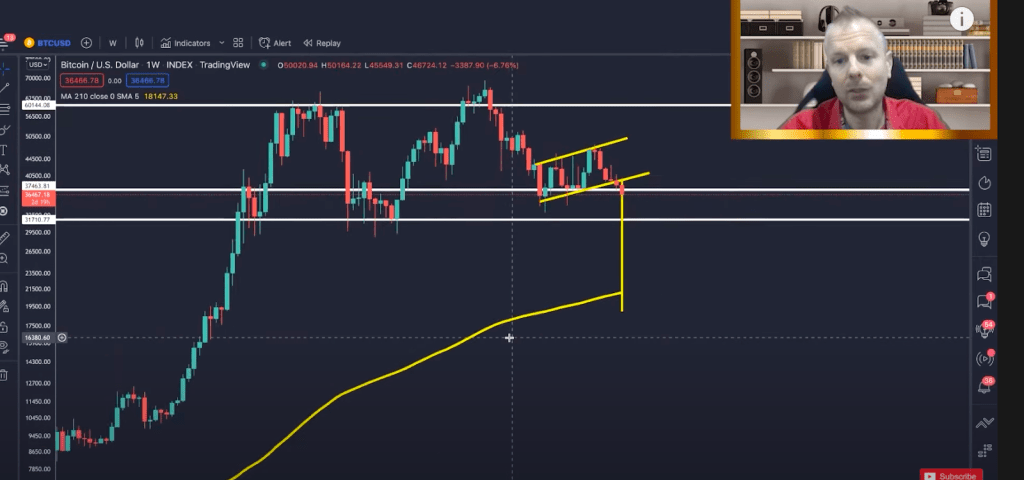

Bitcoin bear flag appeared!

As you can follow from Kriptokoin.com news, Bitcoin lost about 13% this month. It aims to test support from the lower end of a so-called “bear flag,” according to the analyst. Looking at the 210-week moving average, the analyst says that BTC Price could reach a potential low of $20,000.

Overall, the analyst believes there are more bear trends on the horizon and says, “We can undoubtedly see short-term rallies but bears still in control.”