April, the only month of the year to show a sustained decline on the charts, saw the Bitcoin price drop by 20.78%. Such depreciation pushed the price back from the local top of $47,459 to $37,926. Despite BTC recovering somewhat at the time of writing, the bearish trend of the market continues. Justin Bennett, Willy Woo and 2 well-known crypto analysts analyze critical levels that Bitcoin could test for the week…

Bitcoin (BTC) may finally bottom out

According to analyst Justin Bennett

Popular crypto analyst Justin Bennett thinks a local bottom in the cryptocurrency market is on the horizon. He tells his 100,600 Twitter followers that the Nasdaq (NDX) has recently broken out of an ascending channel, which does not bode well for Bitcoin. Looking at the Bitcoin chart

, Bennett suggests that Bitcoin has broken from a rising wedge in the lower timeframe and BTC is ready for a correction.

On-chain analyst Willy Woo draws attention to heavy spot purchases despite sideways movements

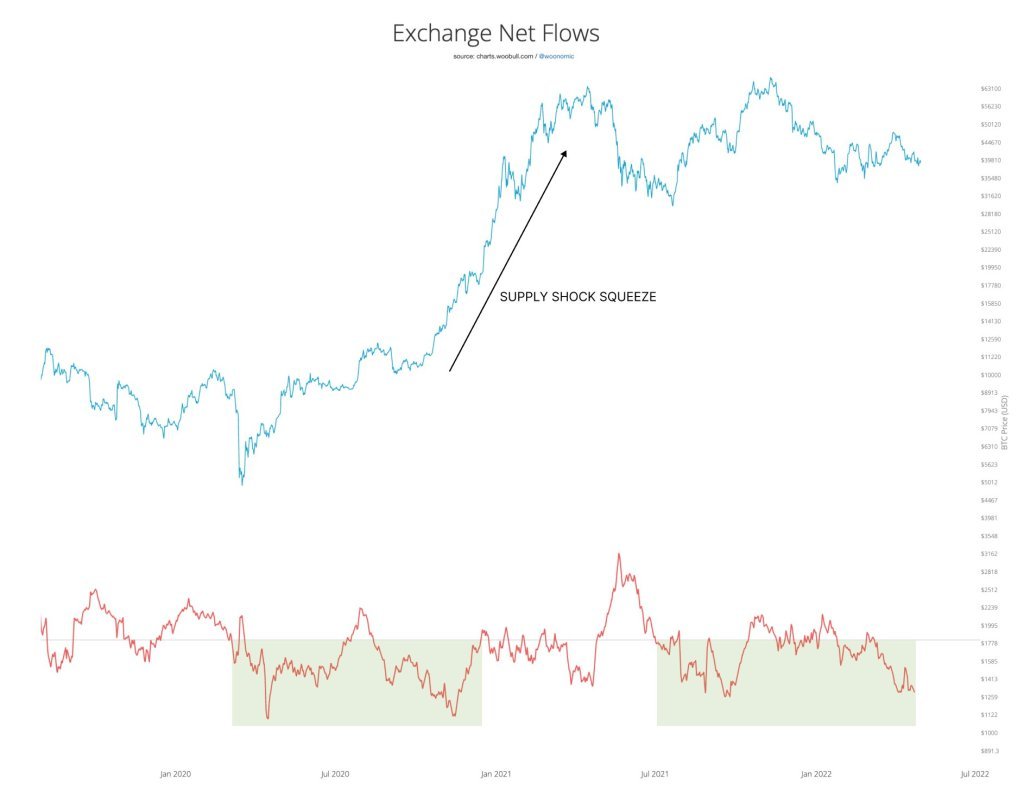

Willy Woo, whose analysis we share as Kriptokoin.com, is about Bitcoin (BTC) ), says it has seen historically unparalleled spot market demand despite the overwhelming price action unfolding over the past few weeks. While the popular analyst told his one million Twitter followers that institutional capital is flowing into Bitcoin, BTC’s price action reached levels in late 2020, where the crypto market traded just before the big drop. According to Willy Woo:

Bitcoin price is flat because Wall St is selling a futures contract in a macro risk aversion trade. Meanwhile, institutional money is accumulating spot BTC at the highest rates and moving into the cold wallet. At such times, I remember the supply shock crunch in the 4th quarter of 2020. According to

Woo, given Bitcoin’s ability to prevent a complete collapse in the face of a steep stock market correction, investors may be seeing BTC as a legitimate safe-haven asset class. . In other words:

Investors already see BTC as a safe haven. It will take time for the price to reflect. Wait for futures to run out of ammo.

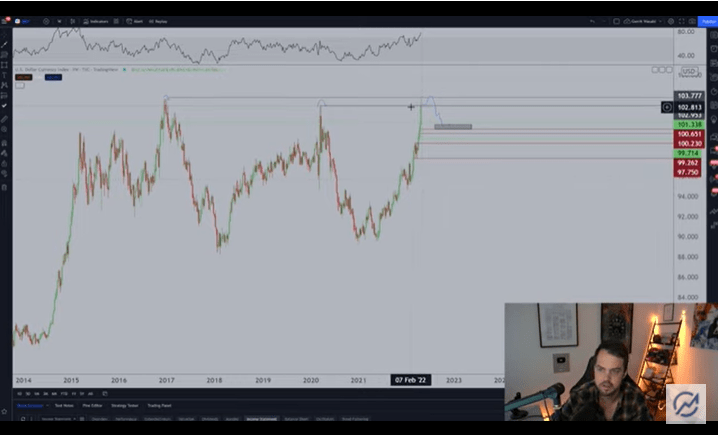

In the short term, Willy Woo says Bitcoin is facing headwinds from macroeconomic factors

However, the USD dollar index (DXY) is at a critical resistance level, helping it ignite rallies from Bitcoin and cryptos. states that it may result in a possible refusal. Woo also points out to veteran commodities analyst Peter Brandt that the TD (Tom DeMark) rank, an indicator that tries to identify turning points in trends, signals a big bearish for DXY. When the TD sequence records nine consecutive candles above the close of the previous four candles, it prints a TD9 signal. Woo says that DXY has officially polished a TD9 that could have major implications for Bitcoin and other assets in the near future.

Data according to Michaël van de Poppe Bitcoin (BTC) bull

According to popular crypto analyst Michaël van de Poppe, if on-chain metrics is an indicator, Bitcoin (BTC) may be preparing for a bullish trend. The analyst tells his 589,000 Twitter followers that Bitcoin’s hash rate has reached the ATH level, which often historically precedes BTC rallies:

The crypto ban remains while the Bitcoin hash rate reaches ATH. This indicates that the demand for Bitcoin mining is increasing, the network is becoming more secure and eventually the price will follow this metric.

Bitcoin hash rate measures the total computing power used for BTC mining and power operations. The higher the hash rate, the higher the resistance of the network to an attack, which is also an important security metric.

Analyst shares a critical Bitcoin price that will move the altcoin market

Looking at Bitcoin’s possible short-term trend, Van de Poppe said that a break of $38,000 or $40,500 could foretell BTC’s price action in the coming days. says:

You should wait until you get a clear drop below $38,000. These will likely be short deals. If we go above $40,500, turn that area to support, this will likely be the long position zone. I’ve been around $39,000 for a long time and if Bitcoin is to decide to hold itself to a crucial support level which is the $39,000 region, at this point I’m looking for a bit longer in altcoins.

Analyst says a major impulse wave is approaching, given Bitcoin’s sideways, lower volatile price action. He adds that as there will be a correction in the US dollar index (DXY), an upside break rather than a downside break is more likely:

There is a big break around the corner. If the USD is going to show additional weakness, I assume we’re heading to the upside. Especially if the Fed isn’t going to announce a heavier tightening than we expected. This will mean that the dollar will weaken further, resulting in an upside move for Bitcoin.