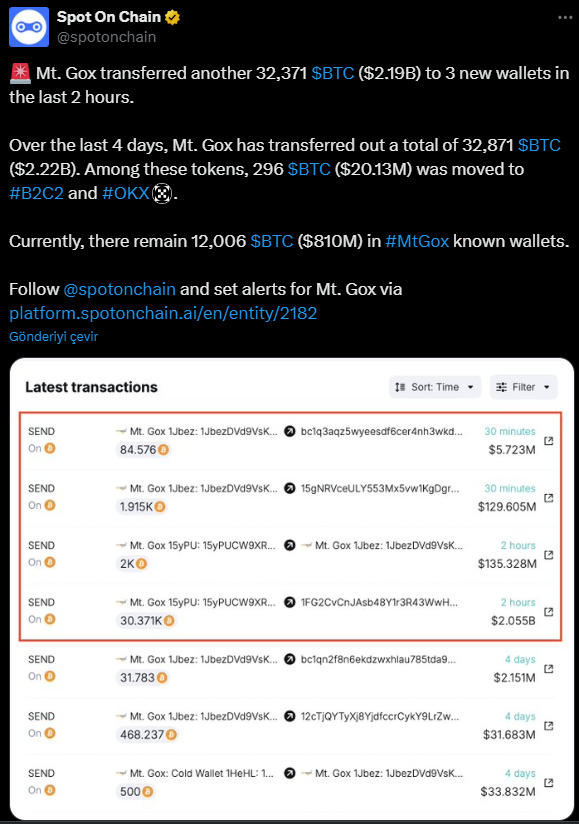

Bankrupt cryptocurrency exchange Mt. Gox transferred 32,371 Bitcoin (BTC) with a total value of approximately $2.2 billion to anonymous wallets last Monday. According to data from blockchain analysis company Arkham, this huge transfer took place in Mt. It stands out as Gox’s biggest move in recent months. While the stock exchange aims to pay creditors during the bankruptcy process, the timing and purpose of this transaction has become a matter of great curiosity in the crypto world.

Mt. Massive Bitcoin transfer from Gox

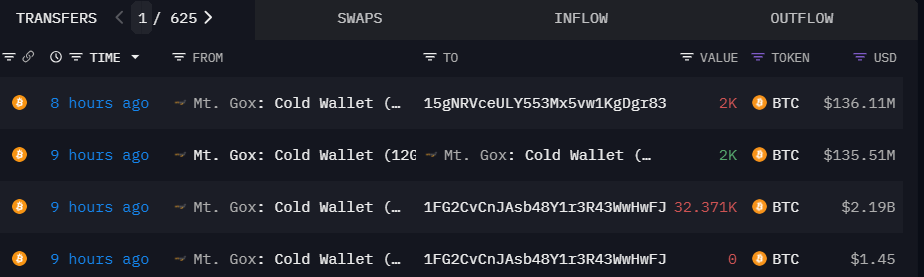

Mt. This transfer made by Gox was directed to two separate wallets. The majority of the transfer, 30,371 BTC, was sent to the address “1FG2C…Rveoy”, while the remaining 2,000 BTC was transferred to the address “1Jbez…LAPs6”. Additionally, 2,000 BTC is worth Mt. It is stated that it was recorded as an internal transaction from one of Gox’s cold wallets to another wallet. Such internal movements may indicate that the stock market is reorganizing its holdings. This week’s large transaction, following a smaller move last week that moved 500 BTC to anonymous wallets, has led to speculation that the creditor payment process will be accelerated.

Mt. Payment processes started immediately after Gox’s past transfers, so it is thought that this new transfer may have a similar purpose. However, in the recent announcement of the stock exchange, it was stated that the payment process to creditors was postponed to 2025. The date, which was initially set as October 31, 2024, was extended by one year to October 31, 2025 by the Japanese court.

Payment process delayed again

Mt. Gox’s bankruptcy process was brought to the agenda with a series of cyber attacks in 2014. These attacks, which resulted in the theft of approximately 850,000 BTC, created a major crisis of confidence in the crypto market at that time. While the stock market handled more than 70 percent of Bitcoin transactions worldwide, this collapse caused thousands of investors to suffer. The court process lasted for many years and finally a rehabilitation process was initiated for the creditors. However, the latest delay decision shows that creditors will have to wait longer to receive their payments.

This development, Mt. While Gox provided temporary relief among its victims, some analysts in the market began to evaluate the impact of the payments. Similar announcements in the past have caused sudden fluctuations in Bitcoin prices; Because there are concerns that mass Bitcoin sales from the stock exchange may cause a decline in the market. Until the date of payments, Mt. It is thought that such movements of Gox may cause fluctuations in Bitcoin prices.

What was the market’s reaction?

Mt. Gox’s Bitcoin transfers sparked mixed reactions among crypto investors. In particular, the possibility of creditors quickly converting their Bitcoin assets into liquid triggers fears that a selling pressure may occur in the market. The volatile course of Bitcoin in recent weeks may lead to an increase in the impact of such transfers on prices. For example, developments in the US presidential election process increased uncertainties on the crypto market, leading to a decline of up to 7 percent in the Bitcoin price.

Market analysts predict that volatility may increase further this week and Bitcoin’s price may fluctuate above $8,000. Investors are interested in Mt. It is stated that if Gox launches its Bitcoins, this may cause a short-term decline. Additionally, some traders are expecting further declines in the market based on the US presidential election results. The possibility that regulations on cryptocurrencies may tighten, especially if Kamala Harris wins the elections, raises concerns. Founded in 2010, Mt. Gox was one of the largest cryptocurrency exchanges at the time, handling more than 70 percent of BTC trading. However, after a series of hacking incidents between 2011 and 2014, the exchange went bankrupt and users’ assets were lost. This loss of trust was one of the biggest crises that Bitcoin and cryptocurrencies in general experienced at that time.