After several days of high volatility, the cryptocurrency market showed low volatility on November 23. Thus, trading volume decreased, reflecting the momentary lack of speculative open interest on long and short positions. Crypto analyst Vinicius Barbosa talks about the possibility of a ‘short squeeze’ for 4 altcoins.

‘Short squueze’ potential is increasing for these 4 altcoins!

Even in an environment where open position volume decreases, it is still possible to find ‘short squeeze’ potential. Specifically, we can do this by looking at the correlation between short positions opened and trading volume over a specific time period. If the sentiment changes from a downward trend to an upward trend by the end of the week, the ‘short squeeze’ potential of 4 altcoin projects increases.

Of these, Bitcoin Cash (BCH) opened a short position of $ 52.61 million in the last 12 hours, accounting for 52.62% of the 12-hour open position volume. Additionally, Avalanche (AVAX) is open at $216.49 million (51.83%), Polkadot (DOT) is at $44.55 million (52.51%), and Tellor (TRB) is at $120.21 million (52.25%). has the position.

Long/Short ratio in derivatives. Source: CoinGlass

Long/Short ratio in derivatives. Source: CoinGlassIn this context, we take a closer look at the market values and exchange volumes of these cryptocurrencies. Thus, we filter out two of the four coins that are more likely to see a ‘short squeeze’.

After the filter, Tellor (TRB) remains in the first place

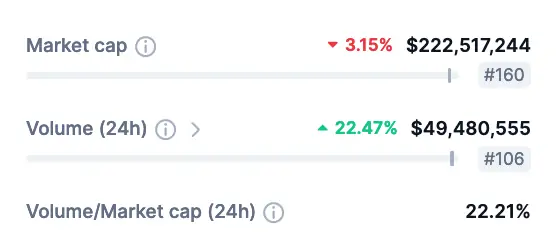

In particular, TRB has the highest weight in short positions opened. The $120.21 million short position opened in the last 12 hours is 2.4 times higher than Tellor’s 24-hour exchange volume of $49.48 million. Additionally, the open interest capitalization of short positions is slightly less than half of the total market cap of $222.51 million. This raises relevant alarms for the altcoin price.

TRB market data. Source: CoinMarketCap

TRB market data. Source: CoinMarketCapMeanwhile, as you follow from Kriptokoin.com, the token rose 700% in one year. Considering this situation, investors and traders should be cautious when looking for a ‘short squeeze’ initiative. Increasing short positions are likely to be a response to this 12-month run. So, it is necessary to understand that TRB may be overbought at this point. However, any meaningful increase in demand could be enough to liquidate short sellers on a low time frame. Meanwhile, TRB is trading at $89.43 at the time of writing.

The second prominent altcoin: Avalanche (AVAX)

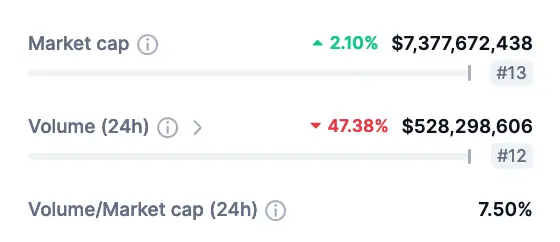

AVAX has a capital and market value of $7.37 billion. It is trading at $20.72 with 24-hour volume of 7.5% of that. Avalanche has the most relevant short weight by these metrics, with 41% of that exchange’s volume and 2.93% of its total market cap.

AVAX market data. Source: CoinMarketCap

AVAX market data. Source: CoinMarketCapIt is also quite remarkable that JPMorgan chose Avalanche for its Blockchain initiative. It is possible that this will bring new demand for the altcoin. Therefore, AVAX is likely to face a potential short squeeze in the coming days.

The opinions and predictions in the article belong to the analyst and are definitely not investment advice. We strongly recommend that you do your own research before investing.