Tech charts show that Bitcoin (BTC) and 4 altcoin projects may be on the verge of a sharp breakout. However, investors are not sure exactly in which direction the price will go. Bitcoin and most major altcoins have been relatively quiet over the holiday period starting on Good Friday. This shows that investors did not make large investments during the US stock markets closed period. This could be due to the tight correlation between Bitcoin and the S&P 500 and uncertainty about the stock market’s performance next week.

Can Bitcoin and these 4 altcoins start a bullish move in the next few days?

While Bitcoin’s price action has been lackluster for the past few days, some altcoin projects that were on Coinbase’s list of 50 cryptoassets considered for listing have witnessed strong trend movements. Could Bitcoin and the 4 altcoins on our list start a bullish move in the next few days? At Kriptokoin.com, we report price analyzes for 5 cryptocurrencies that show early signs of recovery.

Forms pattern showing indecision between bulls and bears: Bitcoin (BTC)

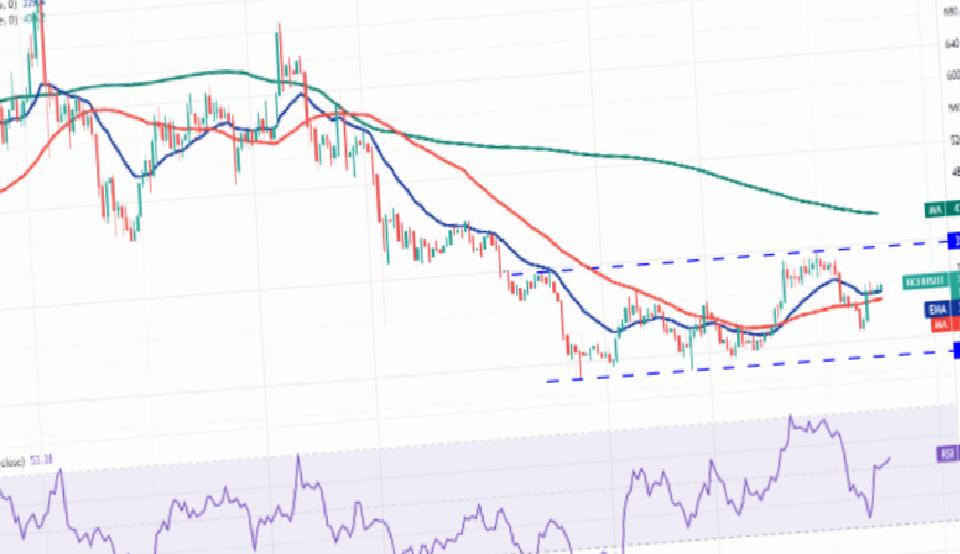

Bitcoin created an intraday candlestick chart on April 16 showing indecision between bulls and bears. Usually, small interval days are followed by an interval expansion, but the direction is difficult to predict in advance. If the price rises above $41,000, the bulls will attempt to push the BTC/USDT pair above the 20-day exponential moving average ($42,085). If successful, the pair could initiate an upward move to the overhead resistance at the 200-day simple moving average ($48,136) and later to the resistance line of the ascending channel.

The downward sloping 20-day EMA and relative strength index (RSI) in the negative zone point to a minor advantage for the bears. Selling could intensify if the price drops and dips below $39,200. The pair may then drop to the support line of the channel. A break and close below this support could extend the decline to $32,917. The 4-hour chart shows that the price is holding the 20-EMA and the bulls are trying to bounce back. If the price rises above the overhead resistance between the 50-SMA and $41,561, the pair could rally to the 200-SMA. Bears are expected to make a strong defense at this level. This positive view will be invalidated in the short term if the price breaks down from the current level and drops below $39,200. The pair may continue to correct later and it could decline towards the strong support at $37,000.

Definately rebounds strong support: Ripple (XRP)

Ripple (XRP) sharply recovered strong support at $0.69, showing strong demand at lower levels. The bulls pushed the price above the 50-day SMA ($0.78) on April 15 but failed to continue the upward move. However, the positive point is that the bulls are trying to sustain the price above the 20-day EMA ($0.77). The flat 20-day EMA and RSI near the midpoint suggest a balance between supply and demand. If the XRP/USDT pair breaks above $0.80, this balance will shift in favor of the bulls. This could push the pair towards the 200-day SMA ($0.88) and then the strong resistance at $0.91.

Contrary to this assumption, if XRP price breaks and sustains below the 20-day EMA, it will indicate that the bears are active at higher levels. Sellers will then try to push the pair to strong support at $0.69. The 4-hour chart shows that the bears were aggressively defending the overhead resistance at the 200-SMA but were unable to break the pair below the 20-EMA. This indicates that the bulls are buying on the dips. If the buyers push the price above the 200-SMA, the bullish momentum could increase. The pair could then rally to $0.85, where the bears could set a stiff barrier. On the downside, a break and close below the 20-EMA could invalidate the bullish outlook in the short term and bring the pair down to the 50-SMA.

Buyers buy on the lows: Chainlink (LINK)

Chainlink (LINK) broke above the downtrend line on March 30 but the bulls failed to sustain higher. Strong selling near $18 dragged the price below the downtrend line. On the positive side, buyers are buying the dip around $13.50 and attempting to form a higher bottom. The first sign of strength will be a break and close above the 20-day EMA ($15). Such a move suggests that the bears may be losing control. The LINK/USDT pair could then rally to $16 and then push the overhead resistance at $18. A break and close above this level could open the doors for a possible rally to the 200-day SMA ($21).

Conversely, if the price drops from the 20-day EMA, the bears will attempt to push the pair to the critical support at $12.50. A break and close below this level could signal a resumption of the downtrend. The pair broke above the downtrend line on the 4-hour chart and is on the verge of completing the 20-EMA and 50-SMA bullish crossover. This indicates that the bulls are trying to make a comeback. If the price continues above the 20-EMA, the pair could rally to $16, where the bears could pose a strong challenge again. The bullish momentum could increase if the buyers break this hurdle. Alternatively, if the price drops and breaks below the 20-EMA, it will suggest strong selling at higher levels. The bears will then try to push the LINK price below $13.50.

This altcoin is trying to bottom: Bitcoin Cash (BCH)

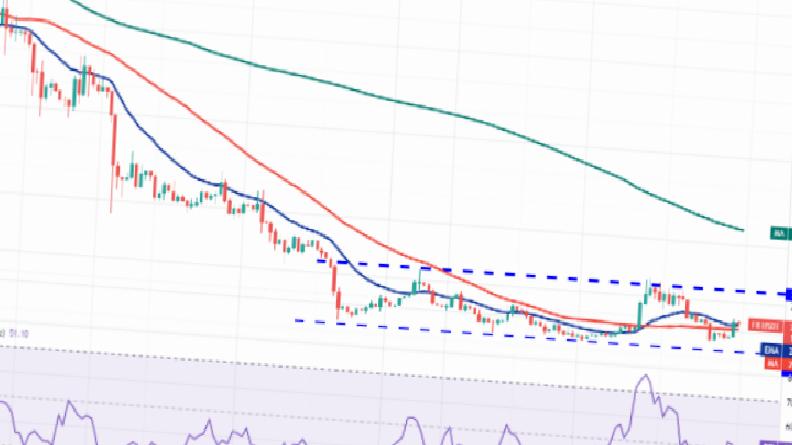

Bitcoin Cash (BCH) has been trying to bottom for the past few days. The price rose sharply on April 13 and broke above the 20-day EMA ($339). Although the bulls failed to build on the upside, it is a positive sign that they did not allow the price to drop below the 50-day SMA ($329). The 20-day EMA is trying to rise and the RSI is above 53, indicating a minor advantage for the bulls. If buyers push the price above $354, the upward move could continue and the BCH/USDT pair could rise to the overhead resistance at $395. Bears are likely to fiercely defend this level. If the price drops from $395, range-bound trading could take a few more days.

If the price drops and breaks below the 50-day SMA, the bears will attempt to push the pair to strong support at $259. The 4-hour chart shows the pair rising sharply from $290 to $353. This may have encouraged short-term investors to take profits, but a positive sign is that the bulls are not allowing the price to drop below the 20-EMA. This shows that the sentiment is positive and traders are buying on the dips. The ascending 20-EMA and the RSI in the positive zone point to the advantage for the buyers. If BCH price rises above $354, the upward move could reach $380 and then $395.

Continues to consolidate: Filecoin (FIL)

Filecoin (FIL) bulls are trying to establish a fundamental pattern and the price has been consolidating between $16.50 and $27 for the past few days. The 20-day EMA ($21) and the 50-day SMA ($20) are flat and the RSI is near the midpoint, indicating a balance between supply and demand. If the bulls sustain the price above the 20-day EMA, the probability of a rally to the overhead resistance at $27 increases. The bulls will have to push and sustain the price above this level to signal the start of a possible new uptrend. This positive view may be invalidated in the short term if the price breaks below the 50-day SMA. The bears will then try to push the FIL/USDT pair down to the strong support at $16.50. A break and close below this level will indicate the resumption of the downtrend.

The bears defend the overhead resistance at $22, but the positive point is that the bulls have not allowed the price to drop below the 200-SMA. If the price rises from the current level and rises above the $22-23 resistance zone, the bullish momentum could increase and the pair could rise to $27. The 20-EMA and 50-SMA complete the bullish crossover and the RSI is in the positive territory, giving buyers an advantage. This positive view may be invalidated in the short term if the pair bounces back and falls below the 200-SMA.