Uniswap (UNI), the decentralized exchange in the Ethereum ecosystem, turned the Binance agenda into an opportunity and experienced a 15 percent increase.

The cryptocurrency market has focused on Binance news feeds since the past day. Binance settled with the US Department of Justice (DOJ) and paid a $4.3 billion fine. Binance, which admitted money laundering crimes, also lost its CEO. Binance CEO CZ announced that he resigned. Additionally, CZ admitted the charges against him and was released on $175 million bail.

The fact that Binance was caught in a huge uproar put crypto investors in a dilemma. While the crypto market perceived the resolution of the Binance incident positively, significant money flow occurred. While there was a $1 billion money outflow from Binance, the trend towards decentralized exchanges increased.

Uniswap, the largest decentralized exchange in terms of market value, turned the central exchange (Binance) crisis into an opportunity and gained attention. The UNI price increased its rise, which started on the night of November 22, to 15 percent during the day.

Uniswap (UNI) has reached a critical threshold with its latest rise!

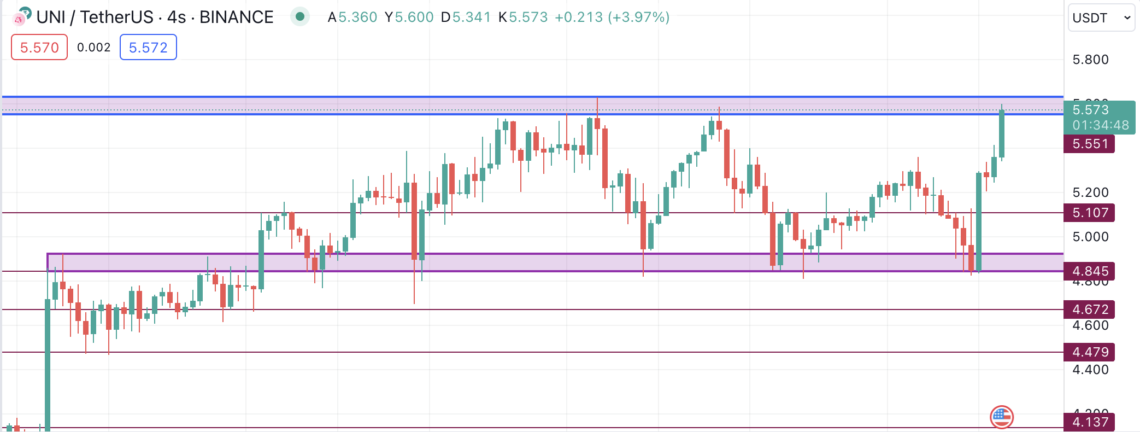

Uniswap (UNI) has approached a critical resistance point with its rise of nearly 15 percent. Binance’s intense presence on the agenda has mobilized decentralized crypto exchanges. On the UNI side, there was an increase from $4.85 to $5.55. Additionally, dYdX’s token (DYDX) increased by 15 percent.

Uniswap is known as the largest decentralized exchange on the Ethereum network. Binance’s place on the agenda accelerated the outflow of money in decentralized exchanges. The drive towards decentralization has pushed UNI to the fore.

UNI transaction volume reached 293 million dollars, an increase of 154 percent in the last 24 hours. The market value of UNI, which experienced incredible growth in volume, increased by 10 percent to 3.27 billion dollars.

With 58 percent of its maximum supply in circulation, UNI hosts the majority of the interest in decentralized exchanges.

Looking at the UNI chart, it seems that the price has reached a critical resistance zone. This area can be described as the area where sellers will put intense pressure and pull the price back. The high market value means that the threshold for UNI narrows. The popular cryptocurrency rose from $4.85 to $5.6 during the day. UNI, which entered the resistance box formed by the price peaks on November 13 and 16, is at a critical threshold.

UNI could push $5.65 if it breaks through the resistance point described as the blue box. A breakout of this zone could push the UNI price towards $5.75. $5.75 can be described as a soft transition zone for UNI. UNI, which is persistent above $5.65, can break $5.75 without difficulty. UNI’s next stop will be $6. Selling pressure may emerge as the main resistance at $6 remains difficult to break. However, if UNI exceeds $6, it may rise to $6.25 in a short time.

On the other hand, UNI may decline as it faces selling pressure within the box and cannot rise above $5.65. The UNI decline could test the short support point at $5.5. If this zone is broken, there could be a sharp decline for UNI to $5.10. The $5.10 support appears as an important region where buyers can regain strength. However, if this zone is also lost, UNI may fall into the support zone in the lower box.