Despite the BTC price falling below $40,000, several technical and on-chain indicators are bullish, according to crypto analyst Yashu Gola. We have prepared the latest movements in Bitcoin price and Yashu Gola’s metric analysis for Kriptokoin.com readers.

Bitcoin rebounds below $40,000 as oil rises

Bitcoin (BTC) dropped below $38,000 in March, giving up all gains it had made last week. The losses were primarily driven by sales in markets at risk, the highest level since 2008 when international benchmark Brent crude rose to almost $139 at the start of March 7.

However, Bitcoin’s failure to hedge against continued market volatility has cast doubts on its ‘safe haven’ status as its correlation coefficient hit 0.87 with the Nasdaq Composite on Monday.

BTC weekly price chart showing correlation with Nasdaq and Gold / Source: TradingView

BTC weekly price chart showing correlation with Nasdaq and Gold / Source: TradingView Conversely, Bitcoin’s biggest rival gold has a negative correlation of 0.38 during the ongoing market turmoil. He underlined that they acted largely in opposition to each other. On the subject, Lloyd Blankfein, senior chairman of Goldman Sachs, shared:

Keeping an open mind about crypto but given the rising US dollar and the stark reminder that governments can freeze accounts and prevent payments under certain circumstances, crypto’s Don’t you think you’ll have a memory now? So far we haven’t seen it in price…

On the one hand, Bitcoin continues its decline potential remains high amid the worsening geopolitical conflict between Russia and Ukraine and expectations for higher rate hikes in March. However, Yashu Gola notes that some technical and on-chain indicators are showing a bullish trend on the lower timeframes and a potential recovery towards $60,000 in the coming months.

Multi-year ascending trendline support

If history repeats, Bitcoin’s recent decline in multi-year ascending trendline support could set the stage for a potential recovery towards the $60,000 resistance level.

BTC weekly price chart with bear markets within technical patterns / Source: TradingView

BTC weekly price chart with bear markets within technical patterns / Source: TradingView Specifically, BTC’s trendline support is a technical triangle called an ascending triangle in conjugation with the horizontal resistance level above. creates a model. This setup has been active since December 2020, serving as a low-end accumulation area and a distribution space for top traders.

Bitcoin whales increase in number

Elsewhere, on-chain data provided by CoinMetrics shows wealthy investors buying Bitcoin near the same level. For example, the number of Bitcoin addresses holding at least 1,000 BTC rose from 2,127 on February 27 to 2,266 on February 28.

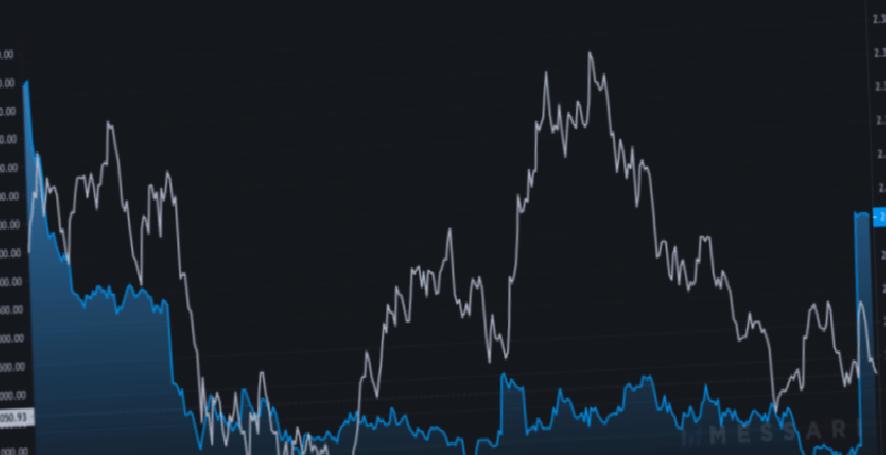

Bitcoin addresses with balances of more than 1K BTC / Source: CoinMetrics, Messari

Bitcoin addresses with balances of more than 1K BTC / Source: CoinMetrics, Messari Over the same period, the price of BTC rose from $38,000 to almost $45,000. As of March 6, even as BTC fell below $38,000, the number of Bitcoin addresses had dropped to just 2,263. This shows that wealthy investors have decided to hold on to their Bitcoin tokens despite temporary bearish sentiments.

Johal Miles, an independent market analyst, also states that the area between $33,000 and $38,000 is a ‘high-volume accumulation zone’ for Bitcoin bulls and that it will be ‘hard for the bears’ to break through:

Bitcoin currently stands at the entire checkpoint. High volume accumulation zone, a challenge for bears to get past that. Good luck to them.

Bitcoin exit trend remains intact

Crypto analysis service Data from Santiment shows that weekly Bitcoin outflows from exchanges since October 2021 have been positive 81% of the time, despite BTC trading near a six-month low. “Interestingly, 21 of the last 26 weeks have seen BTC move more off-exchanges than exchanges,” Santiment said on March 7, referring to the BTC exchange flow balance chart attached below.

BTC currency flow balance / Source: Santiment

BTC currency flow balance / Source: Santiment More Bitcoin exits from exchanges indicate that investors are willing to hold on to it for the longer term. Conversely, increased Bitcoin inflows into exchanges indicate intent to trade BTC for other digital assets or fiat currencies.

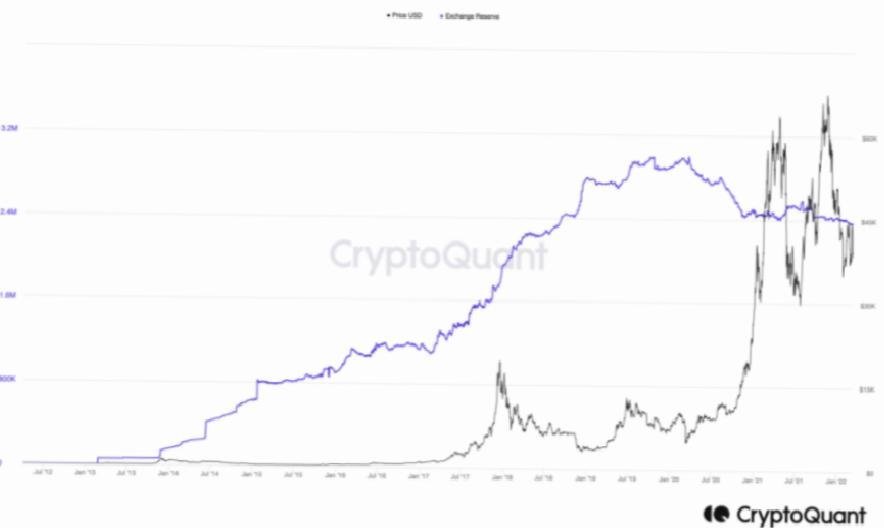

BTC currency reserve / Source: CryptoQuant

BTC currency reserve / Source: CryptoQuant Overall, according to CryptoQuant, the amount of BTC on exchanges is more than September 2018 with less than 2.4 million BTC currently available on crypto exchanges. It continues to decline at the lowest level since.